Mobile app is the way to go for businesses owing to the numerous benefits offered by this platform. Your users are on this platform, and you can accomplish your reach goals only when you cater to their needs via engaging solutions.

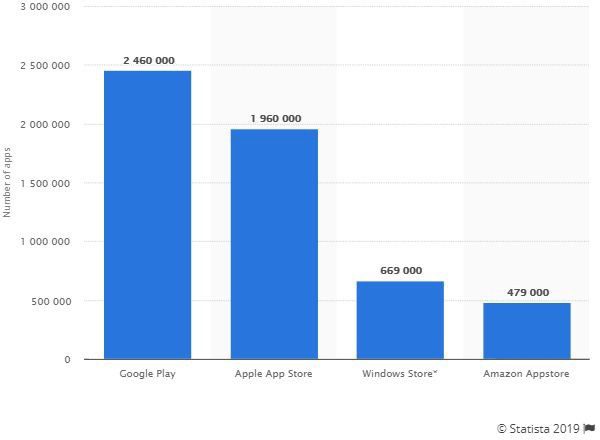

If you observe the app store, you will see that every day a new app is launched. As of date, Statista report indicates, there are close to 1.96 million apps available on the Apple store, and 2.46 million apps on the Google play store.

As apps are increasing on the app store, a number of apps are finding their way out of the mobile phones. Every day, at least one app is being uninstalled somewhere. It could either be the user interface which is not friction free or a hard learning curve that costs you an uninstall.

One major element that you need to consider when developing a mobile app so as to reduce the uninstall rate is the payment gateway. A lot of users prefer paying online, which is why you need to have a gateway that is smooth, seamless and offers instant payment solutions.

If you are planning an Uber-like app for ride sharing or pooling services, then payment gateway plays a crucial role in engaging the audience. Here we will take you through the different types of payment gateways.

How does a payment gateway work?

Before moving on with choosing a good payment gateway, you need to understand what it is and how it works.

A payment gateway is basically an e-commerce service that authenticates the credit card transactions for both the online and offline stores. Basically, the merchant is connected with the processing platform. The payment gateway integration is crucial to the success of the online payments, which offers the actual convenience of making online purchases to the customers.

When the user clicks on “Pay Now”, they are transferred to the payment gateway. It is here that the customer selects the payment method, whether it is a credit card or other transaction method. Once that has been confirmed, the customer is taken to the bank’s website, where they need to enter the details. Once you have confirmed the details, you will be notified if your transaction was a success, and you are taken back to the payment gateway, where the transaction is completed.

Payment gateway offers the following functionality that helps improve transactions.

- Encryption of the data by the web browser, which is then sent to the payment processor

- The payment processor then sends the transaction data to the card’s issuing bank, which either authorizes or denies the request

- Once the authorization is received, the same is forwarded to the payment gateway, which transmits it to the website’s interface

Apart from this, the gateway verifies the address, conducts AVS checks, performs identity morphing techniques etc.

Now that you are aware of how the payment gateway works, let’s understand how you can choose a good payment gateway for your websites or mobile app.

Choosing the ideal payment gateway

- The first concern every merchant faces when choosing the payment gateway is the security. It is important for your customers that the financial information they share on the ecommerce website remains secure. As a merchant, you need to adhere to this need. Apart from the security of the information, they are also looking for PCI-compliance, as it is important especially for credit card payments. You should ideally choose a layered payment gateway for perfect encryption of the

- The payment gateway comes with a high level encryption, also known as the SSL encryption which is 128 bit. This ensures that all the security breaches are completely avoided

- Your second encryption level is the digital signature that you will introduce into the system. In case the person hacking into your system does get the account ID, they would never be able to hack into your account, as it has been safeguarded with the digital signature

- You should always incorporate dynamic IPs within the system, so that if your account is used by another IP, it is automatically

This three-layer encryption will ensure that the payment gateway is serious about taking active security measures for your ecommerce site.

- Do you want to go with a hosted payment gateway or you want to opt for an integrated payment? The answer will help you choose a good payment gateway for your ecommerce

application. The hosted gateways are easier to set up, and ideal for the new stores. However, this gateway will hamper the conversion rates. It can be quite complicated, as a result, people will not prefer checking out with the hosted gateways.

The integrated payment gateway, on the other hand, allows your customers to checkout without leaving your store. They need to input all the data while they are on the ecommerce website, and it can translate into direct orders. If you are choosing a hosted gateway, make sure to simplify the process or add an on-boarding guide for the ease of use.

- The customer experience plays a crucial role when choosing the payment gateway for your mobile app. People who are opting for an Uber-like experience would not want to wait too long to make the payment. They want a similar method to complete the payment as well. That’s why you need to choose a gateway that enhances the experience through one-click, and seamless payment methods. People tend to use multiple payment modes, which is why you should choose a gateway that allows users to pay via their chosen method. For instance, the gateway should accept payments through wallets, credit cards, debit cards etc. when choosing the payment gateway for the Uber-like app, you should choose the one that is optimized for the mobile app

- Uber is a global brand, which is why it needs a gateway that can be used by international customers as well. If you are planning to go global, then you need a gateway that caters to international payment

- The fee structure plays an important role when choosing the payment gateway. Each gateway has a typical structure, which you need to keep in mind. Have a budget defined for the gateway, and make sure the structure defined by the gateway fits your budget

- Customer support is essential whenever you are integrating a third party solution to your app. If you get stuck somewhere, you need to be able to go to someone who can bail you

Summing up

You are bound to scale your app in the future, which is why you need to choose a payment gateway that makes scaling the app seamless and easy. You should also choose a gateway that will update itself to integrate the future currencies such as Bitcoin. The business model for the gateways also need to be considered.

Always keep your options open. If you want to move to another gateway that offers better experience for your riders, then make sure you can make the move in a hassle-free manner.

Author Bio

Yuvrajsinh is a Marketing Manager at Space-O Technologies, a firm having expertise in Uber like app development. He has over 90k LinkedIn followers. With the help of these followers, he has helped over 150 job seekers to find their new job in India. He spends most of his time researching the mobile app and startup trends. He is a regular contributor to popular publications like Entrepreneur, Yourstory, and Upwork.