Podcast: Play in new window | Download

COVID-19 has deepened our reliance on digital tools. Customers have new expectations when it comes to digital experiences, and businesses must consider and adapt to these expectations in order to continue to thrive in this “new normal.”

To discuss what these changes mean for consumers and businesses, and how financial institutions (FIs) can put their best foot forward to meet the increasing demands of their customers, PaymentsJournal sat down with Sandy Condellire, SVP of Security and Decision Products at Mastercard, and Brian Riley, Director of Credit Advisory Service at Mercator Advisory Group.

Post-pandemic life for consumers and businesses

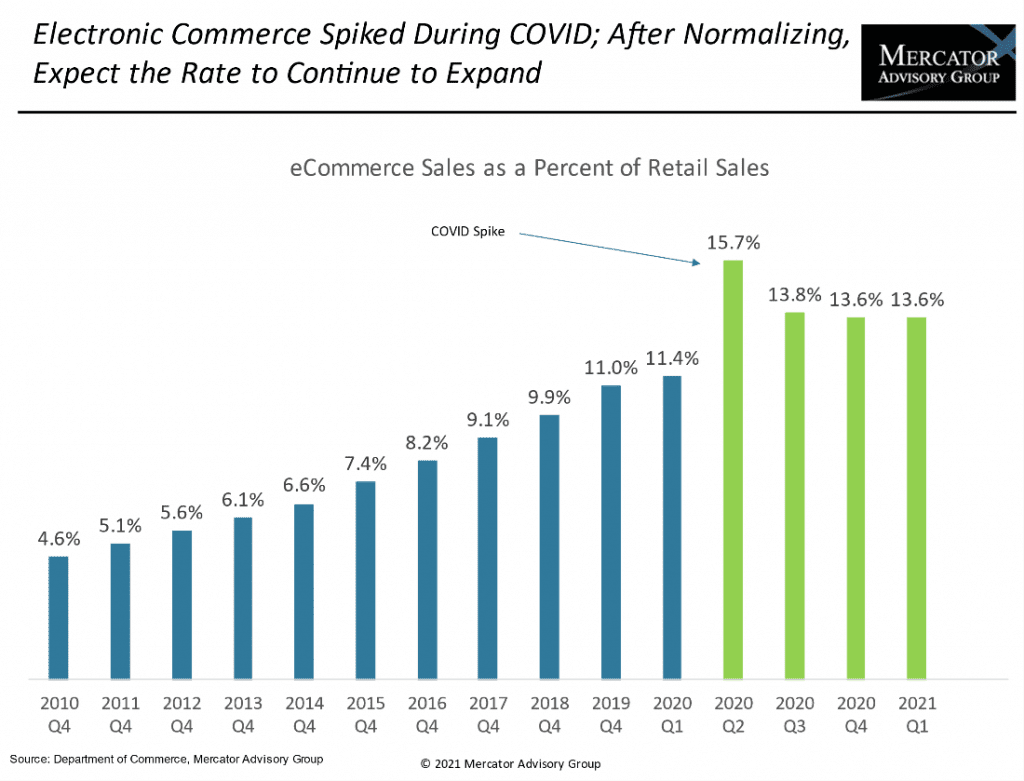

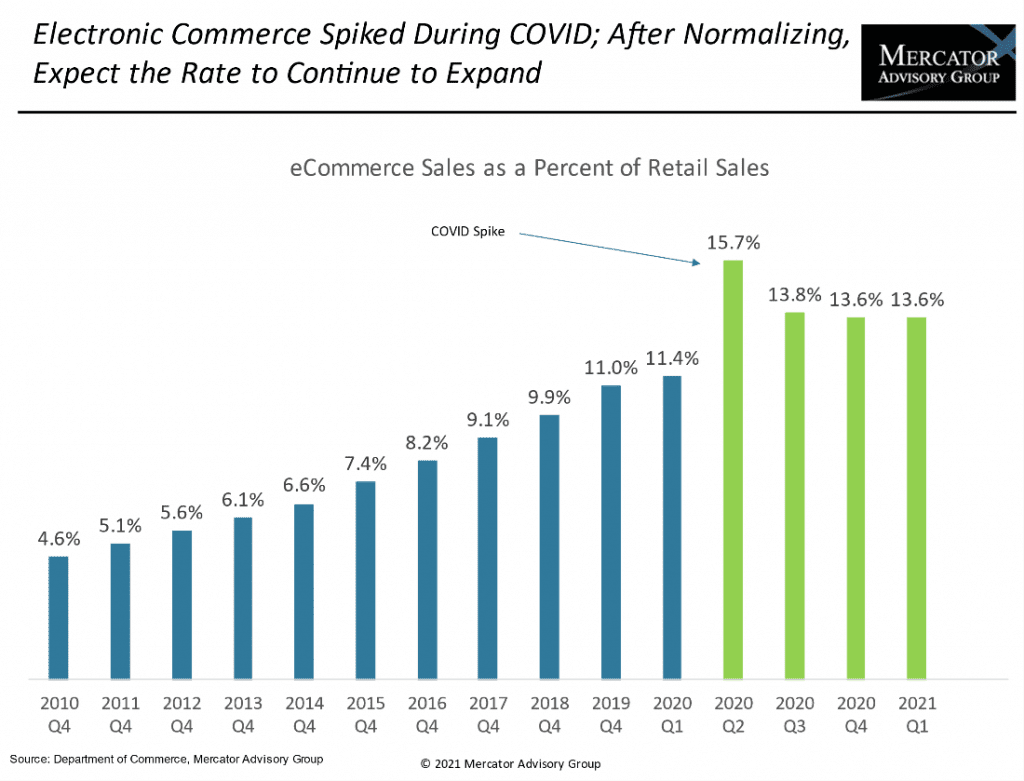

E-commerce took off during COVID-19 when consumers spent over a year social distancing. While the dust is now beginning to settle, the expansion rate of the online marketplace is expected to continue. The chart below contains data gathered from the U.S. Department of Commerce, and it shows online sales as a percentage of total retail sales.

The blue lines from 2010 to 2020 show a steady and predictable rise in e-commerce. This reflects the growth of Amazon and other online businesses that are pushing consumers toward online purchasing by making it easier than ever to shop online.

In Q2 of 2020, e-commerce sales hit 15.7% of retail sales, compared to Q1 of the same year at just 11.4%. “That’s quite a rise, given the steady growth that we’ve had in the past moving up, maybe 200 basis points at the most, typically more, under one basis point a year,” explained Riley.

After the peak in Q2 of 2020, e-commerce transactions as a percent of retail sales dropped down into the 13.6-13.8% range, but that is still higher than the pre-pandemic expectation of 12% for 2021. Experts believe it will stay in the 13% range over the next couple of years before making its way back up to 15%.

Adoption of digital commerce, payments, and banking increased rapidly

According to a Mastercard survey, 63% of global consumers tried new payment methods in the last year that they would not have tried otherwise. But as is with any new technology, there’s always a learning curve.

