Software developers are continuously coming up with new and modern platform solutions, but many are unfamiliar with the nuanced ins and outs of payment flows. Nonetheless, payment-related activity is a crucial feature for applications across almost every vertical.

To help developers bridge the gap in understanding payments and streamline the process of developing high-quality applications for end-consumers, companies have created Software Development Kits (SDKs) that make it possible for developers to build payment solutions, optimize their payments flow, and test their products.

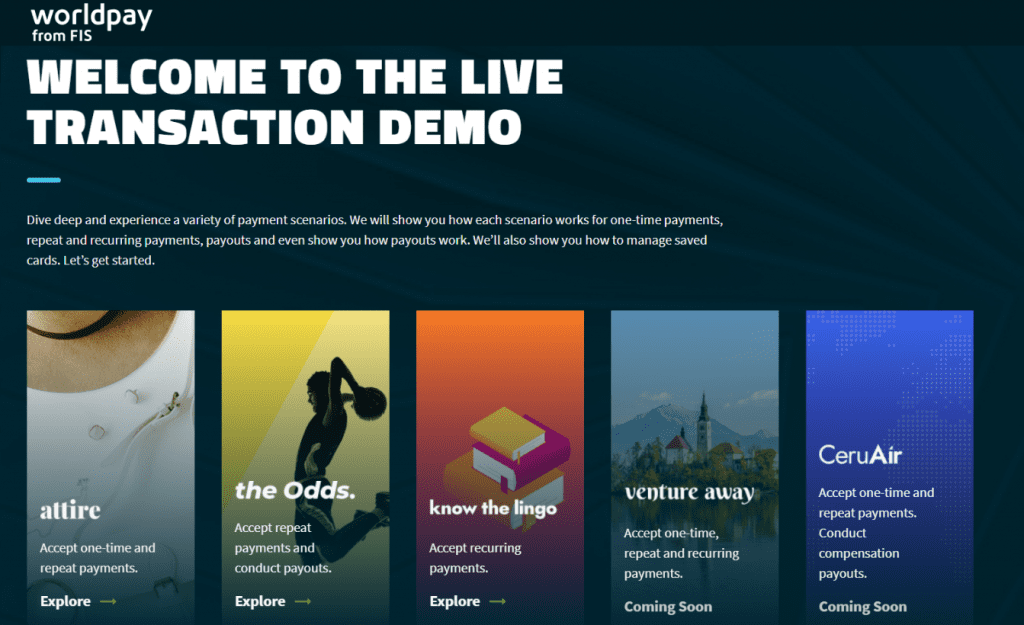

Worldpay from FIS is one such company. Access Worldpay products offer modern APIs, SDKs, documentation with code examples, PCI compliance, a test environment, and interactive demos—everything developers need to build out a payment solution. Developers can easily create their own uniquely styled and branded checkout forms by using the Access Worldpay SDKs and integrate with its range of APIs to build a solution that meets their needs.

API documentation is crucial for payment processing

Application programming interfaces (APIs) are the cornerstone of online financial activity, making it possible for e-commerce sites and mobile applications to process payments and track orders.

Consumers using applications that rely on APIs don’t have to interact with the API itself. Rather, they simply need to know how to navigate the user interface of the app. Software developers don’t have this luxury. Their application has to be able to successfully communicate with a user’s bank and make payments. Luckily, APIs come with documentation that helps them do so.

API documentation is a set of instructions for how to effectively connect with and use an API. It details exactly what an application needs to send to the API to get it to function properly. Payment APIs enable payments, manage recurring subscriptions, and make purchases through apps possible, which is why they are the cornerstone of the modern payments flow.

Visualized payment flows inform developers

Taking it a step further, Worldpay offers developers smart journey demos that simulate card and alternative payment method flows and the outcome of the transaction and verification processes. Developers can test app functionality for authorization success, failure, and errors and view the outcome of verification processes such as 3D Secure authentication.

