Podcast: Play in new window | Download

There are several differences in the payment preferences of consumers across European nations. In Germany, merchants offer invoice payments. In the Netherlands, instant bank transfers dominate the retail space. In Sweden, the mobile wallet Swish has millions of regular users.

Cultural differences aside, a universal theme is emerging: alternative payment methods, or payment methods other than cash or major debit and credit cards, are gaining traction. For merchants serving European customers, these payment methods represent a great opportunity to improve the customer experience, bolster security, reduce card disputes, and more.

To learn more about the rise of alternative payments in Europe and how they benefit merchants and consumers alike, PaymentsJournal sat down with Jack Wilson, Head of Public Policy at TrueLayer and Samee Zafar, Director at Edgar, Dunn & Company.

The rise of alternative payments

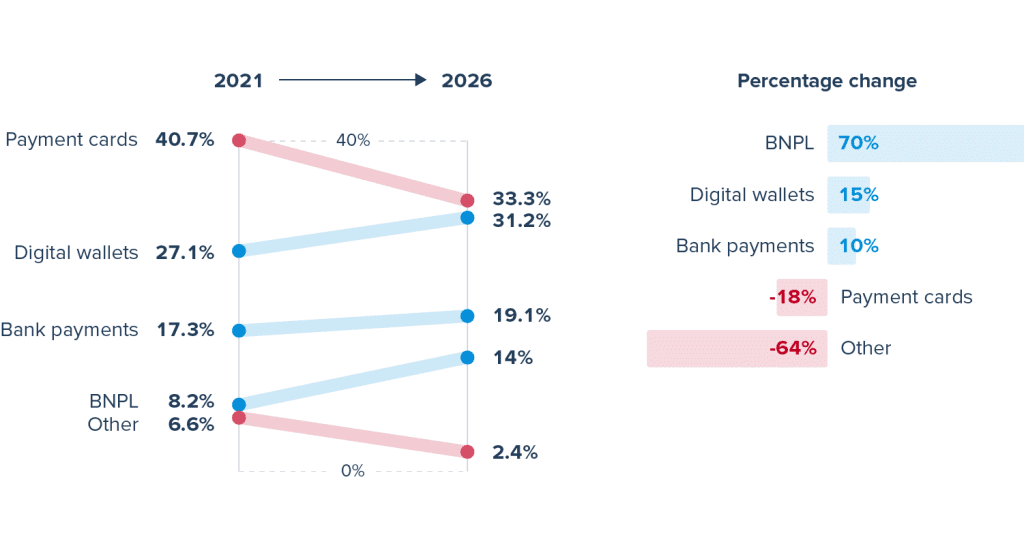

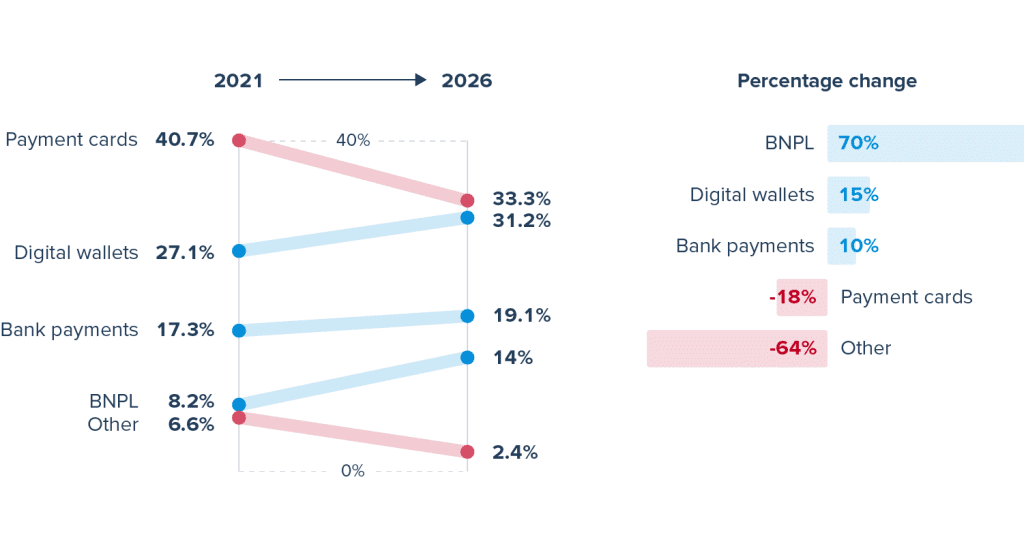

In 2021, credit and debit cards made up 41% of all e-commerce payments in Europe, however, this number is falling. By 2026, two-thirds of e-commerce purchases will be made using alternative payment methods instead.

