The unprecedented COVID-19 pandemic has had an astronomical economic impact on consumers and businesses alike. As a result, the United States government provided economic relief in the form of stimulus payments and loans. But this assistance won’t last forever, making it crucial for financial institutions to get ready to offer responsible and transparent solutions that meet the long-term liquidity needs of their account holders.

To talk more about the importance of deposit liquidity solutions, PaymentsJournal sat down with Jeff Burton, Director of Financial & Risk Management Solutions at Fiserv, and Sarah Grotta, Director of Debit and Alternative Products Advisory Service at Mercator Advisory Group.

Consumer and small business account balances spiked amid COVID-19

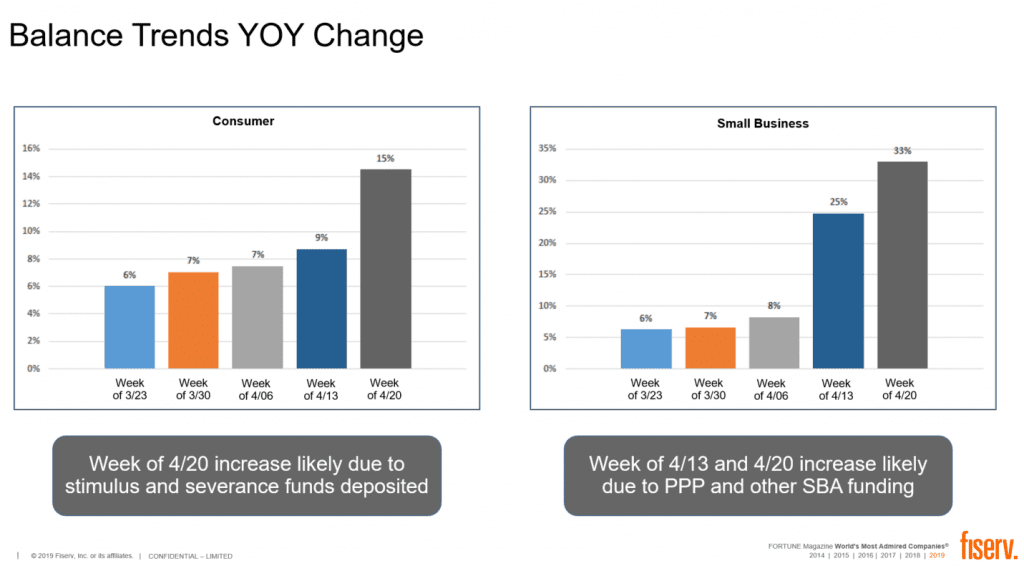

With stay at home orders that resulted in reduced work hours and skyrocketing unemployment rates, one might expect that consumer account balances are decreasing. In reality, however, there’s been a year over year (YOY) jump in account balances, coinciding with when consumers began to receive government stimulus checks intended to offset the economic impact of COVID-19.

Similarly, small businesses have furloughed employees and reduced spending while receiving government assistance in the form of the Paycheck Protection Program (PPP) and EIDL loans and grants. As a result, small businesses have seen a similar jump in account balances, which is apparent in Fiserv’s charts on YOY weekly balance changes in consumer and small business accounts for the weeks of 4/13 and 4/20:

This is leading to a “false narrative in the market where customers look better off from a balance perspective, but that’s really being driven by government stimulus money and slower spending,” explained Burton.

“While customers are being rather pragmatic now, forbearance won’t continue forever, and payments are going to come home to roost at some point,” added Grotta, referring to currently suspended payments such as mortgages, rent, and other expenses business and consumers will soon face.

The long term liquidity needs of consumers and small businesses

Government relief funding related to COVID-19 will not last forever, but consumers and small businesses will continue to have the need for immediate access to funds to pay bills. Banks can play a huge role in bridging the gap between services currently offered and truly meeting the liquidity needs of their customers.

On the consumer side, micro-loans have been challenging for banks to issue. More specifically, customers looking for less than $1,000 of potential liquidity to be repaid within six months is a largely underserved loan segment. Service providers like Fiserv can step in to make the process of offering micro-loans more automated while offering customers a frictionless experience.

On the small business side, the market already has different degrees of saturation and support for meeting liquidity needs. Even so, banks still largely offer only minimal support, so they should be looking to enhance these programs moving forward. For example, using deposit-based information as an adjunct to what banks are already doing today allows them to identify opportunities in previously non-existent customer segments.

