Beginning in October 2015, most American merchants became liable for fraud losses associated with card-present transactions if their point-of-sale (POS) terminals did not support EMV transactions. This caused merchants around the country to upgrade their POS devices to support chip transactions.

Although these upgrades required merchants to spend considerable time and money, the move safeguarded retailers against ballooning fraud costs, while also providing a welcome opportunity to adopt safer, more efficient payment systems.

Now, fuel merchants are facing a similar situation. Starting April 2021, after years of delay, fuel merchants will be liable for fraud costs if their fuel-pump systems do not accept EMV chip cards. Many fuel merchants view upgrading infrastructure to be compliant with the new rules as costly and time consuming. However, if done correctly, investing in better payment platforms actually presents a great opportunity, even with the associated costs.

To help fuel merchants understand the challenges and benefits of upgrading their payment platforms, ACI Worldwide and PaymentsJournal hosted a webinar titled “How Fuel Merchants Can Use Payment Platforms to Drive Innovation & Profits.” The event was hosted by Benny Tadele, VP of Global Merchant Solutions at ACI Worldwide, and Raymond Pucci, Director of Merchant Services at Mercator Advisory Group.

Many merchants are not compliant now, but expect to be next year

If the liability shift were to occur tomorrow, many fuel merchants would simply not be ready, according to data from ACI’s EMV Readiness Survey. Only 33% of operators with over 200 fuel stations reported achieving full EMV deployment as of July 2020. Worse yet, ACI found that by the end of this year, only half of fuel merchants expect to be ready for the liability shift.

However, there is room for optimism. A much larger percentage of fuel merchants (67%) expect to be compliant by April 2021 (including the 33% who are compliant now), when the liability shift is officially slated to occur. And by the end of 2021, up to 97% of merchants expect to be compliant. “That means there’s going to be a lot of work around EMV readiness,” said Tadele.

Merchants face many challenges in making the switch

In order to see the benefits of upgrading payment systems, it’s important to first understand the challenges faced by fuel merchants. With almost 80% of fuel pumps located in C-stores around the country, many fuel merchants are also in the C-store vertical, which comes with its own unique challenges and opportunities. Tadele identified three major areas of difficulty for merchants in this industry:

- Cost control: Since many gas stations and C-Stores operate on very low margins, maintaining a profitable business requires the merchant to keep costs down. Upgrading infrastructure, whether it’s the pumping mechanism or the POS terminal, can require a considerable amount of time and money.

- Fraud & data security: When the liability shift goes into effect, fuel merchants will become liable for fraud costs resulting from card-present transactions at terminals that do not support EMV chip transactions. Merchants must also contend with chargebacks—when a customer disputes having made a purchase and seeks a refund for the charge. And data security is a critical concern for merchants. Data breaches can cost merchants dearly, meaning that they must ensure their customers’ card numbers and other personal information remains safe and secure.

- Need for agility: Customers have come to expect seamless, intuitive experiences that allow them to pay how, when, and where they want. Digital capabilities are central to merchants being able to offer such experiences; merchants that do not offer digital experiences will be left behind by their more digitally-advanced competitors.

EMV upgrades can drive profit, improve security, and facilitate innovation

Though investing in new POS technology at the pump can be costly, merchants can use this opportunity to pursue solutions that address the pain points outlined above. If the upgrades are done with the broader picture in mind, the overall benefits far outweigh the costs.

