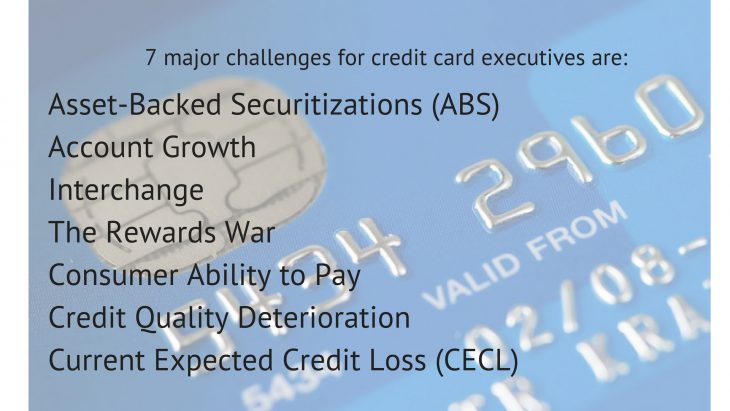

Asset-Backed Securitizations (ABS): Securitizations volumes have been erratic – plummeting during the recession, followed by a 2017 surge. Another sharp fall in the first half of 2018 has the market wondering, “How will this market settle over the next three years?”

Account Growth: Open credit accounts in the US have peaked; but new account bookings are running steady at 60 million customers a year. Account volumes are holding steady at 435 million, suggesting an attrition rate of 15%.

Interchange: US interchange rates are the highest in the world, inviting political and regulatory scrutiny in the (potential) near future. Given the recent $6.5 billion settlement with merchants, its likely that interchange will be reduced in the future.

The Rewards War: Rewards costs account for 1% of many transactions and the costs hurt every issuer’s profitability. Sometimes payments are easy to understand!

Consumer Ability to Pay: prime rates have almost doubled in the past three years, and tightening credit lines on low FICO scored customers should be a consideration.

Credit Quality Deterioration: One-third of credit accounts are less than three years old, so collection strategies need to focus on early delinquencies.

Current Expected Credit Loss (CECL): new accounting changes mandate larger loan reserves which we’ll see hit balance sheets in 2020. Tightened profit margins will limit aggressive lending.