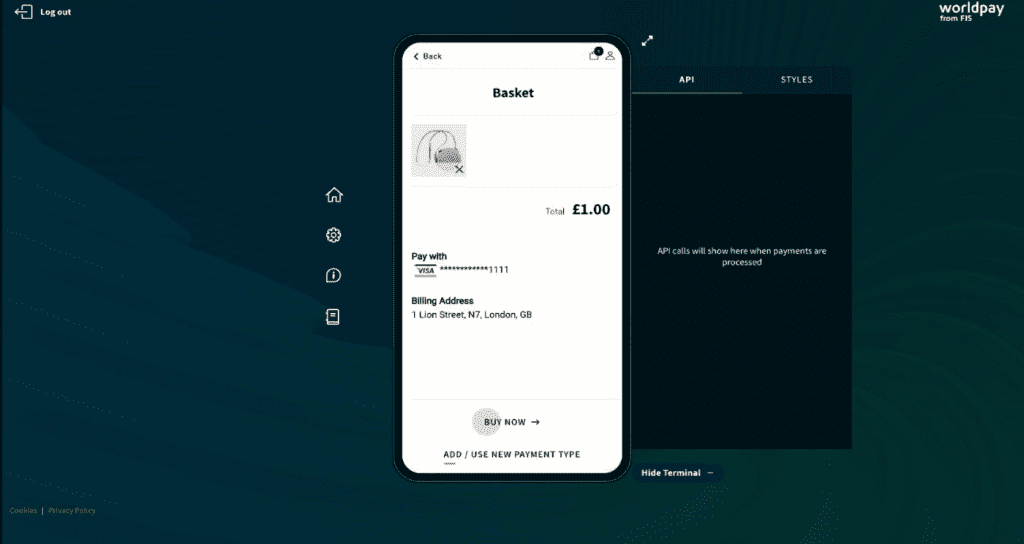

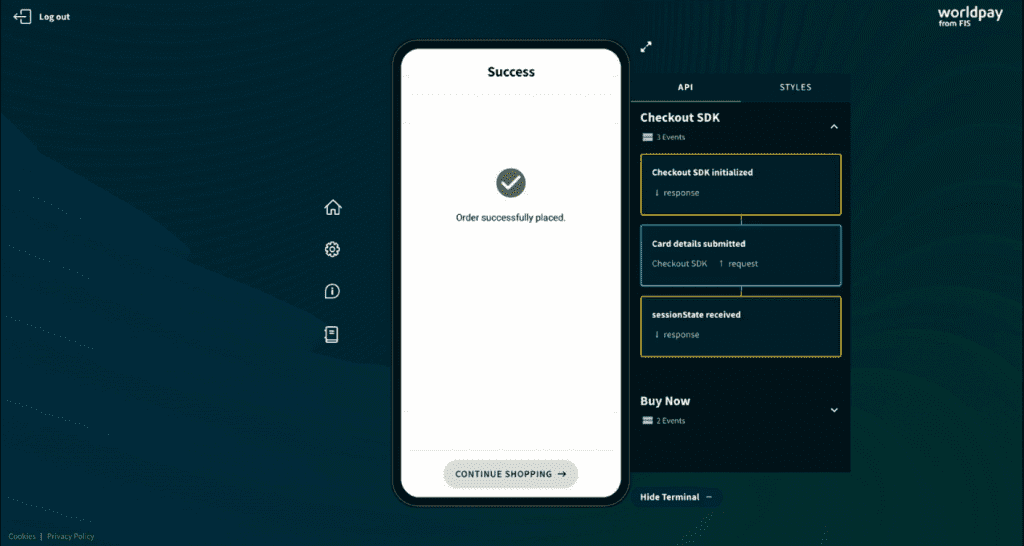

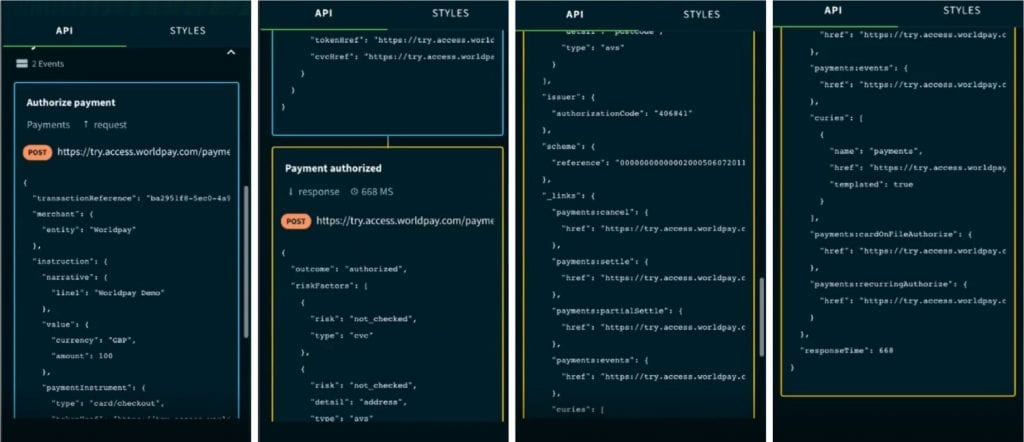

Below, observe Worldpay’s Access Checkout SDK in action as it goes through the payments flow of a stored card purchase with a card verification code (CVC) check:

