The global acceleration of digital transformation has triggered reimagining nearly every business process and interaction. With that acceleration comes a great opportunity to improve efficiency, productivity and security while creating business opportunities.

Organizations often partner with multiple vendors to offer the wide range of products expected by their customers, most of which have different file requirements, schedules, and integration points. Yet, as consumer expectations continue to rise, the need for financial institutions and merchants to be able to send and receive files 24/7 is a top priority.

With growing compliance and security mandates, are financial institutions and merchant organizations equipped to handle that risk and complexity?

To answer this question and learn more about how financial institutions and merchants can balance consumer expectations while ensuring their data, files and transactions are timely and secure, PaymentsJournal sat down with Anna Morrow, Product Manager of Enterprise Payments Solutions at Fiserv, and Raymond Pucci, Director of Merchant Services at Mercator Advisory Group.

The payments landscape changed dramatically during COVID-19

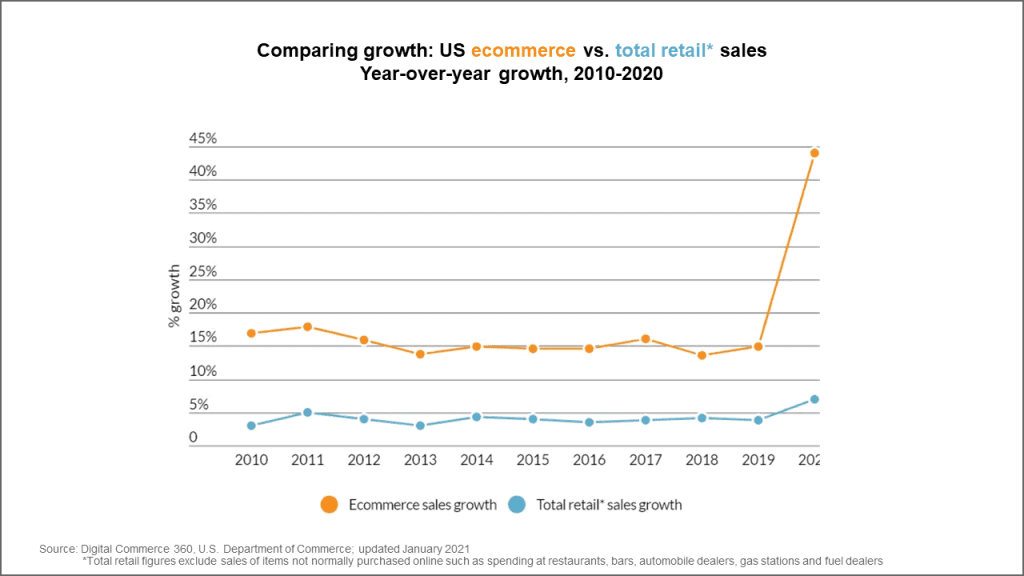

It is well known that the pandemic significantly accelerated pre-existing trends around digital transformation and e-commerce strategies. Three trends in particular stood out to Fiserv, the first of which is shown in the chart below:

“We saw something like 10 years’ worth of growth in e-commerce penetration in a matter of three months, as merchants and financial institutions rushed to provide customers an easy cross-channel experience with flexible digital payment options,” said Morrow.

Second, the underlying customer expectations of ease, efficiency, and accuracy are not limited to payments —they are now across the board whether it is for payments, reports, reconciliation or inventory information.

The third trend, which is the most significant, is that customers have demonstrated a willingness to move away from a company or brand they have been loyal to for years if their needs are not being met.

As merchants and financial institutions know, ensuring streamlined payment experiences is no simple task. “There’s a lot that goes on behind the actual acceptance of a payment. There’s so much data transmission that has to take place, and merchants and financial institutions really in some aspects are overwhelmed by the data that they’re seeing, primarily because of the exponential increase in e-commerce,” said Pucci.

By streamlining data and information exchange and reducing manual inefficiencies, merchants and financial institutions can better meet these rising demands and stay competitive. “Transmission capabilities are going to be so much more important in the years [to come],” Pucci added.

