Podcast: Play in new window | Download

To say merchants had a lot on their plates in 2020 would be an understatement. Brick-and-mortar companies had to shift online rapidly to stay afloat in the era of COVID-19. Others had an established e-commerce presence but were not prepared for the spike in online traffic and the onslaught of fraud that came with it. Now, as consumers embrace their new e-commerce habits for good, it is more important than ever to get the rising threat of fraud under control.

To learn more about the global payment fraud landscape and how merchants can fight back, PaymentsJournal sat down with John Winstel, Director of Fraud Product Management at Worldpay from FIS, and Tim Sloane, VP of Payments Innovation at Mercator Advisory Group.

Fraud is a growing threat for merchants

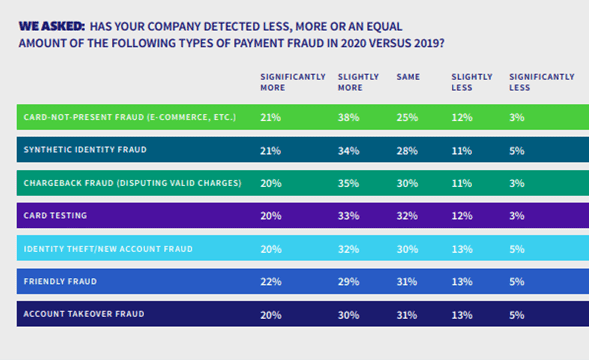

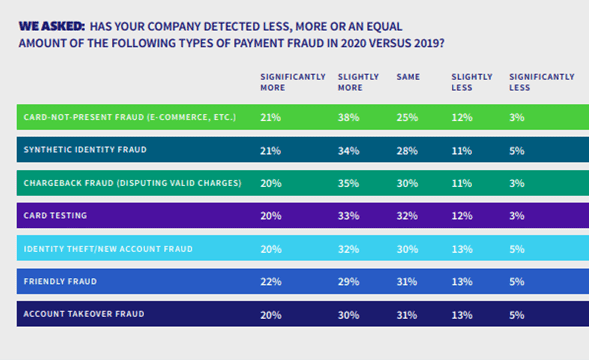

Worldpay by FIS recently conducted its annual Payment Risk Mitigation survey to gain a deeper understanding of the state of the current fraud landscape. The survey asked merchants about the level and types of fraud they experienced in 2020 compared to 2019.

The results, which are shown below, were unsurprising:

“For us that are in the fraud space, I don’t think it came as too much of a surprise for any of us that a majority of the respondents were supporting significant or slightly more fraud losses compared to 2019 year-over-year,” said Winstel.

This rang true across the board for all seven types of payment fraud included in the survey: card-not-present (CNP) fraud, synthetic identity fraud, chargeback fraud, card testing fraud, identity theft/new account fraud, friendly fraud, and account takeover fraud.

Fraud losses can have a significant impact on merchants’ bottom line, and some types of fraud lead to more loss than others. “I know for myself, [synthetic fraud and account takeover fraud] are the two probably most concerning new fraud trends that are out there because the losses can just be so impactful across the board from both a merchant perspective and on the issuing banking side of the house as well,” he added.

Contributing to the spike in fraud was the COVID-19 pandemic, which forced brick & mortar businesses to shift online. Figuring out how to navigate that shift and stay afloat during the pandemic was challenging on its own. For some, doing all of that while keeping fraud at bay was not possible.

“Many of our clients had started to see increases in their chargebacks, they started to see increases in fraud. They were looking for something that they could put in place very quickly,” Winstel explained.

But of course, merchants did not open their businesses for the purpose of fighting fraud. By outsourcing fraud prevention, they can get back to focusing on the core of their business. “You need somebody that’s an expert that you can lean on to help guide you on what your fraud strategy should look like,” advised Winstel.

Establishing a fraud fighting strategy

There are several paths merchants can take when it comes to fighting fraud. One crucial component of a strong fraud prevention strategy is data. Worldpay, for example, built its fraud detection suite using consortium data from its 40 billion annual transactions to help clients gain insight into customer behavior.

“What data you need depends on what it is you’re trying to detect and your mitigation strategy,” said Sloane. Machine learning, behavioral biometrics, and other payments buzzwords can serve as valuable tools in creating such a mitigation strategy.

