For most financial institutions, modernization and digital transformation are top priorities, yet many still struggle in these efforts. Many are unsure where to start and also wary of the potential risks with modernizing legacy systems. Therefore, a large number of banks and credit unions are still in the beginning or exploratory phase of digital transformation.

Yet these projects are more important than ever. Financial institutions face more competition than ever. This is not only from other financial institutions. But they face competition from fintechs and digital-only neobanks, too. This also includes consumer expectations derived from nonfinancial firms such as Amazon and Uber.

Digital transformation and modernization may seem a monumental task, but by using open architecture and taking advantage of partnerships, financial institutions can make great strides. To learn more, PaymentsJournal sat with Lance Homer, Global Head of Digital Payments and Banking Ecosystems for digital infrastructure company Equinix, and Sarah Grotta, Director of Debit and Alternative Products Advisory Service for Mercator Advisory Group.

What Makes a Better Bank?

Ultimately, modernization projects are embarked upon to create a better bank. There are several aspects of what constitutes a “better bank,” noted Homer.

“It’s about being greener, connected, smarter, modular, distributed, and automated,” he said. “These are the things driving digital transformation across the landscape.”

All of the above are byproducts of moving out of legacy data centers and into the cloud. That includes using open application programming interfaces (APIs), breaking up the legacy tech stack, and moving toward a platform model. As one example, Homer noted that moving to the cloud and operating fewer data centers mean banks can reduce their carbon footprint and reach ESG goals quicker.

Furthermore, by adopting a platform model using open APIs to connect with best-of-breed partners, banks can offer more innovative products and services to their customers and bring them to market quickly.

“It’s difficult for banks to differentiate on the thing they used to, like interest rates,” said Homer. “It’s about operating smarter and creating a better end-user experience.”

Grotta added that modernization is a “hot topic” in banking at the moment and that “I get at least two calls per week from financial institutions thinking about embarking on some level of modernization.”

Digital Adoption

She observed that in the past few years — especially spurred on by the pace of digital adoption during the COVID-19 pandemic — many bank and credit union executives are more sensitive to how their institution is lagging when it comes to digital capabilities.

“A lot of them are not happy in the way their institution has reacted when new digital products are launched into the marketplace, and they have a tough time delivering the digital customer experience they want to be known for,” Grotta said. “They need to keep up not only with the competitor down the street, but deliver on experiences that consumers and business are finding in other places as well.”

Homer said it is hard for many institutions to know where to start when it comes to modernization projects, but the ideal place to begin is replacing the “plumbing.”

“For banks, this means positioning to move to the cloud,” he said. “Figure out which applications can move to the cloud and which can’t. Determine where your cloud on-ramps sit and where your partners connect. Then it’s easy to move workloads one at a time.”

Financial institutions should also work to separate their technology stack into its component parts; this can be difficult due to having to work through years of “spaghetti code,” but being modular will enable institutions to be more agile, Homer said.

Banking-as-a-Service

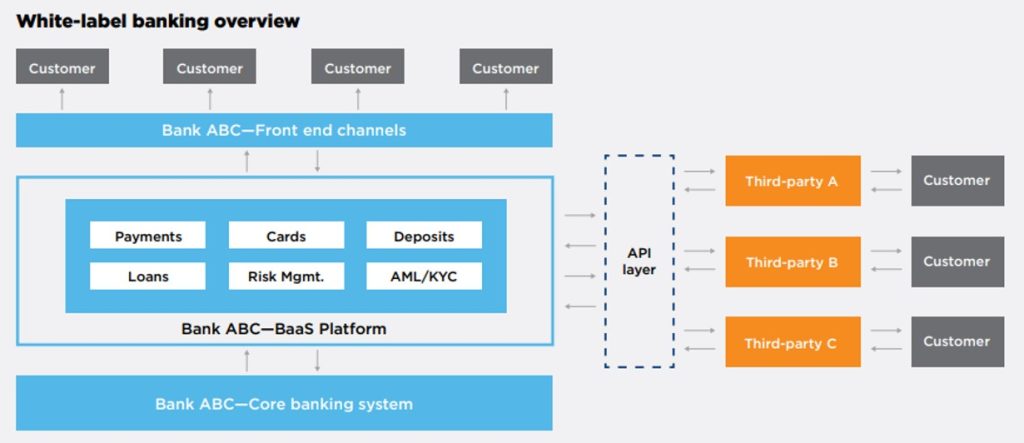

These modernization efforts ultimately help institutions work toward a “banking-as-a-service” (BaaS) model and embrace embedded finance, Homer added.

“We are seeing this as-a-service model being adopted everywhere, across industries,” he said. BaaS “is about rethinking the digital supply chain and rethinking how a bank builds its infrastructure.”

BaaS enables a quicker time to market and the ability to identify new revenue opportunities and to distribute services at the edge. The latter point is critical especially in helping banks move into new geographies by enabling them to manage and store data in the different geographies they operate in.

A platform model is also helpful in facilitating real-time payments, which consumers and businesses are increasingly asking for.

“In the old-batch processing model, you just need to get the file sent by the cutoff time,” said Homer. “But with real-time payments, you need always-on connectivity.”

Finding a Trusted Partner

When it comes to modernization, financial institutions can’t do everything at once so finding a partner to help guide the process is critical. For example, Equinix does not operate its own public cloud, so it can be an effective neutral party in helping banks and credit unions evaluate the different cloud providers, said Homer, as well as to advise how banks and credit unions should build their new tech infrastructure.

“You need to consider the relative strengths of the various cloud providers,” he added. “Also, where do you put non-cloud apps? Not everything can go on the cloud. Some banks can have up to 3,000 apps that are not cloud-ready. They still need to talk to each other. So how do you build an infrastructure so those cloud and non-cloud apps still talk to each other as they did when they were sitting side by side on computers in your data center?”

Grotta noted that banks that are not thinking about these issues need to start doing so now or risk falling behind the curve.

“Open banking is here whether we have mandates about it or not,” she said. “If you don’t have a plan for it now, you are putting your business at risk.”