Consumers need for immediate access to liquidity goes beyond crisis situations. Millions of households in the United States currently have a need for immediate access to money they don’t yet have. Whether their balance shortfall is due to the pandemic or an emergency expense, financial institutions can help account holders bridge the gap.

To learn how Fiserv is enabling financial institutions support their customers, PaymentsJournal sat down with Ken Patrick, General Manager of Deposit Liquidity Solutions at Fiserv and Brian Riley, Director of Credit Advisory Service at Mercator Advisory Group.

What are deposit liquidity solutions?

Deposit liquidity solutions provided by financial institutions are tied to the account holders’ deposit account, and are designed to meet their varied, yet occasional short-term liquidity needs. Unfortunately, financial institutions have not always been an option when account holders’ needed funds.

“When you look at it from a consumer perspective, [there] is a wide gap out there between a deposit and when people can have access to those funds, and it’s ironic that we are at a point when a lot of the world is moving toward faster payments within depository institutions,” said Riley. “So [deposit liquidity] is really a positive product that’s out there to help customers.”

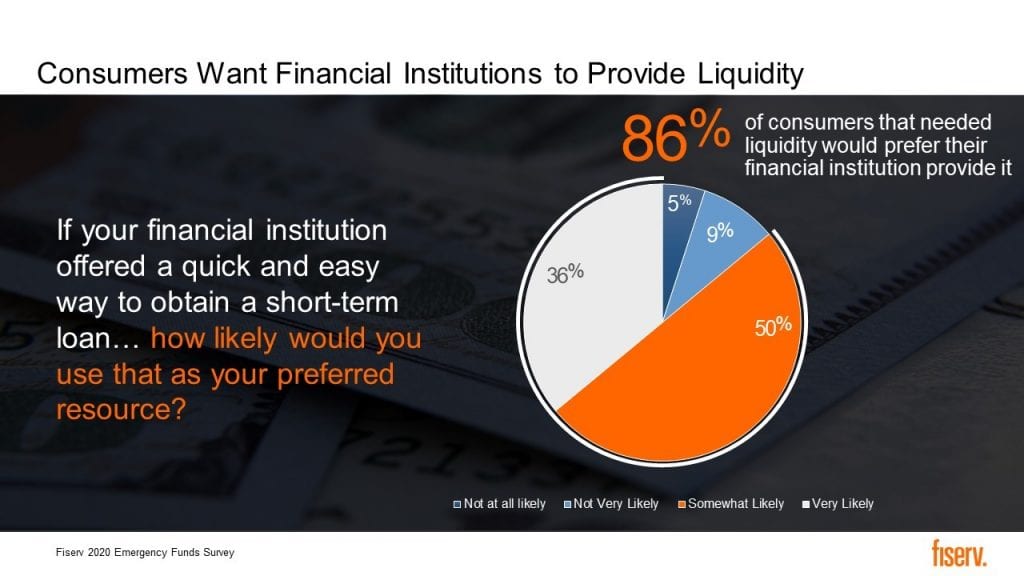

Because financial institutions lack a robust set of deposit liquidity solutions, many consumers are turning to places other than their primary financial institution to access short-term funds. However, notably, a Fiserv survey found that most consumers would rather be getting these funds from their primary financial institution.

“So why do they say that? I think it boils down to three key points: trust in their financial institution, convenience, and overall costs,” explained Patrick. “And I believe that as of now, a traditional financial institution has a competitive advantage in those areas. And my challenge to them is: are you acting on that advantage?”

A well-rounded deposit liquidity strategy can meet consumer cash flow demands…

Recognizing that there is no one-size-fits-all solution, financial institutions are taking a balanced approach with a portfolio of deposit liquidity solutions. A set of proactive solutions for customers who recognize they have a need, and proactively request access to liquidity. These include providing consumers accelerated access to deposited check funds, so they can avoid hold times and slow funds availability policies. Further, based on an account holder’s deposit account history, a financial institution can prequalify a customer for a certain amount of money that they can use and repay over a 90-day period.

“We also advocate reactive solutions for when someone inadvertently overspends their account, the solution steps in to cover them by assessing and managing risk at the account level to facilitate responsible overdraft limit-setting practices”.

“You need multiple arrows in the quiver to service customers. What we have seen is financial institutions have been good with providing these reactive overdraft services. However, there is an opportunity going forward to augment that revenue stream and diversify their liquidity strategy by adding proactive solutions,” said Patrick.

…But financial institutions have historically hesitated to address this demand

According to Patrick, three factors stand out as to why financial institutions have failed to implement a holistic deposit liquidity strategy.

“What’s been holding back progress is uncertainty and the extreme volatility in this space. There’s always been a path forward for these solutions, but it’s a highly regulated environment that gets in the way of people making large investments,” he explained.

Second is complexity, which comes into play during implementation. Building deposit liquidity solutions requires cooperation across multiple technology platforms, which in general are controlled by a multitude of vendors. “You need to be a visionary leader, engaging all key stakeholders and an excellent manager to get them implemented,” he added.

There is also the tendency to view deposit liquidity solutions as a nice-to-have rather than a must-have, a notion that Patrick strongly disagrees with.

Deposit liquidity solutions: What’s in it for banks and financial institutions?

Using the unique, real-time, qualification and risk-scoring methodology from Fiserv, financial institutions reduce cost of transaction to the customers and provide more flexible and affordable deposit liquidity solutions. Because of the enhanced access to funds, financial institutions benefit from the resulting spike in customer loyalty and are able to compete with non-FI providers. Simply put, the ability to offer consumers deposit liquidity services during times of need, within the trusted walls of their financial institution, generates loyalty to that FI.

Offering an anecdote, Patrick explained that a friend of his—a since-retired CEO of a large bank—received letters from account holders thanking him personally for the positive impact the bank’s deposit liquidity solutions had on their lives. The CEO later commented that it was not often that banking professionals at the executive level were told directly by customers that one of their products truly helped them in a moment of need.

But that’s not all. Deposit liquidity also offers what Riley referred to as having “downfield advantages for things like retention and new accounts. It can foster significant growth within a financial institution by having [deposit liquidity solutions] as a core offering.”

Added liquidity supports the demand for self-service solutions in a new world

We have seen a significant shift to digital and self-service options. Deposit liquidity solutions are able to meet the growing demand for such platforms.

“We say we should [have been] prepared for something like that [shift] years ago, we were not, we learned a lesson, and now is the time to take action so financial institution account holders have affordable liquidity options available from the provider they trust the most ” concluded Patrick.