Financial institutions are under growing pressure to adapt to a rapidly changing market and operate efficiently. The cost and complexity of maintaining multiple legacy systems can be overwhelming and resource intensive.

If approached strategically, payment hubs can solve the challenge financial institutions face managing and maintaining existing infrastructure, as well as building capability to address new payment initiatives. To discuss the benefits of payment hubs, PaymentsJournal sat down with Robin LoGiudice, Senior Director of Product Management for Enterprise Payments Solutions at Fiserv, and Steve Murphy, Director of Commercial and Enterprise Payments Advisory Service at Mercator Advisory Group.

Challenges of managing multiple legacy payments systems

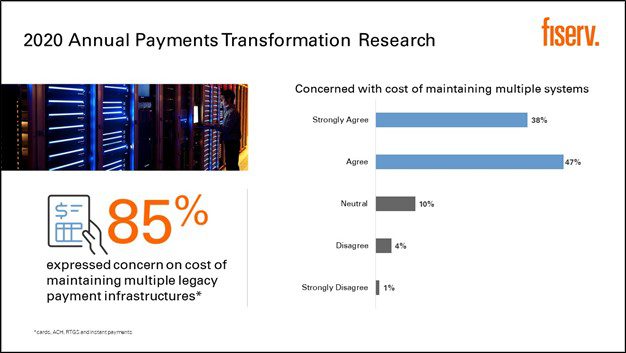

Financial institutions are often managing a “patchwork” of aging and siloed payments systems that simply cannot keep up with all the changes occurring in the market. A fact affirmed in a recent Fiserv payments survey, wherein 85% of respondents said they were concerned with the cost of supporting multiple legacy infrastructures.

The move to real-time payments is also putting pressure on financial institutions to modernize their payments infrastructure with an unknown return on investment. Additionally, all financial institutions are now required to adopt the ISO 20022 format changes at an accelerated rate. Access to data and information about payments is just as important as the payment itself.

“Now we’ve got financial institutions and businesses trying to figure out how [to] better serve [their] customers using this information: ‘Where is my payment? Why did I receive this payment? What is this payment for?’ These are all the questions that customers are asking their financial institutions,” explained LoGiudice.

These key drivers affecting the payments market are acting independently and very often affect different departments and systems within a financial institution. As all of these moving pieces come together, financial institutions are looking for a payments strategy that span multiple payment types rather than buying another silo.

Enterprise payments platforms can address these challenges

Payment hubs are growing in popularity, with banks and financial institutions taking an enterprise approach to solving some of the aforementioned problems, such as real-time payments. “At Fiserv, we look at a payment hub as an enterprise payments platform capable of clearing and settling more than one payment type,” said LoGiudice.

There are many definitions of a payment hub out there and just as many different solution providers, however, not all hubs are created equal, and they do not all offer the same capabilities. This can sometimes create challenges for financial institutions as they sort through what is available in the market. LoGiudice advises that in addition to supporting multiple types of payments, hubs should:

- Provide payments warehousing to facilitate reporting and data analytics that rely on stored payment data over a prolonged period.

- Support messaging and data normalization to enable consistent payment processing and reuse of previously developed assets.

- Support configurable workflow and rules management to enable financial institutions to configure customer preferences and orchestrate their own processing.

- Manage final settlement to support a full end-to-end processing workflow, taking the payment from origination to settlement, including exception processing.

“A payment hub enables financial institutions to handle new and existing payment processing on a single platform in a consistent manner with a single investment and lower cost of ownership,” summarized LoGiudice.

Implementing a payment hub

Implementing a payment hub requires a strategic approach based on the organization’s analysis of what is best for their business. “However, they also need to take a tactical approach,” said LoGiudice. “Financial institutions can’t start with everything at once; they need to start with one payment type.”

For example, many financial institutions are using the emerging real-time payments schemes, such as RTP from The Clearing House, to initiate a payment hub implementation. While this demands an initial technology investment, it solves an urgent market need as well as future proofs the investment for further expansion.

Fiserv has noticed that financial institutions are using the impending ISO 20022 changes to rationalize the move and are migrating existing payments processing to their new payment hub. “From (a) simplified integrations, (b) lower cost of ownership, (c) to a better customer experience, and (d) shared services and operations, the benefits of implementing a payment hub are many,” added LoGiudice.

Selecting a payment hub

Financial institutions should seek a single platform with the capability to process more than one payment type. It should also have a common technology and open architecture in order to ensure a consistent customer experience and the ability to offer new services and products. It’s a strategic roadmap to reduce reliance on legacy technology and processes.

As a global leader in payments and financial technology, Fiserv helps clients achieve best-in-class results through a commitment to innovation and excellence. Enterprise Payments Platform from Fiserv can deliver a payment hub on premise, in the cloud, or as a managed service. It enables financial institutions to integrate a variety of services in real time and offers a seamless customer experience, with speed and convenience.