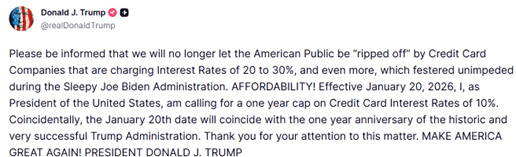

When the president announced the following statement on credit card price controls, credit policy managers must take note and prepare for market disruption.

Javelin commented on this topic in September 2024, when candidate Trump raised the 10% rate cap during his presidential campaign. (See: Market-Drive, Risk-Based Credit Card Price Controls Would Disrupt Borrowing and Lending). In that report, we suggested that credit card lending (and borrowing) would essentially stall because the rate would create losses for all issuers. Were it to happen, our simulation showed that credit card lenders would lose billions, ending with a potential 6.4% negative return on assets in a steady state.

By 2028, lenders could mitigate future losses by contracting lending and imposing stricter FICO Score cutoffs. To minimize risk, credit card lenders would need to lend only to those with FICO Scores of 740 or better, representing 118 million adults. Practically speaking, they would need to cease lending to those in the United States with FICO Scores <740, or about 114 million adults.

Bracing for Impact: Consumers, Investors, Issuers, and Merchants

Credit card lenders have a responsibility to ensure lending is safe and sound and to protect their investors and balance sheets. Lending into credit score ranges that will result in losses is bad business, and financial markets will not accept operational losses, even if executive orders cause them.

A broader concern for lenders and investors is how other financial markets, including auto loans, consumer loans, and shelter products, could be affected by an interest rate mandate. Merchants should be on notice that much of the $4 trillion that passes through credit cards is vulnerable to reductions in credit availability, which will affect verticals ranging from durable spending to everyday card use and consumable products. Credit card issuers will need to rethink their business models entirely, as profitability will no longer swing from black to red.

Four Strategies to Mitigate Risk from 10% Interest Pricing Controls

Although the discussion centered on a Truth Social post, it would be reckless not to consider the impacts and countermeasures. Here are four facets to consider; each requires some form of regulatory endorsement but is germane to the 10% issue, which will also require more than a comment on social media:

Overhaul the Minimum Due Strategy. The construction of a minimum due is an American invention that allows a small portion of the balance to be paid while interest is serviced. The metric is roughly 1/36 of the outstanding balance. Many companies use the same format, but others do not. India, for example, is closer to 1/20. This higher amount benefits the consumer by paying off a larger portion of the principal balance each month. Canadians in Ontario recently underwent a mandated increase in minimum due amounts, which appears to be successful. Although it does not affect other provinces, the province requires that all credit card transactions amortize on a 5% of balance standard. A similar action in the U.S., perhaps doubling the minimum due to a 10% increase, would mitigate much of the risk in interest rate spreads. However, expect a spike in delinquencies as households face less available credit and higher payment rates.

Shut off lending to FICO Scores < 740. This will reduce lending, but it will eliminate future lending risk to high-risk borrowers, directly improving operational revenue. Cutting off credit limits to those outside prime credit is severe, but the lender has a responsibility to its shareholders, particularly given the public benefit of credit extension.

Impose a transaction fee on borrowing. To offset the disruption caused by an interest price control, card issuers should consider alternative uses in Sharia-compliant lending. Islamic financing prohibits charging interest (riba). Fees may be charged, but interest may not. Perhaps the industry needs to consider a blended approach of reducing interest rates and adding a transaction fee to offset the revenue loss.

Make Credit Card Interest Tax Deductible Again. Credit card interest was tax-deductible up until the Tax Reform Act of 1986. To control inflation and encourage savings, the deduction was eliminated. While the impact will vary by adjusted income, a return to deductibility would provide a meaningful benefit to many consumers, allowing the current average interest rate of 22.25 to remain competitive in the market.

Summary

The executive-level discussion of credit card interest rate price controls requires credit card issuers to position themselves and protect their investors. We propose four action items that will require bank lobbying and influence to achieve; in the interim, we suggest that each contingent be considered. For borrowers, it will be a tight credit market. For merchants, lost sales. For issuers, a revenue challenge, and for investors, an unacceptable situation.