Ch-ch-ch-ch-changes have been happening in the payments industry since it laid its roots, but 2020 brought on a level of digitization that was not expected to happen for years. With a pandemic and a resulting economic crash, consumers were forced to adapt to new technologies. Now more than ever, people are turning to their phones and computers to make payments and conduct banking transactions.

In the recent webinar, “Payments Modernization Update: What FedNow, Nacha, and TCH Updates Mean to Your Payments Strategy,” powered by Mercator Advisory Group, Mark Ranta CTP, Payments Practice Lead at Alacriti, and Sarah Grotta, Director of Debit and Alternative Products Advisory Services Mercator Advisory Group, further discussed these changes and the concerns that come with them.

Viva la revolución: A changing payment market

It seems like Netflix has become a part of Americans’ everyday lives, especially over the last twelve months. The pandemic has only accelerated the drive for an as-a-service (aaS) or instant on-demand experience, both in television viewing habits and beyond.

“That idea of going in and looking for something and then immediately feeling fulfilled, that really is at the heart of what’s driving what we’re seeing in payments, and what our clients are asking us to bring to market,” said Ranta.

When this instant experience expectation from consumers seeps into the infrastructure of the payments industry, companies such as the Automated Clearing House (ACH) and Fedwire come into play. “All of the underpinnings of what you experience in your payments life really started to take root and are based on those old processes,” continued Ranta.

In 2017, The Clearing House announced the launch of the real-time payments (RTP) network, which is the real driver of the digital payments era. As people continue to interact with their finances in a wholly digital way—contactless payments, mobile wallets, and mobile banking all becoming increasingly popular over the last year—the payment infrastructure will continue on its evolutionary journey.

2020 goes digital

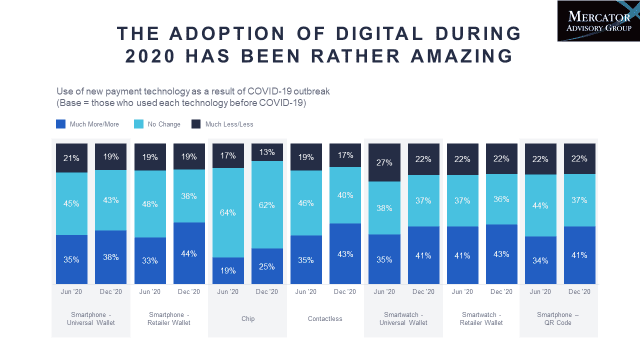

In a survey conducted by Mercator Advisory Group in June 2020 and again in December of the same year, experts measured people’s reactions to the global pandemic based on their payment habits. The chart below illustrates noticeable growth in the use of universal payment wallets. “So that means solutions like Apple Pay, and also the use of a mobile retailer wallet. That might be a wallet that somebody would use to place an order and then go and pick up that order, or also a wallet that could be used at a specific retailer online,” explained Grotta. “We’re also seeing a pretty big increase in the use of contactless cards, too.”

In June 2020, 35% of people surveyed said that they were using a contactless card more or much more than before the onset of COVID-19. By December, that number had grown to 43%. It is clear that there is a shift happening in payments, and that shift is carrying over to banking habits.

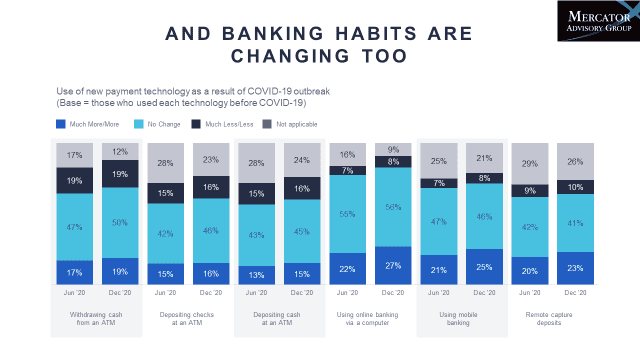

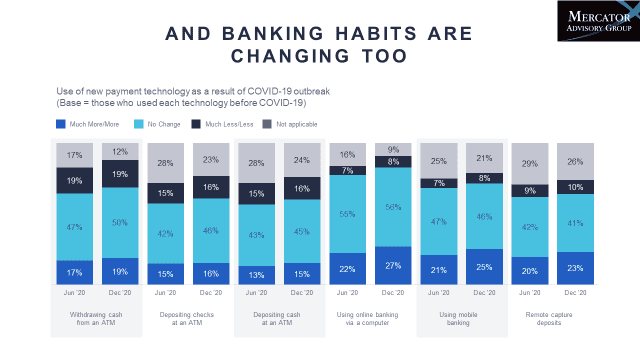

The chart above depicts clear shifts in the use of ATM machines. While both withdrawals and deposits have seen slight growth between June and December 2020, many survey respondents said they are using ATMs less or much less since the COVID-19 outbreak. The number of respondents using online banking, mobile banking, and remote capture deposits has increased over the six months between the two surveys.

When Grotta asked bankers, processors, and fintechs about the types of payments and banking habit changes they are seeing, she consistently heard these three messages:

- FIs have been working on introducing more digital solutions for several years and saw adult adoption occur in numbers that were not expected for another 2-3 years. Instead, this jump in adoption happened over a matter of months.

- The changes in habits exposed the gaps where some FIs need to make adjustments and further invest (i.e. AI systems).

- The belief that consumers are slow to adopt new banking and payment habits may not be accurate. They are actually quick to adapt out of necessity or for the right incentive.

There are a lot of changes happening in the payments market, and payment rail providers, processors, technology providers, and fintechs are working to accommodate the accelerated digitization across these platforms.

Payment trend concerns

Anytime a new payment type is presented, there are concerns about payment fraud and other cybercrime. With more and more consumers trending toward digital payments and online banking, these concerns will require an ongoing effort to keep under control.

Fortunately, institutions are adopting some simple yet effective tactics.

“First of all, I think you likely know that within real-time payments—these are really credit push only—so no debit. That’s really going to help to keep fraud levels under control,” said Grotta. “And again, we are taking a very controlled approach to applying transaction limits, to keep that fraud under control. So we have the opportunity to make sure that we have all of the measures in place, before we really open everything up.”

Taking a step back from fraud control concerns, credit unions and bank executives are asking themselves an important question: Which of these new payment types do I adopt or not adopt? It comes down to which solutions will resonate most with members. “This is going to require good knowledge of members’ and customers’ needs,” said Grotta. “They won’t necessarily know to ask for a specific solution.”

The final major concern involves competitors, which include not only other CUs and banks, but also big tech and fintech. Timing is important when trying to stay afloat in the market, and getting it right is what leads to successful adoption and satisfied, loyal customers. Investing too early could result in new technologies sitting idle, while late investments could mean the potential loss of business.

Takeaway

While the acceleration of new technology in the payments world is a lot to take in, customers seem to view these changes favorably. Adoption of these trending technologies is important for FIs because that is how they will retain their members’ loyalty. To learn more about industry changes and concerns, get access to the full webinar by filling out the from below.