Getting a credit card has never been easier. Yet the rise in issued cards exacerbates the ever-present challenges that face issuers, banks, and above all else, consumers. User loyalty is at an all-time low. Banks and issuers struggle to retain existing cardholders due to the plethora of rewards programs incentivizing customers to apply for new cards. At the same time, consumers are having a difficult time paying off their balances, driving card debt and delinquencies to record levels. Faced with these challenges, financial institutions are turning to new customer engagement strategies – utilizing artificial intelligence to transform the oft-fraught relationship into a win-win for all.

Fleeting loyalty, skyrocketing debt create challenges for issuers and consumers

The abundance of credit card options along with a constant stream of enticing offers for new customers has created a loyalty crisis. Long-term customers are harder to nurture, as competitors poach cardholders by outdoing each other with extravagant rewards and perks. These perks, not a sense of brand loyalty, have become the prime factor in gaining and retaining customers, with 75% of cards now offering a rewards program, up from 58% two years ago, and 60% of Americans selecting their preferred card based on rewards offered.

While older consumers may be more hesitant to rapidly shift from card to card, millennials and younger card users have no such hang-ups. As banks battle to acquire new cardholders, the costs of acquisition have skyrocketed. In a recent example, J.P. Morgan Chase announced a $330 million charge to cover excessive reward redemption costs.

Getting into the wallets of users is just the first step. The average American has 3.7 credit cards to their name, so for banks who issue cards with no annual fee, it is not enough to simply be in a consumers pocket. For these cards to become profitable, they must become the “preferred card of use”.

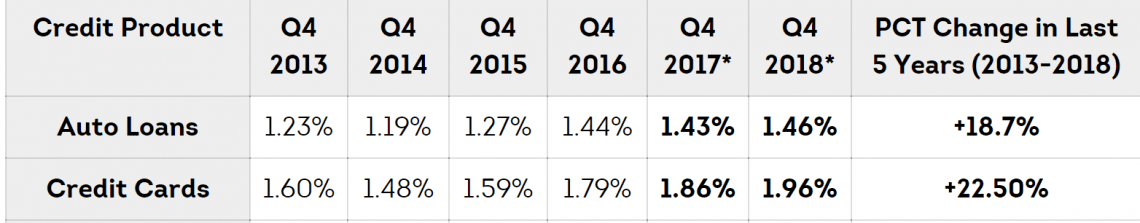

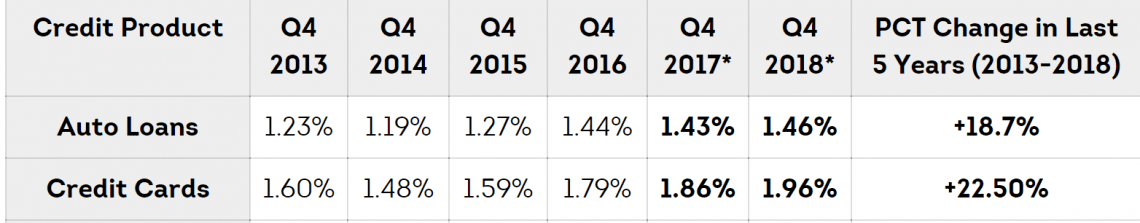

Provided issuers succeed in acquiring new users and becoming the card of choice, they face a final concern – the continued rise in credit card payment delinquency rates, which have grown 22.5% in the last 5 years and are expected to reach 1.96% by the end of 2018.