Behavioral biometrics can be used to monitor customer behavior throughout the transaction process to determine whether potential customers are, in fact, who they claim to be. “It really starts with the merchant understanding what [its] top priority is and then looking at what data [it] can get. Data integration is key,” Sloane added.

Adding additional data at the checkout point can benefit merchants looking to better detect fraud. “Some of these seem so simple, but if you’re evaluating a transaction, and the only two metrics that the fraud system sees are the card number and maybe the dollar amount, it’s going to be pretty tough to decipher whether or not that’s a fraudulent transaction. But if you can layer in the Bill To, Ship To, the device, the location, the email address, and then there’s so much more there that you can really hone in on,” said Winstel.

The result of that layering is an overall increase in card acceptance and authorization rates and a fine-tuned focus on mitigating fraud losses that can eat away at the merchant’s bottom line.

What the evolving presence of e-commerce means for fraud management

Looking ahead, Worldpay by FIS anticipates that changes in consumer behavior in 2020, such as the explosive year-over-year growth of e-commerce–it grew 19% from 2019 to 2020–will have a lasting impact on the fraud risk and prevention space.

“A lot of that was driven by people who were forced to make changes in the way that they shopped [and] the way they transacted,” said Winstel. “And I think what we’re going to start seeing going into 2021 and beyond, and we’re continuing to see it this year, is that those convenience factors that have come out of this… are now taking hold,” he added.

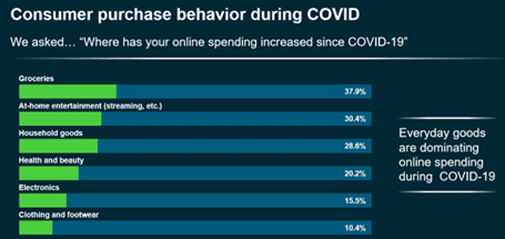

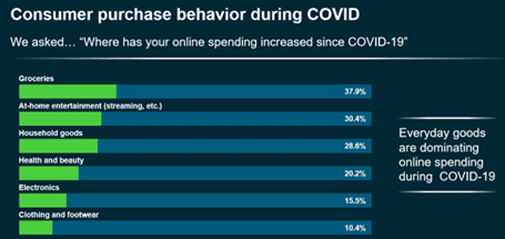

Worldpay’s survey of consumer purchasing behavior found that everyday purchases such as groceries, at-home entertainment, and household goods dominated online spending during COVID-19.

As far as how consumers are paying online, mobile wallets were the most popular payment method. In 2020, mobile wallets were used for 45% of e-commerce payment transactions. By 2024, this number will rise above 50%.

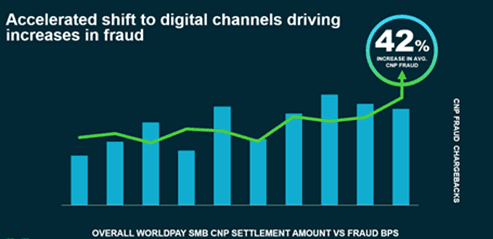

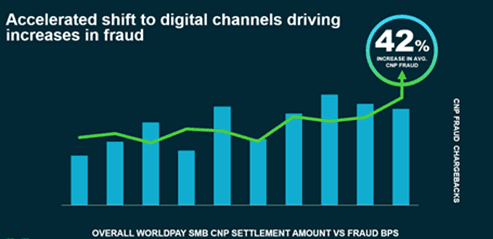

As consumers become increasingly comfortable with buying online in a CNP environment, fraud management is becoming increasingly crucial for merchants to avoid losses. This was evident in Worldpay’s survey, in which SMBs reported an average increase in fraud losses of 42%.

The takeaway

E-commerce is accelerating, in large part due to COVID-19, and shows no signs of letting up. This has opened opportunities for sophisticated fraudsters to exploit unprepared merchants.

“Criminal sophistication is going up, and they’re not going to stop. They’re going to continue to improve their game, and we have to improve our game to protect ourselves,” noted Sloane.

The biggest takeaway for merchants? Do not let your guard down.

“You need to make sure that you have a strong fraud strategy, and that you’re working with all the respective groups throughout your organization so they understand the goals from a fraud perspective of what you’re trying to achieve, while at the same time balancing that from a sales and finance perspective,” Winstel concluded.

Content from this episode of the PaymentsJournal podcast comes from Worldpay’s 2021 Payment Risk Mitigation survey. Click here to gain access to the full report.