Podcast: Play in new window | Download

One of the most overlooked trends in the payments industry is the rise of the Internet of Things (IoT). From smartwatches to internet-enabled refrigerators, there’s been a proliferation of IoT infrastructure. Billions of IoT devices are coming to market around the globe.

These devices collect vast amounts of information and enable a range of payment and logistical capabilities. This means that as IoT devices become more ubiquitous, the world of payments and commerce will be greatly impacted.

To better understand the rise of IoT and why companies should pay attention to this trend, PaymentsJournal sat down with Tim Sloane, VP of Payments Innovation at Mercator Advisory Group, and David Nelyubin, a research analyst with Mercator focused on IoT-driven payments. The two analysts recently published IoT Payments: How the Internet of Things Is Influencing Payments, a report that sketches out the first comprehensive framework of IoT payments.

During the conversation, Sloane and Nelyubin discussed Mercator’s IoT framework and how IoT-driven payments fit into the broader payments landscape. They also discussed the state of the market and explained why companies should take note.

What is an IoT-driven Payment?

In order to understand how IoT devices are changing payments, one must first define what an IoT payment is. Such a definition may seem self-explanatory, but it is actually more nuanced than one may expect. It is not simply any payment made from an IoT device.

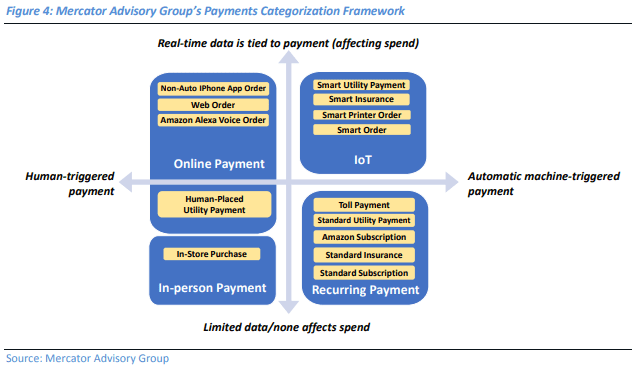

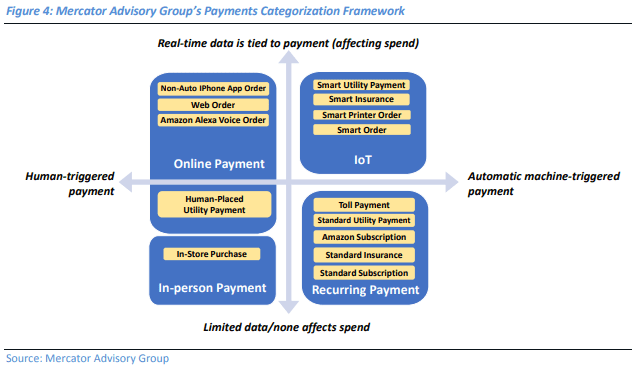

Mercator’s framework categorizes all payment types along two axes: the degree of human involvement and the amount of data being used to determine spend. Thus, Mercator classifies IoT payments as a machine-triggered payment based on real-time data analytics. Defining IoT payments in this way enables one to understand the subtle, yet important, impact IoT devices can have on payments, explained Nelyubin.

If a person consciously decides to make a payment through their Apple Watch, for example, that is not so different from traditional shopping; both are human triggered. Moreover, someone’s Apple Watch making a recurring payment for a newspaper subscription is no different from traditional recurring payments.

The type of IoT-driven payments that are innovative are the ones made autonomously by the device based on analyzing relevant data. Nelyubin explained how an IoT-enabled Brita Infinity Pitcher can detect when the filter needs to be replaced. Instead of waiting for the human to notice the filter needs replacing, the device can order and pay for a replacement on its own.

It’s not just pitchers ordering new filters. Fridges can order food, printers can order paper, and smartwatches can schedule and pay for a doctor’s appointment if it detects a person is sick. Mercator Advisory Group estimated that in 2019, these type of payments totaled over one billion dollars.

Better understanding the market through NAICS codes

Beyond creating the first industry-wide definition of IoT-driven payments and determining the market size, Mercator also explored which industries were involved in this emerging payment type. Sloane and Nelyubin classified each company, product, and purchased product by using the North American Industry Classification System (NAICS).

By using NAICS industry codes to link each IoT device to the product type it can order, Mercator was able to understand which industries are beginning to support IoT-driven payments and which products are being purchased. This allows Mercator to “look at one solution and understand what industry that solution comes from so that we can understand not only existing products, but future products that might come from others within that industry,” explained Sloane.

He likened the efforts to Mercator’s previous groundbreaking work in the prepaid industry. Back in 2004, Sloane was the first researcher to clearly identify the different segments in the prepaid space. Within a few years, Mercator was able to track how the prepaid space was growing and what new areas it had expanded into. “Our intent with the IoT payments framework is to create that ability to identify volume coming from specific segments, specific industry codes, so that we can track it over time,” he said.

How IoT-driven payments can benefit companies

One immediate area where IoT-driven payments can positively impact businesses is in replenishment. Since IoT devices can automate the replenishment process, both in ordering the proper item and in paying for it, they create a platform for stable revenue streams. A smart printer ordering its own ink and paper when needed ensures the consumer has crucial supplies and the company keeps a solid revenue stream.

But the impact of IoT can be much greater. Accessing troves of data can result in the company improving upon its product offerings. Sloane mentioned a fascinating example from the insurance industry. Progressive Insurance offers some users the option to put a transponder in their car. The device tracks a variety of information, from the average speed driven to where the person drives to. Based on all this data, Progressive can tailor the price of its insurance plan to the driving habits of a person.

“Our expectation is we’re going to see more and more of companies shaping what they offer based on the information they’re collecting from the device,” said Sloane.

IoT devices are also impacting supply chains. IoT devices can keep track of which items are needed at each stage of supply chain and order them when needed. Moreover, it’s becoming possible for a supplier to track all the parts in the supply chain, allowing them to understand how many parts are in transit, how many parts are sitting in containers, and so on. This increases efficiency and optimizes delivery capabilities.

Mercator can help companies develop an IoT plan

Given how important IoT-enabled payments will be for nearly every market vertical, companies should start to better understand IoT technology and what opportunities exist. However, since the topic is very complicated and only just coming into focus, companies may not know where to start.

That is why Mercator put together its framework and published a report on the IoT-driven payment space. The resources and expertise Mercator Advisory Group brings to the IoT space can help companies develop an IoT plan. “We have developed a framework and taxonomy that is really going help our clients get into this market more rapidly,” said Sloane.