If you are going to monitor economic health, consumer confidence, and the long-range perspective on retail payments, the credit card industry is undoubtedly the place to start. The business was headed on a terrific course as we entered 2020, and no credit card policy manager, or economic expert, could foretell that a global pandemic would disrupt economies around the world.

In a Mercator Viewpoint published today, we talk about how some top players reacted to the economic uncertainty. One interesting point is that although fintechs might call financial institutions obsolete, insensitive to consumer wants, or slow to move, top issuers like American Express, Bank of America, Capital One, Chase, Citi, Discover, and Wells Fargo were nimble as could be.

There are many good examples of how well and how quickly both small banks and credit unions, regional banks, and global banks reacted. Top banks were lucky enough to be under Dodd-Frank directives to build up their loan loss reserves under CECL requirements. What seemed to be an onerous regulatory demand was instead a backstop that averted a credit crisis. The U.S. market was not alone- the rest of the world had similar requirements under IFRS-9.

But think for a moment about the people that make the industry work. For example, I’d guess that 70,000 people work in the U.S. credit card business and would expect close to 50,000 of them to work in back-office functions like call center operations, plastics rendition, statement processing, and risk management.

With trillions of transactions processing yearly and half a billion active cards, you must rely on technology and the people that use and support it. In comes the unexpected global event. It wasn’t a dirty bomb bringing down an electric grid or a national defense issue. Of all things, it was a health crisis.

Out came contingency plans. Numerous regulations, including Sarbanes-Oxley (SOX), require an effective strategy. In a near instant, call center people had to shift homeward with stockpiled laptops—policies for payment deferments needed to be adapted to the moment. Inbound applications had to be serviced, and card issuers had to balance risk management with customer compassion.

In any event, as you can tell from 1Q and 2Q21 revenues, the proof is in the pudding. The industry survived. So the credit card industry deserves a pat-on-the-back, so there it is, and here comes 2H21.

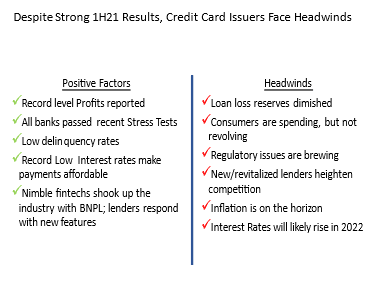

Watch out for 2022. There are some positive factors but expect some headwinds. Our view follows below.

German philosopher Friedrich Nietzsche said in 1888: “Out of life’s school of war—what doesn’t kill me, makes me stronger,” which is fitting in today’s financial services environment. It is time to start preparing for 2022, and this time, the card industry is stronger, but the risks are higher.

Overview provided by Brian Riley, Director, Credit Advisory Service at Mercator Advisory Group