As recent readers of PaymentsJournal will likely recall, we have been writing a fair number articles on the increasing interest in and marketing of subscription services. By subscription services we are referring to the goods and services companies provide consumers or business on a monthly basis and charge their fees accordingly.

Usually, these fees are charged monthly and billing is done in the background without much notice to the end user. Some Mercator clients refer to these as “invisible payments” or Merchant Initiated Transactions (MITs). Regardless of how these are named, these payments are becoming more popular and, perhaps, gaining more scrutiny.

A recent article in ITProPortal, The subscription economy – a dance between customer and business, point out that while a subscription model might be good for certain businesses to offer, adoption is not guaranteed.

This isn’t a one-way street though and customer satisfaction and happiness with the new processes must be factored in. If customers don’t buy into the subscription system, then that regular revenue stream will soon dry up. However, with faster delivery times, less up-front costs and more personalized services, why would customers not be jumping on board the subscription train?

This may be down to the disruption customers will have to go through too. From changing how they spend their budgets through to potentially being reluctant to receive the regular influx of services that the business wants to push their way.

From a business perspective, subscription services make a lot of sense. It is basically a constant revenue stream for those that offer them – an annuity, if you like. That said, what does it mean for the consumer?

A simple Google search will bring up article after article of people who have signed up for subscription services only to find out they are spending hundreds of dollars on these services. In fact, savvy developers have gotten in the game to provide apps that help consumers manage their subscription services.

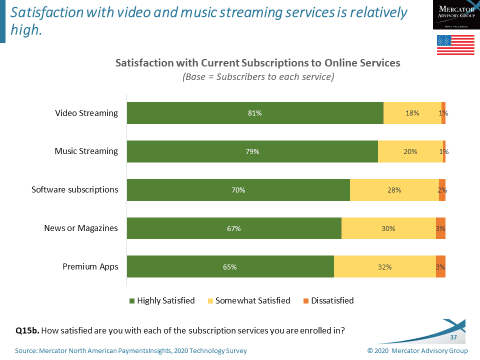

With all the news about subscription services, what do we know about what consumers think about them? Our most recent North American PaymentsInsights survey asked consumers about their satisfaction with online subscription services like video and music streaming (about 6 in 10 subscribe) and “box of the month” club memberships (about 2 in 10 subscribe).

As the graph below shows, consumers are pretty happy with their online subscription services:

While the satisfaction numbers are fairly high for these services now, I wouldn’t be surprised to see them fall as new, less established players enter the market. Many of these new players will have less value to deliver and will need to get in line with the others as consumers decide which to choose from.

The subscription service business model makes a lot of sense from a business perspective, and I would bet it is here to stay. However, like any new idea, it will morph as business after business tries to create a constant revenue stream.

Overview by Peter Reville, Director, Primary Research Services at Mercator Advisory Group