This projection does not mean that the number of card transactions is decreasing. Rather, card payments will encompass a smaller percentage of total e-commerce payments by 2026. “While the total pie of payments will increase, the market share of alternatives to cards will grow and, accordingly, card market share will decline. So you will see that by 2026, we think that about two-thirds of total e-commerce transactions will be made with alternative payment instruments,” said Zafar.

This includes payment methods such as Buy Now, Pay Later (BNPL), digital wallets, and bank payments. Each of these categories is expected to gain in market share at the expense of both credit and debit cards.

The “why” behind alternative payment growth

Simply put, alternative payments are convenient, cheap, and effective. The two major advantages of card payments are authorization–guaranteed funds to the merchant–and payment speed. But with modern banking payments, instant payments, and other alternative payment methods, those advantages are no longer exclusive to cards.

The increasing accessibility of alternative payment methods is also a factor. “Non-card payments are becoming much more accessible to merchants as technology improves. Open banking is a good example of that, where developer-first companies like TrueLayer… make it as easy as possible to integrate with a non-card payment method. So that’s why merchants have the opportunity to switch away from cards,” added Wilson.

How new payment methods benefit merchants

There are several compelling reasons why merchants should integrate alternative payment methods into their offerings. For starters, merchants with a wider selection of payment methods have higher conversion rates (the percentage of customers who complete the transaction). This means fewer checkout abandonments and a higher probability of a successful sale. “That’s the first reason why merchants love alternative payment methods alongside cards, because they reduce their shopping cart abandonment rates,” said Zafar.

A second benefit for merchants is that alternative payment methods are often less expensive than card acceptance. While interchange fees in Europe have decreased in recent years, that decrease has not been passed onto all merchants by acquiring banks. “In fact, there has been a significant reduction in interchange, but the small merchants continue to pay high rates,” continued Zafar.

According to Wilson, cost savings is the biggest determiner for merchants. “If you look at cards, that is [fees of] up to 3% of transactions for processing card payments, whereas open-banking payments… can be around [or] lower than 1%—and that’s not even counting contingent charges, for example, the cost of processing a chargeback,” he explained.

The role of open banking

Open banking plays an important role in alternative payment methods. According to TrueLayer, open banking is a disruptive technology that seeks to bypass the dominance of card networks and other traditional financial rails by letting banks open their systems directly to developers and services by way of APIs. Open banking can be pivotal in helping merchants integrate new payment methods into their offerings.

“What open banking does is it enables the infrastructure of instant or faster payments to be leveraged by merchants, and that’s because it gives them the ability to [work with] third-party providers like TrueLayer to initiate these instant payments on behalf of customers,” said Wilson. Thanks to the open-banking ecosystem, funds can now move directly from a consumer account to a merchant account. “What you have is third-party providers making agreements with merchants to integrate the payment method into the checkout, then you have the third-party provider providing that payment service to the consumer at checkout,” he added.

This reduces the time it takes for funds to arrive in a merchant’s account. With card payments, “a merchant can be waiting for a number of days for those funds to arrive. But that is not the case with open banking, and it can really help from a liquidity perspective and a cash-management perspective for merchants,” explained Wilson.

The takeaway

The future of payments is bright. European consumers are increasingly recognizing the value of alternative payment methods, which is apparent given the anticipated decline in debit and credit card market share for e-commerce payments.

Meanwhile, open banking has made it easier for merchants to partner with experienced third-party providers that can enable new payment methods. Merchants that fail to incorporate alternative payment methods into their offerings will miss out on all the benefits that can result from doing so.

“It is now possible to make a payment within Europe from one person to another or from one person to an entity or merchant as efficiently, more cheaply, and with a better or an equally good customer experience as cards. For the first time, we now have a credible alternative to cards, which we never had before,” concluded Zafar.