While mobile and online commerce—including peer-to-peer, crowdshare and marketplace—continues to grow, payments companies are faced with challenges as businesses, as well as consumers, react to constant, massive data breaches.

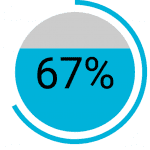

With the increased amount of personal data available on the dark web, fraudsters are attacking mobile and online channels in particular. According to IDology’s Sixth Annual Fraud Report, 67 percent of and 63 percent experienced a rise in mobile fraud over the last 12 months. The report, which measures fraud trends across multiple industries, revealed several key findings:

While Card Fraud and Account Takeovers Are Still Most Prevalent, Mobile Fraud Surges

- Credit, debit and prepaid card fraud continues to dominate, reported by 64 percent of fintech and payments businesses as the most prevalent fraud vector. Card fraud was also reported as the most prevalent type of fraud among the majority of companies (67 percent) across all industries.

- Account takeover also continues to be a widespread issue. Fifty-six percent of fintech and payments companies indicated surging account takeover prevalence in their industry.

- ACH/wire fraud was increasingly pervasive among 42 percent of fintech and payments businesses. This is most likely indicative of the rise in frequency of peer-to-peer (P2P) fraud due to an increase in the use of mobile applications and online services and increased speed of payments.

- Mobile fraud is surging, up 117 percent since last year. Mobile fraud of all types, including porting, spoofing and hacking, has increased year-over-year. Caller ID spoofing is up by 74 percent, porting by 69 percent and SMS interception by 50 percent compared to 2017. As consumers increasingly rely on mobile devices to manage their lives and conduct business, fraudsters flock to exploit the channel’s vulnerabilities.

Minimizing Customer Friction Becomes #1 Challenge to Fraud Prevention

Today’s consumers require faster and easier payments and are moving more toward online and mobile channels. With this trend, however, comes pressures on companies to detect and prevent fraud while also providing a frictionless customer experience.

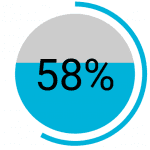

For the first time in the lifetime of the Fraud Report, balancing customer friction with fraud prevention is the biggest challenge in fighting fraud for 72 percent of fintech and payments businesses. Fifty-eight percent of fintech businesses also reported that identity verification is one of the biggest fraud prevention challenges within their industry, the highest number across all industries.

According to a consumer digital identity study also published by IDology earlier this year, one in three consumers has abandoned an account-opening process because it was too difficult or took too long. This, along with growing security concerns among consumers, put payments businesses and merchants in a difficult position when trying to balance fraud prevention and the customer experience.

Fintech and Payments Businesses Say They Are Least Prepared for Threats Posed by Mobile Fraud, Synthetic Identities and Account Takeovers

Across the board, responding businesses expressed that their industries are ill-prepared to handle mobile fraud, synthetic identity fraud and account takeover. The top fraud vectors that fintech and payments companies feel most unprepared to handle are:

- mobile attacks – 39 percent

- account takeover – 31 percent

- synthetic identity fraud – 25 percent

With more than 224 million mobile devices in the United States and the growth in mobile device attacks, concern about and awareness of these problems are increasing. In fact, the number of companies that feel unprepared for mobile fraud surged by 167 percent over last year.

Companies Need to Rethink Identity Verification to Make It a More Frictionless Process

Consumers want to be protected, but they also want payments to be fast and easy. When working to prevent fraud, it’s important to remember that the vast majority of transactions that occur each day aren’t fraud attempts—they’re legitimate customer actions. It’s not surprising that 75 percent of companies say identity verification has grown in complexity in the last years, but 85 percent also see identity verification as a strategic differentiator.

The key to preventing fraud without creating undue friction is thinking about identity verification strategically and deploying a comprehensive, layered identity verification solution with an array of dynamic and intelligent “step-up” escalation methods. Validating identities with behind-the-scenes methods and applying friction only when needed can facilitate faster payments while still deterring fraud. Further, companies that join a consortium network create additional protection by gaining insights into the fraud that other organizations across other industries are experiencing—making trends easier to spot and defend against.

For more actionable insights and to keep up with the latest trends, download the full IDology Sixth Annual Fraud Report.

Christina Luttrell is the senior vice president of operations for IDology, a leader in multi-layered identity verification, authentication and fraud prevention.