The COVID-19 pandemic has been the catalyst for a slew of changes in consumer behavior, including the search for more ways to budget and improve finances. Online purchases are growing exponentially, and buy now, pay later (BNPL) is quickly becoming mainstream in the payments industry for its flexibility and ease of use.

Recognizing that the demand for this convenient payment option will only continue to grow, PSCU recently announced that it will soon offer a new Installment Payments solution that will enable credit unions to offer more flexible ways for eligible members to pay.

To learn more about the rise of BNPL and PSCU’s new solution, PaymentsJournal sat down with Jeremiah Lotz, Managing Vice President of Digital and Data at PSCU, and Brian Riley, Director of Credit Advisory Service at Mercator Advisory Group.

The rise of buy now, pay later

While the general concept of buy now, pay later has been around for decades in the form of retail financing, it is now being driven by fintech and technology companies in new ways.

“Buy now, pay later lending in its current form is engineered to fit into a household budget and provide a transaction finance for a medium-ticket or small-ticket item that gets paid in four transactions over time. It’s been something that fintechs have attached themselves to in an aggressive way,” said Riley.

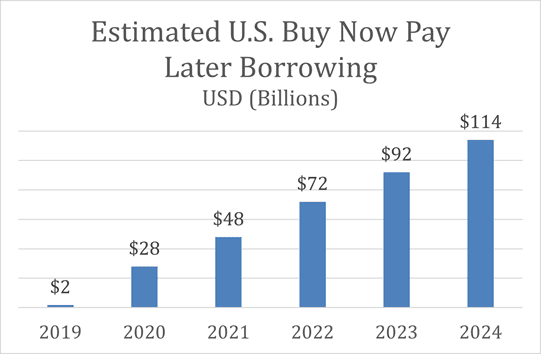

The chart below, provided by Mercator Advisory Group, reveals that buy now, pay later will surpass $100 billion in the U.S. by 2024, up from just $2 billion in 2019.

It should come as no surprise that COVID-19 boosted the popularity of BNPL among consumers. “The timing was perfect for it because these are small-ticket items that you would typically find on an online channel, and many people that were not prepared for credit with their credit scores or having the financial wherewithal to qualify for bank-grade lending were able to get loans,” Riley added.

BNPL presents an opportunity for financial institutions (FIs) and fintechs to meet consumers where they are from a technology perspective and provide a level of convenience that matches to today’s world. Think of it as a modernized retail layaway program. “The opportunity here is with the touch of a finger on your digital device, you can get the product that you’re looking for, but you can also then set up some terms and long-term payment options that match your experiences and expectations,” said Lotz.

Young adults are a key target demographic for BNPL

Generally speaking, Millennials and Generation Z young adults are key target demographics for BNPL. “These are digital natives who have grown up in a world in which they have instant gratification opportunities. So in this case, you are instantly able to get ahold of this product or this service that you’re looking for. And they have the ability to make it work for them under their terms,” explained Lotz.

Of course, this does not mean that other demographics aren’t interested in leveraging the flexibility that BNPL solutions offer. Data from the Federal Reserve indicates that revolving debt for adults over 70 is growing faster than it is among young adults. “But that’s exactly where you don’t want to be growing,” warned Riley. “As you attach the customers or members, you want to be able to get in and nurture them for life, and that long-standing relationship is important,” he added.

Through installment lending, credit unions can come out on top

According to Lotz, financial institutions and credit unions need to recognize that BNPL is more than just a trend. “I think the long-term relationship you’re able to build with that customer…can [be built by] offering them the opportunity to build credit to ultimately rely on you as a financial institution for other needs,” he said.

By taking advantage of this opportunity, FIs and credit unions can position themselves nicely for long-term revenue gains. “As long as credit unions continue to leverage this as one of their opportunities and educate the customers around these other services that they provide, I think it definitely creates long-term revenue generation for those financial institutions, but then also offers these consumers the ability to truly understand how credit unions are there for them,” he added.

Smaller credit unions can benefit from BNPL products that help them remain competitive in a landscape that is increasingly crowded by both large FIs and tech-savvy fintechs. “This is a good opportunity for credit unions to realize they have an advantage over some of these fintechs, and that these fintechs are able to offer a very specific piece of functionality. As a credit union, if you put this in the spirit of your entire offering, tie it to your rewards program, tie it to offerings of other solutions, it really does start to solidify you as that primary financial institution,” said Lotz.

Introducing PSCU’s Installment Payments Solution

Recognizing the potential of the BNPL space, PSCU recently announced that it is moving forward with an installment payment capability. The Installment Payments solution is powered by technology from Fiserv.

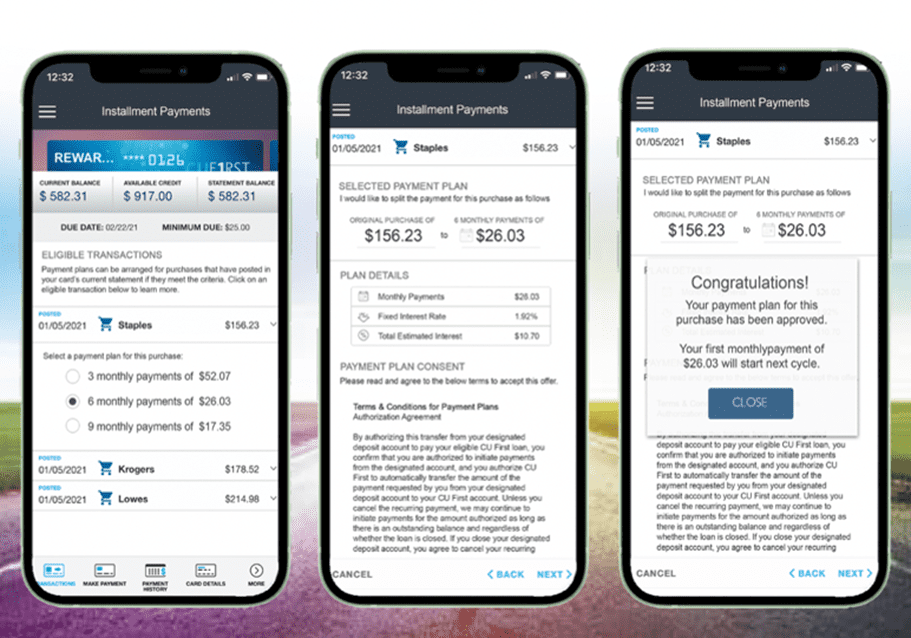

“What this will do is leverage the consumer’s card account through the financial institution. They will make a purchase and then they will be able to [use] PSCU’s digital mobile application, that we put out into the market through our credit union relationships, to go in and take that purchase that they made and turn it into an installment plan,” explained Lotz.

The visual below, provided by PSCU, illustrates the seamless and straightforward transaction experience for consumers leveraging the Installment Payments solution:

All in all, it is a win-win. It gives credit union members the freedom to budget as needed and have greater control over their finances. From a financial institution or credit union perspective, it offers the opportunity to have a different type of spend and transactional relationship with consumers than they could in the past.

Enhancing the solution further is the fact that it gives consumers the seamless and convenient customer experience they crave. “The experience is pretty simple from a consumer perspective. You make a transaction, you pick what works best for you, you accept those terms, and you’re on your way,” concluded Lotz.