In today’s world, no one likes to wait for anything – least of all their money. Whether it’s an employee waiting for payday, a friend waiting for an acquaintance to complete their Venmo request, or a customer waiting for their refund after returning a product. Money is time and time is money! Small businesses face these struggles every day. Their livelihood often depends on receiving payments promptly in order to run their business and manage cash flow to make all ends meet.

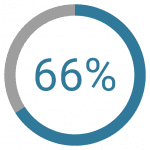

In fact, for small business owners and entrepreneurs, the lag between what we consider “getting paid” – such as seeing a customer swipe their card or paying an invoice – and having that money finally hit a small business’ bank account can be an excruciating wait. According to QuickBooks’ recent global survey of small business owners in the U.S., UK, Canada, Australia and India, nearly two thirds (66 percent) of small business owners report that the time it takes money to process after receiving payment has the largest impact on their company’s cash flow. This is compared to not getting paid by customers or clients within the terms of the payment (34 percent).

The journey of a small business or self-employed professional doesn’t usually follow a predictable path. Businesses try to accomplish new tasks, tackle new projects and attempt to make progress on unknown and unpredictable circumstances daily. Knowing this, it’s absolutely crucial for the payments industry to embrace faster funding in order to help small businesses – and by extension the larger global economy – thrive. And this is what is seen in the data presented by QuickBooks. For many small businesses and self-employed individuals who struggle with cash flow, the problem isn’t that they don’t have funds in the pipeline, it’s that they don’t have the funds readily available when they need them to cover real-time expenses. The research found that on average, U.S. small businesses have $53,399 in outstanding receivables!

So how can the payments industry help combat this problem and fully embrace faster funding? Two key components include next day credit card deposits and enabling faster settlement on Automatic Clearing Houses (ACH) payments.

Next Day Credit Card Deposits

Typically, when a small business gets paid via credit card it takes up to three business days for the payment to post to their bank account. During this time, the product or service has already been given to the customer, and overhead expenses such as payroll, inventory or rent may come up. This cash flow delay limits their ability to stay competitive and restricts the opportunity to re-invest back in their business. By providing next day deposit on all credit card transactions, the payments industry will give small businesses access to funds they desperately need right away, while helping them with one of the biggest pain points they face: managing cash flow.

ACH

Another important way small businesses get paid is through ACH bank transfers – making up over $5.6B in payments volume each quarter. Typically, these transactions take even longer than traditional credit card transactions – sometimes up to seven business days for the money to post to a small business’ account. As with credit card payments, this lag time can cause massive cash flow issues for small businesses.

With a rich history in Payments and operation of over $40B in payments volume, QuickBooks is at the forefront of change. We recently unveiled next day deposits for both credit card and ACH transactions, in which if a payment is processed by 3 p.m. PT, the funds will be in the customer’s account by the next business day. For those payments processed after 3 p.m. PT, the funds will be available the following business day – still a vast improvement when compared to the week-long waiting period that many small businesses typically face. This is made possible by fundamentally improving risk and transactional monitoring systems and leveraging the power of our ecosystem and machine learning to gather a rich perspective on fraud and bad actor behavior.

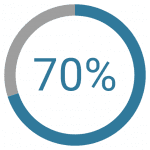

Cash flow is the lifeblood of small businesses, and those small businesses are the lifeblood of the economy – responsible for 70 percent of new jobs created and accounting for 99.9 percent of all businesses in the United States. Faster funding is just one way we in the payments industry can contribute and tip the scales in their favor so they can prosper.

My hope is that, similar to the work we are doing at Intuit, all of us in the payments industry can embrace faster funding and bring innovation that helps small businesses effectively manage their cash and succeed.