Podcast: Play in new window | Download

In recent years, merchants have chipped away at the bill payment market, offering consumers a pleasant overall experience and a breadth of payment options. While many financial institutions offer forms of bill payment, the experience, transparency, and setup is not ideal for consumers. Because of this, merchants continue to gain bill pay market share.

To take a closer look at why it is important for financial institutions to recapture the bill payment market and how leveraging electronic bill payment and presentment (EBPP) technology enables them to do so, PaymentsJournal spoke with Nirmal Kumar, CTO and Head of Product at Aliaswire, and Sarah Grotta, Director of Debit and Alternative Products Advisory Service at Mercator Advisory Group.

Automatic and digital payments are emerging as preferred bill pay methods

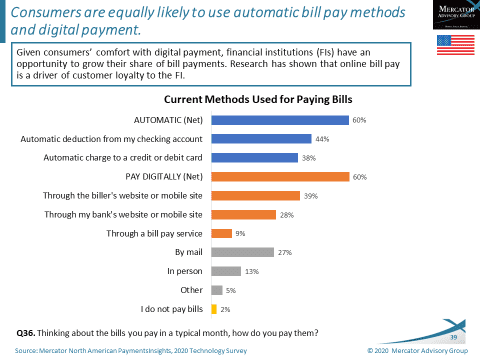

The chart below contains findings from a consumer survey conducted by Mercator Advisory Group on consumer payment habits. The survey revealed that consumers are choosing a breadth of payment types to pay their bills, and that the payment type they choose is largely dependent on their specific needs for each particular payment.

“This chart really epitomizes what the payments industry has witnessed in the bill pay industry,” explained Grotta. “There have been a lot of changes in bill pay habits in the past several years, and as with most payment types, there’s been an expected shift towards digital interfaces.” While some consumers still pay bills via check, there is a clear preference for automation and digital payment options.

Much of this shift is driven by the better customer experience digital bill pay can offer. Paying bills directly on a biller’s website often offers more payment choices, automation, and clarity of information surrounding the bill pay process.

Unfortunately, not every financial institution has kept up with these preferences. While banks do recognize that bill pay both drives institutional loyalty and is critical to consumers’ financial wellbeing, they are missing opportunities to make it a more central part of their interactions with customers. Ultimately, both increasing bill pay enrollment and creating a highly automated and efficient operating environment for all participants in the bill pay cycle is crucial for future success.

Emerging trends in the EBPP space

“Historically, EBPP has been focused on the electronification of payments through various portals and IVR systems; there was less consideration given to account posting and marking payments as done,” noted Kumar. But as electronification becomes more ubiquitous, other focus areas are being honed in on.

First, billers of all sizes want a cost-effective way to equip their platforms with the features that were traditionally only available to enterprise billers with large IT teams. Prioritizing the implementation of fully integrated, end-to-end systems that post payments in nearly real-time are needed to do so.

“Historically, EBPP has been focused on the electronification of payments through various portals and IVR systems.”

NIrmal Kumar, CEO and Head of Product, Aliaswire

Secondbillers want to provide payers with the best experience possible. As a result, billers have begun tailoring the payer’s user experience to the vertical the specific bill pertains to. For example, the information accessible to a payer regarding a healthcare payment may look different from that of an insurance payment. But there is still ample room for improvement in this area, and the onset of the global COVID-19 pandemic has accelerated consumers’ interest in, and demand for, automated and electronic bill payment options.

Because of the need to offer consumer-centric bill pay services, there is also increasing discussion around how to converge BSP (bill service provider) and bank bill pay. One example is Mastercard Bill Pay Exchange, which enables consumers to pay a variety of bills without setting up separate accounts for each biller. Aliaswire was among the first to offer Bill Pay Exchange to its customers.

How to modernize and improve the bill pay process

In a typical payments ecosystem, there are three parties involved: the person making the payment, the biller receiving the payment, and the systems in between that ensure security and regulatory compliance. According to Kumar, there are demands for improvement in all three areas:

- Bill process automation. Billers benefit from increased automation because payments can be immediately reflected in their accounts receivable (AR) billing system without manual intervention.

- Frictionless payments experiences. On the payer side, tailored payment experiences, the displaying of relevant and vertical-specific information, and the ability to seamlessly make a payment greatly enhance the customer experience.

- Security and compliance. That said, a tailored customer experience should not come at the expense of security. On the backend, a biller may need to comply with HIPAA, PCI, or other industry-specific regulations while making advances in automation and the payer experience.

By improving each of these areas in their bill pay offerings, financial institutions can meet the needs of both payers and billers in a secure way. While implementing value-added bill pay capabilities may seem difficult, leveraging EBPP technology makes it possible for banks to do so in an efficient and affordable way.

Aliaswire is taking a new approach to EBPP

Knowing that consumers have a high level of trust for their banks, Aliaswire designed its DirectBiller solution to help its bank partners onboard new billers and support them with technology that offers automation, a better customer experience, and regulatory compliance.

Aliaswire is also in the midst of developing a number of bill payment initiatives that break through conventional bill payment methods. These include notifying customers about a bill through an email or text message and allowing them to pay via the web, mobile device, text, and interactive voice response (IVR) interactions. Further, Aliaswire is working on integrating alternate payment mechanisms emerging in the market, such as real-time payment capabilities and Zelle, into the bill pay space in a cost effective manner.

Lastly, Aliaswire’s integration with Mastercard Bill Pay Exchange (BPX) allows it to bring the economy of scale to banks and billers alike. With this one integration, a biller can be accessible to their customers from any bank that is on MasterCard BPX and a bank can have access to all the billers on our BSP Platform, avoiding a long and costly integration with each biller separately.

Conclusion

Merchants have largely taken control of the bill pay market because of their ability to offer a seamless customer experience. However, financial institutions can recapture the market by leveraging EBPP technology to meet consumer and biller demands and regulatory requirements. Aliaswire partners with banks to offer bill pay services, such as its DirectBiller solution, helping them take back the bill pay market.