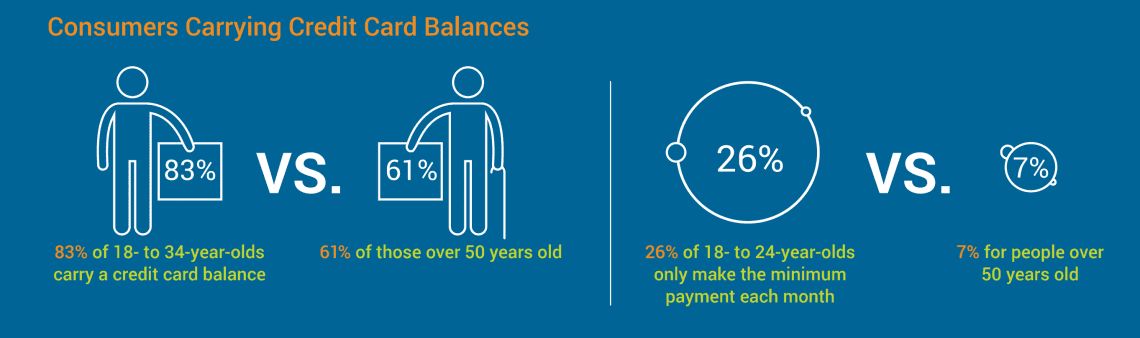

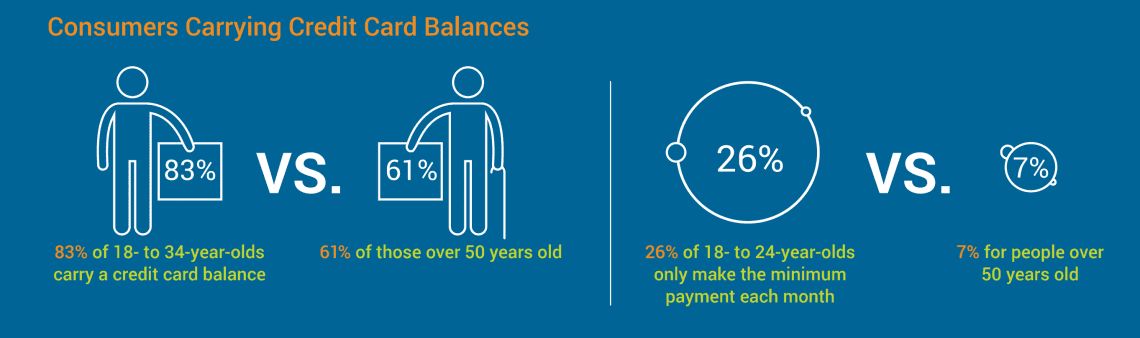

The ease with which credit can be accessed has led to a growing problem. Americans have accumulated over $1 trillion in credit card debt, with the average American holding a balance of $6,354 – a 2.7% jump over the past year. Even more alarming is the mounting debt of young cardholders. Among 18-24 year-olds, only 1 out of 4 makes the minimum payment each month. The result? National credit card debt is on the rise and worsening.

Artificial Intelligence: Turning Transactions into Currency

Credit card issuers are finding that personalized services are key to retaining customers. Once the initial rewards have been consumed, the risk of losing customers rises. In fact, 33% of consumers who have left business relationships, such as banks and credit cards, did so due to the lack of personalized service.

Yet card issuers are sitting on a goldmine – troves of customer transaction data. With the help of AI, they can make this data useful to the customer in the form of highly personalized, just-in-time advice and insights.

From the most basic task to the most sophisticated areas of personal finance, AI can provide the personalized guidance that consumers desperately crave – maximize credit card rewards, select a new card based on changes in their financial needs, and help stick to saving and spending targets. AI can also detect upcoming deadlines and alert cardholders, thereby reducing the odds of delinquency and associated fees.

Beyond the day-to-day financial management advice, new systems are capable of guiding cardholders through the process of paying off outstanding debt smartly. By analyzing the financial situation of the cardholder in real-time and over longer periods, AI-driven systems can accurately forecast spending patterns and determine how much money is safe to set aside for debt repayments on any given day. Access to aggregated banking data is helpful, but sufficiently accurate predictions can be made without it as well. This personalized, forward-looking approach is key to helping cardholders move out of the red.

Helping consumers reduce their credit card debt is a double-edged sword for financial institutions. In 2016, card issuers collected over $100 billion in fees and interest on debt. Card issuers can offset lost fee revenues through long-term value. By keeping customers happy and demonstrating how they place customers first, card issuers hope to become the “preferred card of use.”

This is especially true for premium card holders, who tend to pay their full balance each month. By delivering personalized advice, card issuers hope to create additional incentives for these customers to stick with their card and reap rewards from the high annual fees these happy customers are paying.

The Future of Credit Card is Personal

Consumers are in full control of which credit cards they use. Gone are the days of expensive and generic card offerings. With the introduction of AI, more personalized, relevant, and helpful benefits and services can be offered – and customers know it. While 2 out of 3 users of non-bank apps are highly concerned about their privacy, they are still willing to share their data with a trusted partner in return for personalized insights and helpful services. The new “preferred card to use” will be the one that offers fair fees, customized benefits, and proactive advice that help customers be smart about their credit card spending and move out of the red.