Multiple vendor partnerships makes true integration hard to achieve

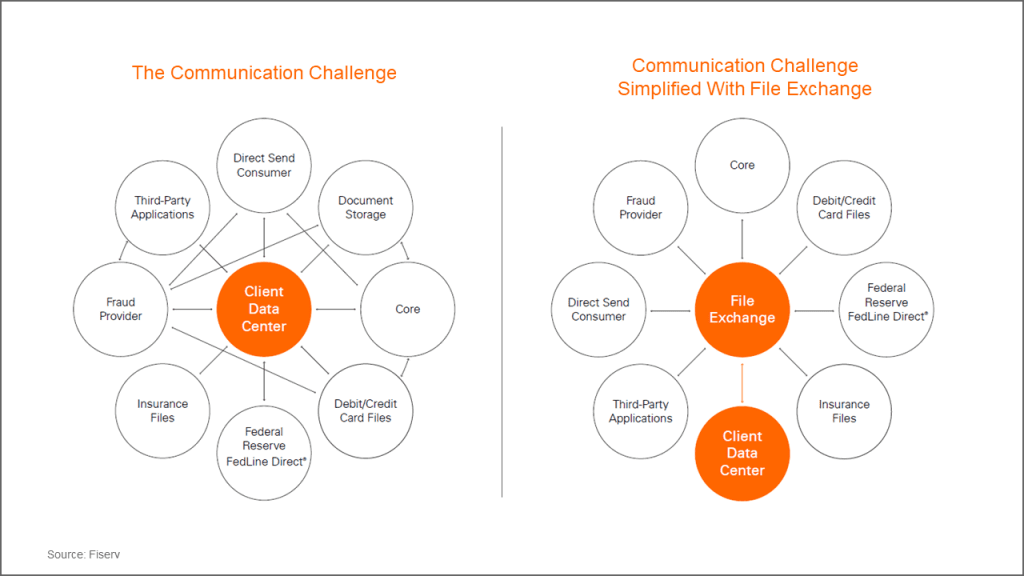

To deliver a well-rounded customer experience, many are partnering with a multitude of vendors to provide the full breadth of functionality their customers expect. “This can make true integration difficult because with each new vendor or service comes a different backend system that needs to be integrated with pre-existing systems. But many times, these have different file format, naming and scheduling requirements,” said Morrow.

eCommerce is a maze of vendors and consumers, requiring visibility into everything from payments and refunds to the supply chain, and data transmissions cut across the full spectrum of services. Because of this, organizations must have the ability to send and receive data 24/7, but not every organization is set up to manage and monitor those transmissions on their own. Additionally, robust offerings that simplify the overall payment and commerce experience for consumers can be incredibly expensive for merchants and financial institutions, which rings especially true for those attempting to implement and manage new systems on their own.

“Financial institutions and merchants have to implement and integrate and support these services, all while trying to keep up with ever increasing security and regulatory requirements. Then, when adding new functionality to bridge a gap in their digital or e-commerce strategy, speeding time to market is crucial so they not only start to see a return on investment as soon as possible, but also so they don’t lose their customers to someone else,” Morrow added.

Automating manual processes can address these challenges

Fortunately, there are ways for financial institutions and merchants to mitigate some of these barriers. By securing solutions that automate manual processes, they can spend more time focusing on their actual business and delivering great customer experiences.

“These [automation] solutions certainly are ways that can give them resources, particularly for small and medium merchants that may not have the capabilities that can do all of this and are under cost and resource pressure. Merchants are going to be looking for ways to save money, reduce costs, and really get to the matter at hand and that’s servicing their customers,” said Pucci.

