As new technology like AI-driven devices (Alexa, Siri, etc.) become more commonplace in households, consumers are utilizing the technology for shopping. Wirecard North America recently surveyed 515 US adults about their shopping habits to see where digital fits in. The results suggest that digital, mobile, and AI-assisted payments hold the greatest potential to create efficiencies, reduce costs, and improve customer service. We spoke with Deirdre Ives, Wirecard’s North America Managing Director, to help us unpack what the results of the survey might tell us about the relationship between futuristic tech, payments, and customer service.

Wirecard North America recently conducted a consumer survey…

We always keep a finger on the pulse of consumer sentiment so that we can serve our business clients effectively. Tuning in to the customer experience gives us a lot of information about how our payments solutions are working, and it helps us pinpoint where we can partner with merchants to improve their UX.

What do those insights tell us about payments?

In a nutshell, the responses from this survey support the idea we’ve seen in outside research: that the moment of payment holds the greatest potential to create efficiencies, reduce costs, and improve customer service.

What are some of the key indicators of that?

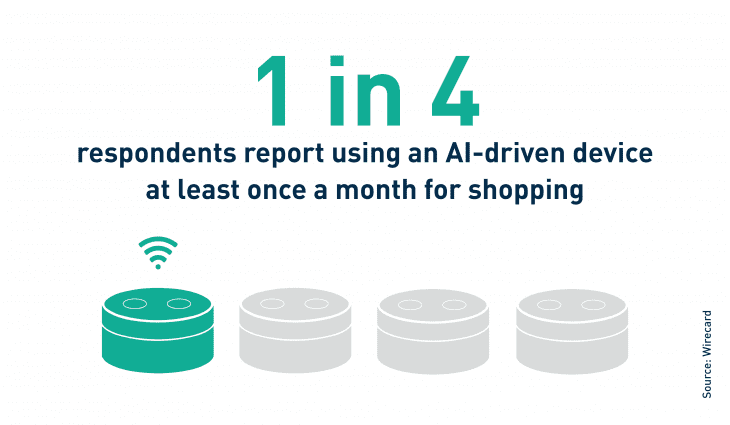

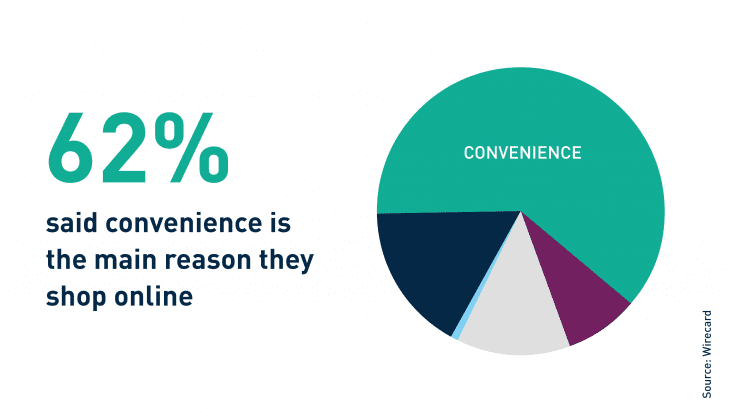

We wanted to find out what kinds of technology consumers shop with and how they use it. Our respondents tracked with average adoption rates for AI-driven technologies and gadgets, and a large majority pay with traditional credit and debit cards. The positive trends we saw in tech usage seem to run alongside the convenience factor. For instance, when they do use smart devices, they buy everyday, replenishable items like home goods, pet supplies, and the like. When they’re dissatisfied with brick-and-mortar shopping, it’s because they have to stand in long lines or can’t find what they want. Digital payment solutions address all of those concerns. Brand loyalty rests on customer service and personalization, and high-quality, personalized customer service depends on digital integration.

Any surprises in the survey?

We were a little surprised to see that 58 percent of respondents consider in-store to be their primary retail medium. The industry has its eye trained on digital, mobile, e-commerce, seamless… It’s easy to start thinking that consumers see it that way, too. In fact, people have real lives, and their shopping experience still takes place very much in the real world.

What are some of the key takeaways?

In payments, the key role of new technology is convenience. Consumers make purchases online, through an app, or with Alexa because it’s convenient. So our job is to develop the right tech to make all payment moments – online, on mobile, in the store – convenient, fast, personalized, even invisible where possible.

We’ve talked a lot about millennials – now Gen Z is up and coming. How will 18- to 24-year-olds change how we’ll think about payments in a few years?

I think changes will come mainly in how merchants integrate payment into the overall shopping experience. We know that 73 percent of our respondents are happy with their in-store shopping experience, and they split down the middle over their top preference – 46 percent prefer in store; 46 percent prefer to shop online. Keep in mind this was a relatively small survey – 515 adults – but it lines up with other research we’ve seen that suggest that businesses will want to invest more in integration of payments.