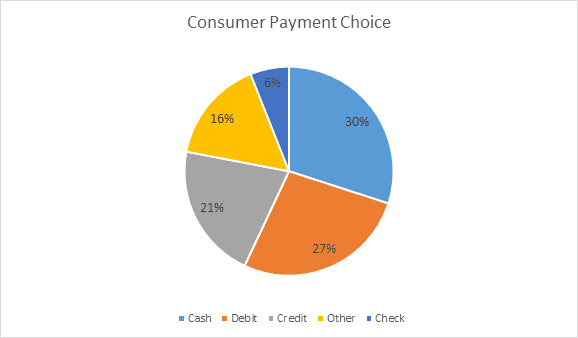

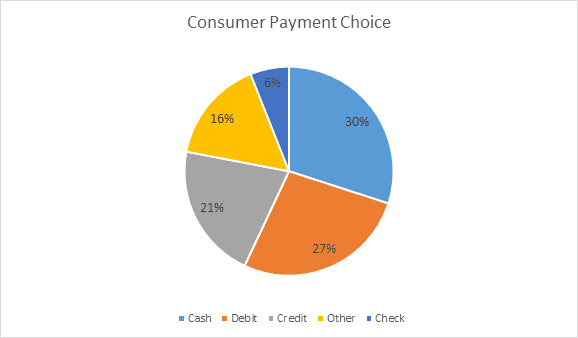

More cities and other municipalities are banning retailers from banning cash. Since a percentage of the population still operates in a cash-only environment, and many but not all, are low-income individuals, banning cash is the equivalent of banning this segment of society from these establishments. From a recent Fed study, here’s the break out of payment types:

An article in Bloomberg highlights this, but also points out that preserving the option of using cash is not deterring the growth of electronic payments.

Even as some U.S. cities seek to protect low-income consumers by barring stores and restaurants from shunning physical currency, digital payments are building acceptance around the world. A Citigroup Inc. index that measures the readiness of 84 countries to adopt electronic payments has increased 5.5 percent in the past five years, the bank said in a report this week.

“It’s a tale of two different philosophies. The situation on the ground inside the United States is very different than the situation” abroad, Jeff Sloan, chief executive officer of payments processor Global Payments Inc., said in an interview. “Most governments outside the United States are really focused on digitization.”

The movement away from cash has proven a boon for payments companies. Mastercard Inc. shares have gained 38 percent in the past year, and Visa Inc.is up 32 percent, compared with a 15 percent increase in the S&P 500 Information Technology Index. The payments networks are each up more than 1,000 percent over the past decade, more than double the information tech index and triple the S&P 500.

Overview by Sarah Grotta, Director, Debit and Alternative Products Advisory Service at Mercator Advisory Group