In the current and post-COVID-19 world, real-time payments (RTP) provide banks with the opportunity to take back control of payments from non-bank providers and meet the growing demands of modern consumers and businesses. Beyond that, RTP capabilities enable banks to serve the greater good through the development of real-time products for specific use cases.

To talk more about why commercial banks need to have an RTP strategy in place, PaymentsJournal sat down with Carrie Blankenship, Director of Product Management, Enterprise Payments Platform at Fiserv and Sarah Grotta, Director of Debit and Alternative Products Advisory Service at Mercator Advisory Group.

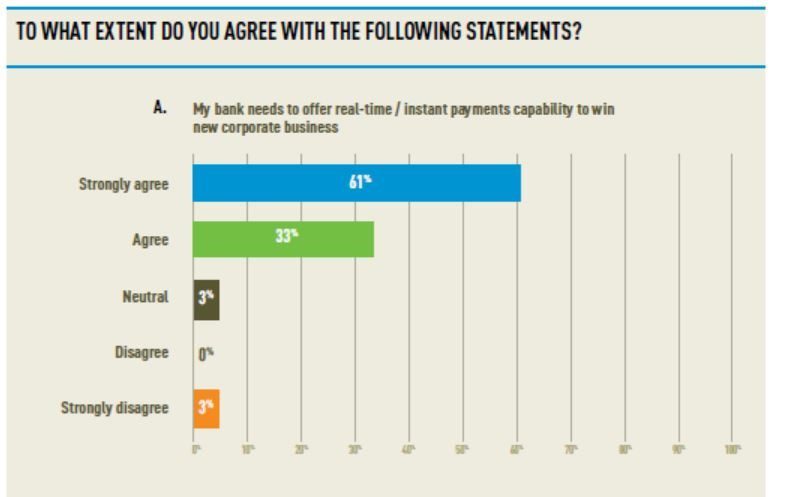

Banks Agree That They Need RTP Capabilities

The following chart, which contains results from a survey jointly conducted by Fiserv and Finextra in 2019, reveals that banks already recognize that real-time/instant payment capabilities are important to have. Among survey respondents, 94% agreed or strongly agreed that their bank needs to offer these capabilities to win new corporate business.

How banks have chosen to adopt real-time/instant payments varies, but there are two main approaches: build or buy. The choice depends on whether banks are able to design these payment capabilities around the specific use cases needed by their clients. Some banks build their own capabilities and connections to instant payment networks such as The Clearing House or Zelle, which have a variety of programs built into their systems.

Others buy turnkey solutions that already exist with specific capabilities built-in. By taking into consideration the use cases most important to their client base, and having conversations with vendors, internal architects, and internal sales teams to determine what technical help is needed, banks can determine the best way to approach RTPs.

RTPs Have Experienced Rapid Growth in Recent Years, Which Isn’t Expected to Slow Down

The Clearing House launched its RTP® network in November 2017, and has since grown to more than five million monthly transactions with consistent double-digit monthly growth. Furthermore, this network now reaches over 50% of U.S. transaction accounts which shows there is a lot of interest in and connections to the RTP market.

In the first half of 2020, there are still just a limited number of “send” use cases, as many banks are connected in the receive-only mode. As more use cases develop for sending, rapid hockey stick growth can be expected. “Those five million monthly transactions could very quickly become 10 million, 20 million, or potentially even more in the next 2.5 years,” said Blankenship.

And that’s why banks should no longer consider RTP capabilities as optional. Rather, they should prioritize RTP as an essential function to keep customers satisfied–or risk losing to competitors that can fulfill a broad range of RTP use cases.

RTP Comes with Other Opportunities for Banks

It’s not just consumers that benefit from RTPs. RTP capabilities help banks attract new business and expand their current business to generate additional revenue.

Even if a bank pursues receive-only capabilities, a variety of strategic opportunities will arise: instant transfers, small business B2B, payment information included in RTPs to eliminate notoriously insecure email invoices, cash upon delivery, and funding after-hours are just a few such opportunities. While many believed that the initial use cases for RTPs were going to be exclusive to corporate payments, these examples make it clear that there are valuable B2C opportunities as well.

Using the example of funding after-hours, a bank with after-hours RTP capabilities could provide consumers with instant car loan approvals when they’re at a dealership on a Sunday afternoon, enhancing a notoriously cumbersome and unpleasant customer experience.

RTP Products Can Serve the Greater Good During and After COVID-19

The COVID-19 pandemic has widespread economic implications that affect nearly everyone in one way or another. RTP products can enable valuable services that help those impacted during COVID-19. Many of these services will have continued value after the pandemic has passed.

Keeping COVID-19 in mind, here are a few examples of how RTP products can serve the greater good:

- Government stimulus payments. Government stimulus payments coming through direct deposit typically take around one to two business days to process, but sometimes that one to two days is a long time to wait. Consumers “being able to receive an instant payment can bridge that gap even a few days sooner, especially if they need to shop for essentials or pay a bill,” explained Blankenship, adding that getting those payments a “couple of days sooner can make a big difference for certain people.”

- Ongoing unemployment benefits. Similarly to stimulus payments, being able to receive unemployment payments instantly upon approval thanks to a RTP product can give peace of mind to individuals in tough financial situations that need funds access as soon as possible.

- Gig economy payout. Gig workers working for grocery delivery services, such as InstaCart, often need immediate access to funds to keep working. For example, they may need to fill up their car with gas after a round of deliveries. Having to wait multiple days for a payment could impede their ability to work and earn an income in the meantime. A “work today, get paid today” model available through a RTP product could reduce some of the financial burden gig workers experience.

- Insurance claim disbursement. Account holders who experience significant events, such as a car accident or a home fire, don’t have the option to wait: they have to take care of certain needs immediately. Whether it be booking a rental car, reserving a place to sleep, or purchasing a basic need like a toothbrush, these individuals need access to funds immediately.

These are just a handful of examples of positive experiences that can be gained with the availability of instant payments through RTP products.

Conclusion

The growing number of instant payment use cases makes it critical for commercial banks to offer RTP services to their consumers. If they choose not to, they risk losing consumers to fintechs and other non-banking providers that are doing so. RTP products that facilitate instant payments provide value not only to banks, but the greater good as well.