Limiting fraud and improving security

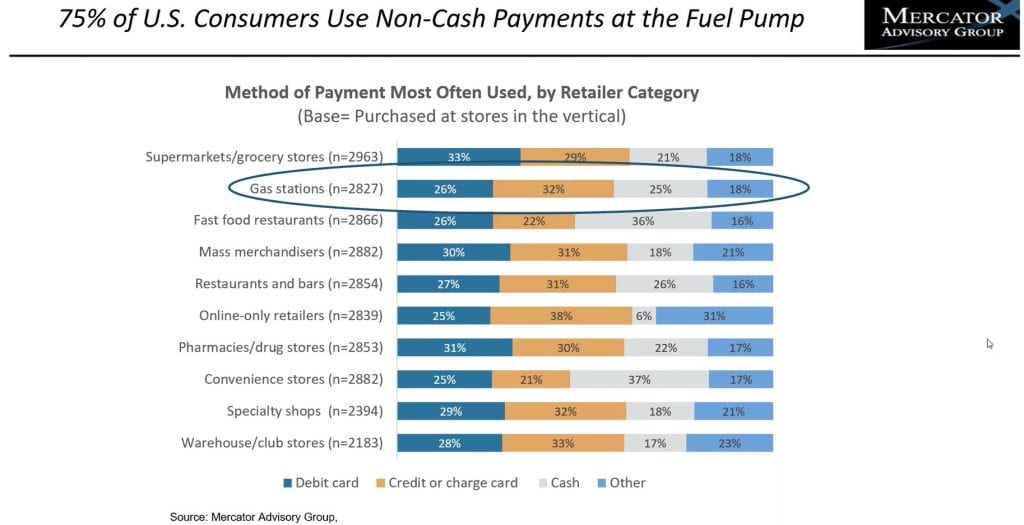

With EMV technology in place, fuel merchants will not be on the hook for card-present fraud losses. This will lead to considerable savings, explained Tadele, because losses associated with fraudulent card usage in this vertical are expected to reach $450 million. The losses are expected to be so high because card transactions comprise a large percentage of overall C-store/gas station payment volumes: Nearly 75% of consumers use non-cash payment methods at the fuel pump, according to Mercator Advisory Group.

But deploying EMV is only part of the opportunity for merchants. “In addition to addressing the counterfeit fraud problem, addressing breaches and controlling exposure of data in transit is going to be important,” noted Tadele.

Point-to-point encryption (P2PE) is one solution merchants should explore to secure data in transit. P2PE solutions instantly convert sensitive payment card information into indecipherable code right when the card is used, “meaning from the minute that card and sensitive information hits the merchant’s payment system, all the way to a safe harbor upstream, the data is encrypted,” explained Tadele.

According to ACI’s EMV Readiness Survey, nearly 40% of fuel merchants are considering P2PE solutions as part of their general EMV upgrade, a testament to how useful such a solution can be.

Since merchants often need to retain customer information, tokenization is another security tool which can be of great benefit. Sensitive data, including card numbers, account details, and customer’s personal information, is replaced with a token, which is basically “a representation of your customer in a non-sensitive manner,” said Tadele.

Finally, investing in better general fraud management solutions is key, with nearly 60% of fuel merchants considering fraud management platforms as part of the EMV upgrade. These solutions will better safeguard against fraudulent digital and physical transactions, as well as other types of crime, including loyalty fraud.

An opportunity for innovation

Fuel merchants can also use this opportunity to pursue innovations that greatly improve the customer experience, a fact that is not lost on many fuel merchants. In its survey, ACI found that the majority of these merchants are considering additional improvements on top of EMV upgrades.

For example, merchants can use this opportunity to begin accepting new payment methods, including touch-free payment options like mobile wallets, QR codes, and contactless cards. Even without the pandemic, supporting more digital payment methods helps merchants because customers value payment choice and a smooth customer experience. But with COVID modifying consumer behavior, supporting these payment methods is more critical than ever, noted Tadele.

Another area of opportunity for merchants is in beefing up their loyalty programs and general marketing tools. Pucci explained how C-stores and gas stations can use enhanced loyalty programs to increase how much customers spend per transaction, in addition to the frequency of transactions. Other options include installing screens at the pump to display messages and deals to customers.

How to use mobile apps to drive change

Mobile apps will be a critical tool for merchants looking to seize the opportunity presented by EMV upgrades. Already, major retailers have deployed mobile apps with great success.

“Many national fuel retailers have their own mobile apps with integrated features, whether that includes station locators, payment options and loyalty programs,” said Pucci, adding that it’s a good time for smaller retailers to follow suit.

To learn what the best practices are while designing an app, what features and functionality are necessary, and how the overall customer experience can be improved, listen to rest of the webinar, “How Fuel Merchants Can Use Platforms to Drive Innovation & Profits”, here.