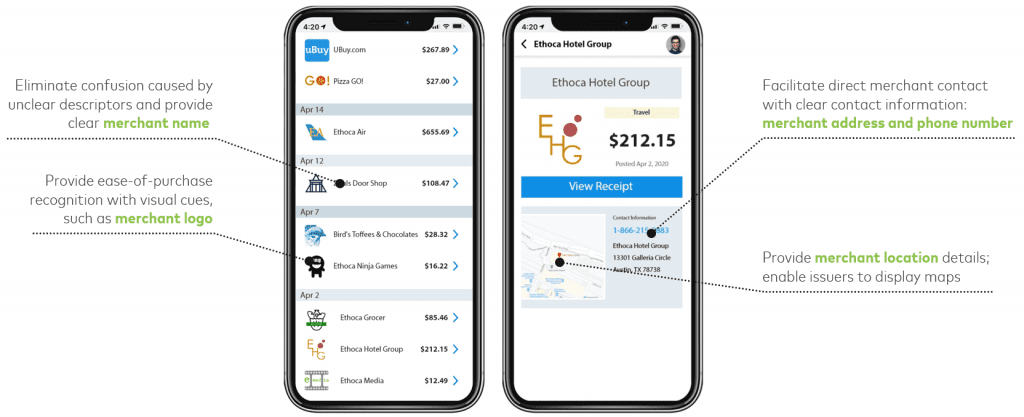

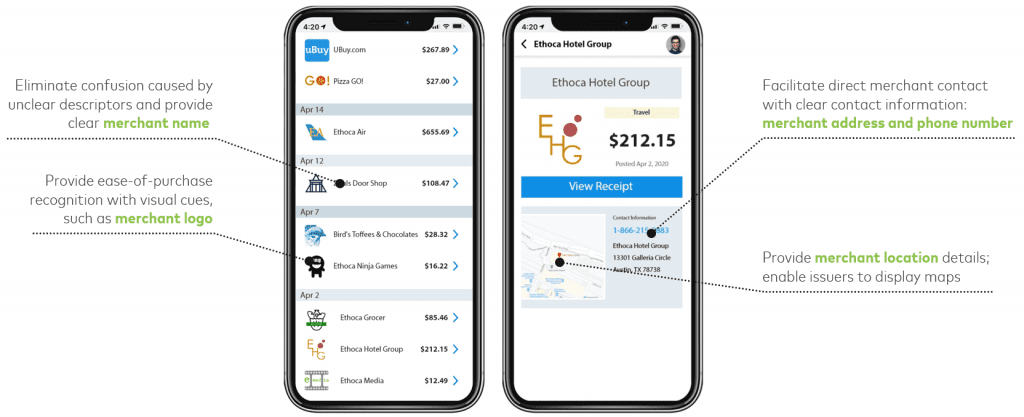

Digital and contactless payments are often commended for their convenience and simplicity. However, one area that raises challenges for consumers with more digital purchases is what’s known as ‘purchase confusion.’

This happens when a cardholder reviews their statement, but the transactions aren’t clear – often listed under names or descriptors that the buyer doesn’t recognize. “That’s really leading to confusion for consumers about what they bought, and who they bought it from,” said Condellire. “And for some people, this is the first time experiencing this in an online environment.”

In fact, 77% of customers surveyed have difficulty recognizing transactions on their banking statements. Additionally, 72% of surveyed consumers feel anxious or annoyed when unable to recognize a transaction.

What’s at stake for FIs?

FIs are now feeling the pressure to keep up with the pace of digital demand. As consumers continue to seek frictionless experiences and the convenience of having information at their fingertips, FIs must add new features and services to improve the cardholder experience when using digital banking apps. Simultaneously, they must also encourage the use of those digital banking apps, providing options and additional information in those apps that allow users to find answers to questions without having to call the bank – including details like clear merchant names, logos, and even full digital receipts.

For example, a customer may cause a case of friendly fraud, which makes up about 50% of all transactions that end up being chargebacks. Friendly fraud is when the account holder reports a purchase as fraud, even though the transaction was legitimate. Often this results from confusion, with the customer not recognizing their purchase because there’s a lack of detail to help them recall what they bought.

With the rise in e-commerce sales, there’s more opportunity customers can become confused about what they’ve bought. This can lead to an increase in calls coming into support centers as customers look to make sense of their purchase history. On the FI’s side, making this information more accessible can build a better experience, and decreases the resources needed to handle the inquiries.

“A real dispute can be the sign of a fraud event happening, and that’s where you want to spend your money on the bank side—not in solving these quick calls that could easily be resolved,” concluded Riley.

The future of the digital experience

FIs have made many advancements in a short span of time, but it’s really only the beginning. Once they have the attention of their account holders, the next step is finding more ways to connect with them.

For future developments, FIs should focus on how to provide more opportunities for consumer engagement. “This could be features like providing greater consumer control and self-service options,” said Condellire.

For example, a customer has a subscription to a streaming service, which they pay for using their credit card. However, that card has expired, and they now need to update their subscription to reflect the new account number. A banking application that can access a customers’ subscription service and allow them update it can reduce friction and allow for ease of transition.

From a merchant’s perspective, FIs could also offer merchant rewards or future discounts through digital receipts directly in the digital bank environment – extending the reach of their customer programs. This would provide the merchant with both brand recognition and increased sales.

“Overall, we’ve got a lot of opportunity to look at how we [can] really take this digital transformation to the next level,” added Condellire. Ethoca will be discussing these opportunities in an in-depth webinar scheduled for August 18th