As consumer payment preferences continue to change, and the payments industry evolves to meet these preferences, fraud prevention solutions will need to be flexible and scalable to ensure that consumers and companies can transact securely.

Kount, a company at the forefront of digital fraud prevention, recently released such a solution: the Identity Trust Global Network. To talk more about the importance of identity trust and Kount’s unique solution, PaymentsJournal spoke with Gary Sevounts, Chief Marketing Officer at Kount, and Tim Sloane, VP of Payments Innovation at Mercator Advisory Group.

What is identity trust?

Kount defines identity trust as “the ability to establish the level of trust for each identity behind every payment, account creation, and login event.” Each of these interactions has identifiers behind it, and each identity has a determinable trust level. A strong digital identity trust platform, such as Kount’s, accurately identifies and verifies the level of trust behind individual interactions, which is critical to effectively prevent fraud.

Identity trust levels can range from very low to very high. If an identity trust level is very low, it’s almost guaranteed to be fraud and knowing this allows businesses to react accordingly. On the flipside, an identity level determined to be very high allows businesses to feel confident that the interaction or transaction is legitimate.

For identity trust levels that fall somewhere between low and high, businesses have the option of stepping up authentication and monitoring customers for progressively trustworthy behavior. If a trustworthy pattern is established and the trust level rises, that extra layer of authentication can be removed.

What is an identity trust network?

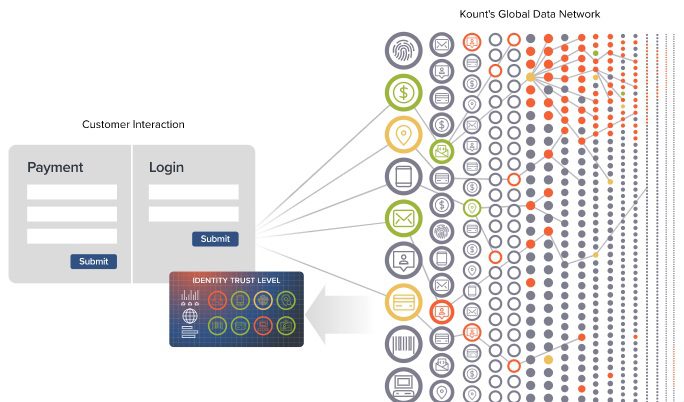

An identity trust network is a platform enabled with technological capabilities that can establish identity trust. Identity trust platforms go above and beyond the older method of evaluating identity trust level with a handful of device identity elements and an email address. Kount’s AI-powered Identity Trust Global Network, for example, looks at the “physical location of the interaction, correlation between the card transaction location, card location, shipping location, and history of the address,” explained Sevounts.

Commenting on this, Sloane added that “fraud platforms have been expanding to incorporate more of the customer journey, all the way from the first time they touch the website to ordering and payment disputes. It’s great to see that Kount has integrated identity trust right up front.”

Three major components that go into an identity trust network are:

- A big network of identifiers (data)

- Artificial intelligence (AI) and machine learning (ML) capabilities that provide accurate results

- An engine with the ability to customize personalized experiences

The importance of real-time capabilities

It is important that identity trust level capabilities are not only accurate, but can be processed in real time. Companies relying on third party processors often connect to APIs that take time to process and provide data. Depending on the processor, this can take anywhere from a few minutes to multiple days.

“The speed of a company’s response can be the difference between losing business and gaining revenue.”

Gary Sevounts, Chief Marketing Officer at Kount

For time-sensitive transactions, such as a gamer trying to make an in-game purchase or an e-commerce consumer creating an online account, the convenience of real-time transactions is particularly crucial. “The speed of a company’s response can be the difference between losing business and gaining revenue,” noted Sevounts. “It’s really not something that can be delayed.”

Recognizing this as critically important, Kount’s Identity Trust Global Network comes with an extensive and diverse set of built-in data that provides consumers with that real-time experience they crave, while protecting them from fraud.

An identity trust network improves the customer experience

Accurately identifying the trust level behind an interaction does more than prevent fraud. It also enables personalized customer experiences. If the identity trust level is determined to be high and a business feels confident in that, they may want to deliver a VIP, frictionless customer experience. This experience, in true, could motivate these customers to shop more and generate more revenue for the business.

Businesses with data on previous transactions can customize the customer experience even further by offering personalized recommendations. For online merchants, this customization and personalization enables them to better compete with e-commerce behemoths like Amazon.

Businesses benefit from identity trust in other ways, too

By using an identity trust network to create a better customer experience, businesses can increase revenue, establish a good brand reputation, and generate repeat customers.

Businesses using Kount’s Identity Trust Global Network have reported reduction in chargebacks, manual reviews, and false positives, while seeing significant improvements in operational efficiencies.

Kount’s Identity Trust Global Network

Kount’s Identity Trust Global Network, which encompasses the customer journey from start to finish, is an in-depth fraud prevention platform that reviews over 32 billion annual interactions, including over 17 billion devices each year and 2.7 billion fraud signals per interaction. The network spans across 75 industries and includes over 6,500 customers and payment providers.

“Having the depth and richness of data makes the world of a difference in being able to accurately identify the trust level,” said Sevounts, who added that Kount’s major advantage is that it “has built that data over 13 years of working with some of the largest online businesses and financial institutions in the world.”

Within milliseconds of initiating an interaction, Kount’s platform analyzes billions of identifiers for each transaction through hundreds of different types of data. It then links what data points belong together, analyzes those, and comes back with an identity trust level in real time.

The takeaway

A strong identity trust platform can be used by businesses in dozens of industries, and is a worthy investment for those looking to prevent digital fraud. Adopting such a platform also offers customers a personalized experience that brings them back, in addition to reducing manual labor for the company. Kount’s Identity Trust Global Network stands out as a leading digital fraud prevention solution, as the company’s vast pool of data enables it to accurately determine identity trust in real time.