It is getting pretty easy to understand the angst American Express, Mastercard and Visa had about the Indian credit card market last quarter. In October 2018, Amex, MC and Visa were in violation of local laws “everytime an Indian swiped a credit or debit card”, according to the NY Times. The issue centered on a Reserve Bank of India requirement that data be localized, and processed and stored only in India. Friction grew when the payment brands offered to have mirror files posted locally for regulatory scrutiny, but RBI wants exclusive control of the data, to be stored only in India. Provincialism continues.

So, here comes a new mass transit card for the 1+ billion population in India. Indian Express reports:

- Dubbed as ‘One Nation One Card’, the inter-operable transport card would allow the holders to pay for their bus travel, toll taxes, parking charges, retail shopping and even withdraw money.

- The RuPay Contactless Card with NCMC is now available with almost 25 banks, including SBI and PNB as debit, credit or prepaid cards. You will have to contact your bank to get the RuPay card.

- NCMC cards are issued from banks on debit/credit/pre-paid card product platform. A customer may use this single card for making payments across all segments including metro, bus, suburban railways, toll, parking, smart city and retail shopping.

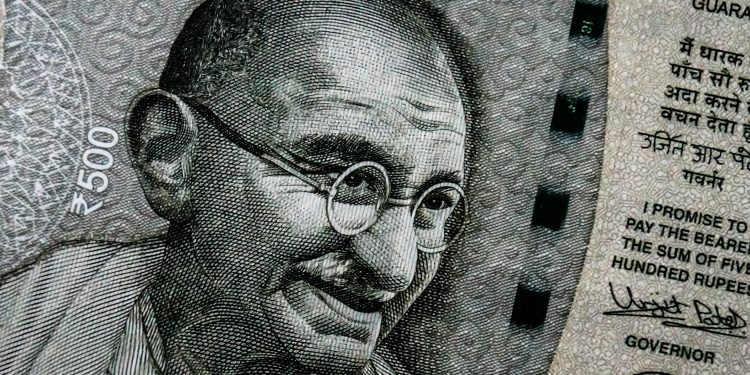

Hmmm. The RuPay card, the domestic payment scheme sponsored by the Reserve Bank of India. Looks like a Visa, smells like a Mastercard, but it is a local payment scheme. The Times of India adds:

- The indigenously-developed One Nation One Card has merged with Rupay card which can be used in any part of the country. These are bank-based cards on debit/credit/prepaid product platform which will be available with more than 25 banks.

The Economic Times mentions:

- “Now, our dream of ‘One Nation One Card’ has been realized. People can also withdraw money using this Common Mobility Card. This RuPay card can be used for travelling in metros in any part of the country. In simple terms, we have merged the RuPay card with the mobility card,” the prime minister said.

Competition in the cards business is intense, but the playing field becomes slanted when you add a home-based regulator!

Overview by Brian Riley, Director, Credit Advisory Service at Mercator Advisory Group