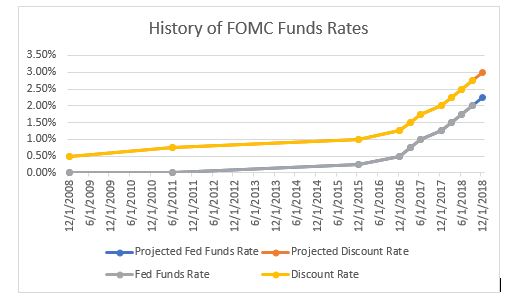

The Federal Reserve has been raising interest rates at an increasing rate over the past three years. In December 2015 both the Federal Funds rate and the Discount rate were increased by 0.25%. One year later both rates were raised by 0.25% again. After two years with single 0.25% increases, the pace increased in 2017 with three more 0.25% increases. The pace of increases has accelerated again with three 0.25% increases already in 2018 with one more expected this December. This acceleration in pace and lack of any indication of when the increases will stop is driving consternation in the market place.

On JP Morgan’s conference call Friday morning Chairman and CEO Jamie Dimon commented, “I have much higher odds of it being 4% than most other people.” This is consistent with a statement he made in his 2017 letter to shareholders where he stated that the 10-year bond should be trading around 4%, and the short end should be trading around 2.5%. Currently the 10-year bond issued 10/15 yields approximately 3.23% (a big jump from the month prior, when the 9/17 issue yielded 2.96%) while the 3-year bond yields approximately 2.99%; these rates are up from approximately 2.4% and 2.0% respectively as of the end of last year. Clearly the short end (note the 52-week bill is yielding approximately 2.6% as well) has increased faster, reaching Dimon’s target already. This has caused the yield curve to flatten, leaving room for the 10-year to rise closer to that 4% target. I fully expect this to happen, barring a significant setback to the economy, even without future increases in the Federal Funds rate, which are almost a certainty.

These interest rate increases and the rate of projected future rate increases are having an effect on all aspects of the economy and have been linked to the recent volatility in the stock market, as reported by CNBC. It’s not surprising that rising interest rates (especially with the 10/15 auction) are impacting the stock market, as it is much easier to justify historically high PE ratios when interest rates are low. If interest rates are going to be increasing it makes it much harder to justify such lofty valuations. You can hear Warren Buffet’s take on interest rates and stock valuations in this video interview.

However, no matter how broad the impact of rising interest rates might be, the increase in interest rates has an even more direct impact on the payments industry. Increased rates have a clear impact on card issuers, as they must pay higher interest rates on their borrowed capital. Consumer spending is also affected because consumers have less spending capacity as more of their income is directed to higher interest payments and higher savings rates drive a high propensity to save. As Brian Riley, Director of Credit Advisory Service at Mercator Advisory Group, previously reported, consumers should be looking to lock in lower rates while they can since now is a time when credit card issuers should be thinking how to align balance transfers and introductory offers with the open market.

Other Related News Coverage

Why the Stock Market Went Loco – Barron’s

Fed Officials See Strong Economy Justifying Interest Rate Rises – WSJ

5 Reasons Why Higher Interest Rates Matter – Forbes

History of FOMC Funds

Federal Funds and Discount Rate Definitions

Federal Funds Rate: The interest rate that depository institutions charge each other for overnight loans of funds.

Discount Rate: The discount rate is the interest rate charged to commercial banks and other depository institutions on loans they receive from their regional Federal Reserve Bank’s lending facility – the discount window.