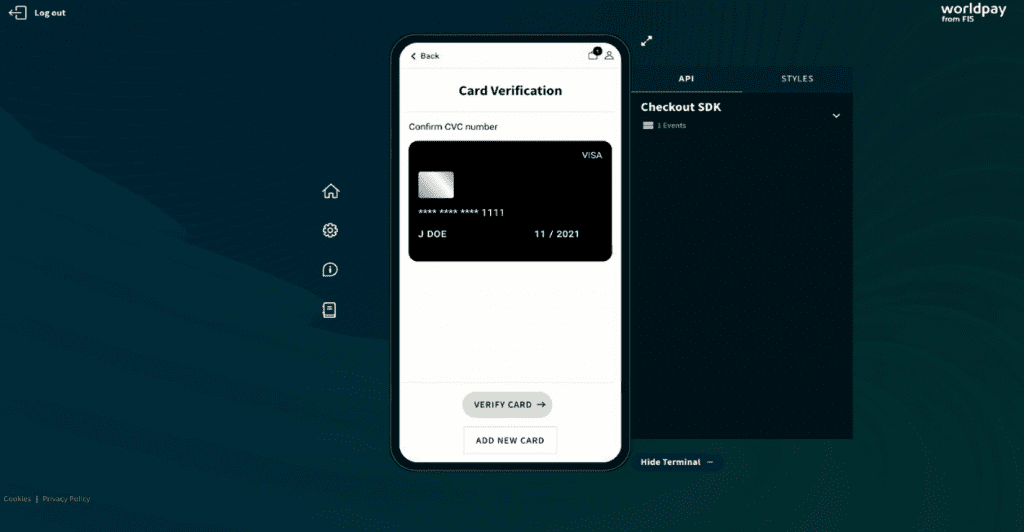

After placing the item in their cart, the hypothetical customer verifies their CVC number for the card that is already stored on-file:

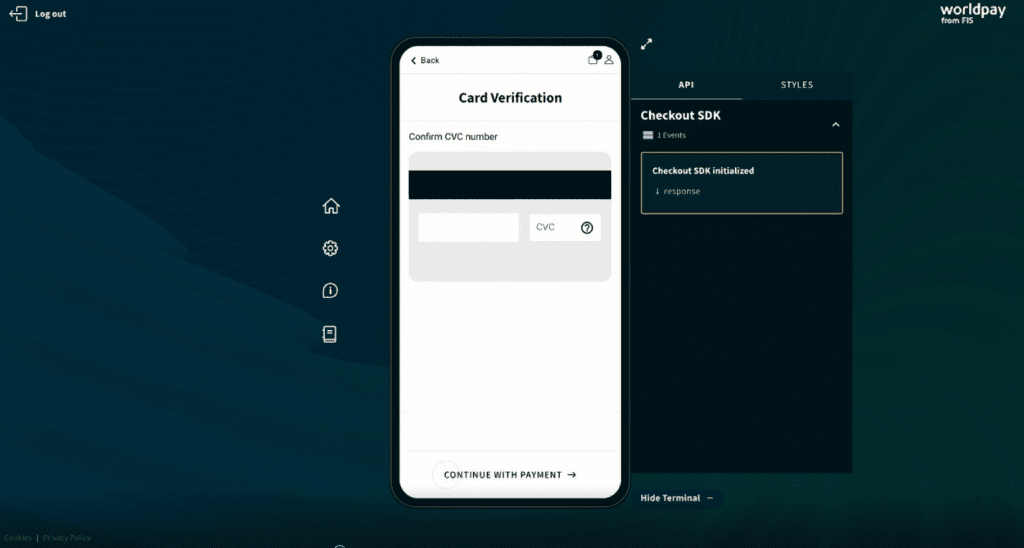

In this use case, the card number itself, as well as the expiry date, were previously stored as tokens for repeat payments. To maintain PCI compliance, the CVC is not stored past the verification process:

When the user submits their order, Worldpay encapsulates the card data:

On the left, the simulation shows the front-facing interface that will be visible to the customer. On the right, developers can see how the payment flow is fulfilled in a step-by-step manner via the SDK and APIs:

Additional use cases for Access Worldpay beyond a stored card purchase with a CVC check include processing one-off (single time non-stored) payments, recurring payments, frictionless stored card purchases, and updating and deleting tokens.

Since it is a test environment, there are no connections to a financial institution that would process an actual transaction. This means that there will be no transfer of funds. This testing service enables software developers to demo the crucial functionality of payment flows in a simple and effective way.

Developers need meet PCI compliance standards

Another factor developers need to keep in mind when integrating a payments flow is ensuring compliance with Payment Card Industry Data Security Standards (PCI DSS). PCI DSS is a set of security standards that aims to secure credit and debit card transactions against fraud and data theft. Any business—including e-commerce merchants—that processes credit or debit transactions needs to be PCI compliant.

Of course, PCI DSS compliance is nuanced and complex, and software developers would prefer to direct their attention to creating a user-friendly, seamless, and appealing app. The good news is that there are tools available that make it possible for them to do just that without compromising compliance.

Checkout SDK

Access Worldpay’s Checkout SDK, which was built to meet the qualifications of SAQ-a, can be integrated into websites and used to build apps.

It offers a low cost PCI compliant solution that enables merchants to capture card data securely and maintain autonomy over the look and feel of the checkout experience via mobile and web. It also allows businesses to process stored card transactions, one off or recurring payments, and update or delete tokens and can be used with different Access APIs to complete the payment flow that best fits an organization’s needs.

The takeaway

Worldpay’s toolkit enables developers to build payment solutions. Demos help developers understand payment flows and test their products. APIs make it possible for merchants to complete the payment flow, while documentation helps them integrate by providing specific guidance around flows and code examples. Checkout SDK serves as a low cost PCI compliant solution and retain autonomy over the look and feel of the checkout experience.