New guidance gives banks the opportunity to meet customers’ liquidity needs

“Banks have done a really good job in responding to the needs of their customers and the pandemic as a whole in providing relief to consumers,” said Burton. Some pandemic-related changes made by banks will become permanent as they consider their long term strategy for offering benefits to consumers.

Two recent developments make it possible for banks to begin playing a significant role in providing liquidity bridges to consumers, which will be much-needed as government assistance ceases. First, the recent issuance of a joint statement by four federal regulators, which encourages banks and credit unions to provide alternative loan programs that comply with basic principles, offers the previously lacking guidance banks need.

Even more significantly, the Federal Deposit Insurance Corporation (FDIC) repealed two older letters that created ambiguity in the marketplace around deposit advance programs, giving banks a clean slate to innovate and best serve customers’ liquidity needs.

These developments make it possible for banks to offer deposit advance programs to eligible account holders. This is significant, as regulatory guidance for small-dollar lending has been historically vague and lacked direction. Small dollar loan programs are important to consumers; a Fiserv study conducted in 2018 found that 72% of consumers need short-term funds annually—and that was well before the COVID-19 pandemic emerged.

Liquidity drives loyalty

It is critical that banks maintain and manage relationships with their consumers long-term, and a suite of deposit liquidity solutions is a tool that can be used to do so. Banks that offer customers access to liquidity they need, as opposed to forcing them to enter into a debt cycle around payday lending, have more satisfied and loyal customers.

Fiserv found that a vast majority (94%) of checking account customers said they would be abundantly more interested in programs if their banks offered them, and that rings true for deposit liquidity solutions. By providing customers with liquidity in times of need, banks are able to maintain a deeper relationship that translates into renewed and increased long-term customer loyalty from its customers.

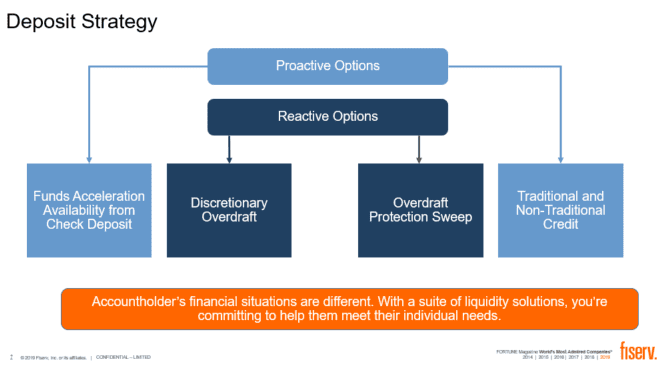

Proactive vs. reactive liquidity needs

Liquidity strategies need to contain both proactive and reactive options. Consumers who proactively request access to liquidity, such as quicker access to check proceeds or a small-dollar loan, want to know the terms, conditions, and fees associated with accessing these funds. Banks that provide transparent, high-quality liquidity services can reap the rewards of offering a solution with a strong value proposition, including the previously mentioned customer loyalty.

One such solution is Fiserv’s Immediate Funds, which was designed to address deposit availability by working with consumers and small business owners as checks are being deposited. Financial institutions that adopt this service are able to offer their customers an easy and convenient way to immediately access funds through their own bank account, delivering the differentiated consumer experience the market demands.

Reactive liquidity options are important as well. In the event that a customer is unable to proactively manage their finances, such as overdrawing from an account, banks can step in to offer support that saves the customer from the embarrassment of being declined.

There is ample room for improvement regarding overdraft, the most prevalent form of deposit liquidity that banks provide. Punitive policies with high fees reduce customer satisfaction and retention. Rather than relying on the one-size-fits-all approach to setting overdraft limits, banks should consider providing more forgiving overdraft policies and using an analytic solution that enables them to establish overdraft limits based on a specific account holder’s risk level.

Consumers and small businesses want immediate availability when checks come in so they can better manage their cash flow and spend with certainty. Financial institutions that adopt this value-added service are able to offer their customers an easy and convenient way to immediately access funds through their own bank account, delivering the differentiated consumer experience the market demands.

Ultimately, banks should keep both proactive and reactive scenarios in mind while implementing a solution to offer consumers the best possible experience.

Conclusion

Government assistance related to COVID-19 has provided small businesses and consumers with some economic support, but the funding won’t last forever. The inevitable end of government funding makes it more important than ever for banks to be well-prepared to offer a suite of deposit liquidity solutions. Banks that meet account holder liquidity needs will reap the benefits of a loyal, highly satisfied customer base.