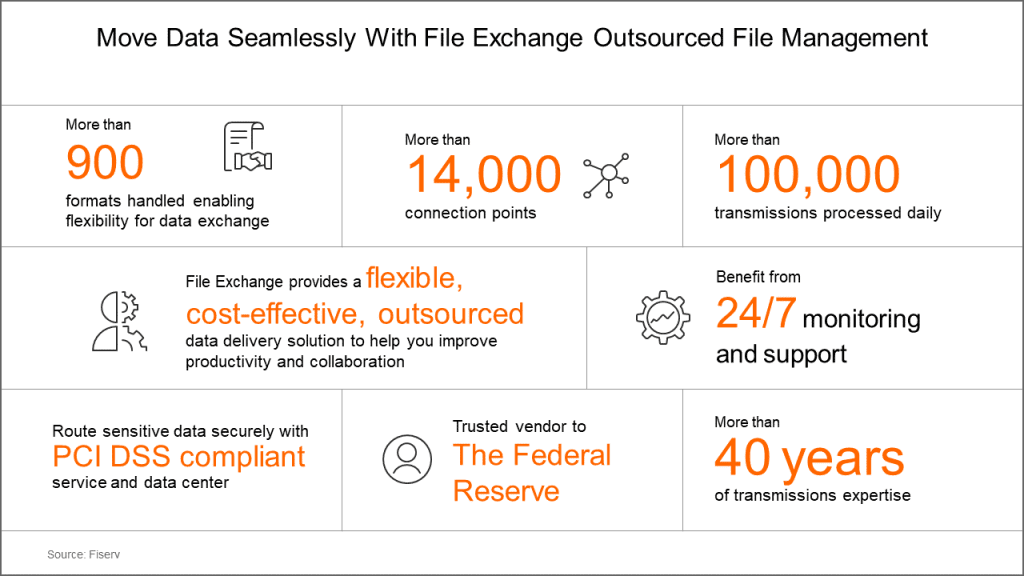

Enter File Exchange from Fiserv, a data transmission and conversion service that supports an average of over two million data transmissions for more than 14,000 connection points on a monthly basis (including core processors, various payment and reconciliation products, external partners such as the Federal Reserve and Fiserv clients, their commercial customers and third-party vendors). With an ASP model and scalable architecture, File Exchange (formerly XRoads) helps clients manage data transmission growth and integrations without requiring additional client IT resources to procure, install and maintain on-site data transfer applications and expensive infrastructure.

Fiserv File Exchange reduces inefficiencies

Fiserv assists clients in automating their file transmissions and related workflows. “We help our financial institution and merchant clients reduce inefficiencies and risks by acting as a single connection point for their commercial customers and third-party vendors. This allows transmissions and related manual processes to be consolidated, automated, and monitored by an experienced team that’s staffed 24/7,” said Morrow.

For example, a client that receives payment files from multiple source points across several channels (ACH, issue, wire, card etc.) must ensure they’re formatted properly and send them to various downstream systems (processors, report archives, receivables vendors) ahead of the appropriate processing windows – all while being able to check file totals in accordance with their internal validation procedures.

File Exchange lets Fiserv clients consolidate the connectivity of these source points and downstream systems into a single sending and receiving point. It can also perform customized in-flight edit checks to detect format issues or duplicate files, reformat received files to meet the endpoints’ needs, stop files for onscreen client review and validation and send email notifications when individual transmissions are sent or received. File Exchange also offers automated copy creation, and transmission specific scheduling and file naming to support different processing deadlines.

This immensely simplifies communication challenges, as shown in the chart below:

“A key differentiator for File Exchange is that it’s really customizable.

So depending on what the individual client’s needs are, or even getting down to the individual file flow or workflow needs, we can help provide a customized solution or build a customized solution along with the client so they’re getting the best experience possible,” explained Morrow.

The takeaway

With rising consumer demands, merchants and financial institutions must focus on ways to reduce inefficiencies and digitize and automate processes to meet customers where they are. By doing so, they can deliver optimal customer experiences across functions and payment channels.

A trusted partner that understands the full scope of the challenges and has a proven history of delivering and managing solutions can help financial institutions and merchants succeed.

“The age of digitization has arrived. And when we think of e-commerce, especially with mobile devices, that’s really become lifestyle commerce now, and consumers will continue to gravitate to online transactions and finance, and expecting their merchants and financial institutions to meet their needs,” concluded Pucci.