Podcast: Play in new window | Download

With the rise of ecommerce and the emergence of new payment technologies, the legacy dispute process is badly outdated. Chargebacks are proliferating, costing merchants and issuers considerable time and money to process and resolve. Likewise, consumer satisfaction is negatively impacted by the long, inefficient chargeback processes.

One of the central issues is that many disputed transactions ending up in the chargeback ecosystem simply don’t belong in that channel. For example, a consumer may not recognize a purchase on their card statement because a merchant billed under a different name. Seeing an unfamiliar merchant name, the cardholder may then initiate a dispute, despite actually being behind the transaction.

With these issues in mind, Mastercard is working to fix the chargeback process. PaymentsJournal wanted to learn more about Mastercard’s innovative approach, so we sat down with Patrick Kelly, Mastercard’s vice president of Product Management for Cyber and Intelligence Solutions. Joining us was Tim Sloane, VP of Payments Innovation at Mercator Advisory Group.

Kelly and Sloane identified the factors driving the rise of chargeback volumes and explain why Mastercard is focusing on this area in particular. They also discussed how Mastercard is leveraging its recent acquisitions of NuData, a cybersecurity company, and Ethoca, a company focused on improving chargebacks, to innovate across the entire consumer journey.

Mastercard is looking at the full consumer journey, not just the transaction

The payments industry has witnessed many changes in recent years, and Mastercard is responding accordingly.

“With the growth in ecommerce and digital payments, instant gratification, and consumers wanting to pay how they want to pay, when they want to pay, it’s important for Mastercard to be enabling a good consumer experience,” said Kelly.

To create a positive consumer experience, Mastercard is setting its sights beyond just the transaction, an area where the company has historically focused. Although securing the transaction is still important, so is the need for improving the dispute process and the overall experience after the transaction occurs.

A major part of the consumer journey after the transaction is chargebacks, the mechanism by which a consumer can contest a purchase. However, while the payments industry has rapidly changed, the chargeback process has lagged behind, explained Kelly.

“We know it’s not built sufficiently to support some of the challenges that are in the digital space,” he said. For example, the rapid increase of ecommerce and the rise of digital payment methods have caused a significant rise in chargebacks that the current system is ill-equipped to handle. And since the process is long, there are a lot of operational expenses for merchants and issuers.

Also important is that consumers are prone to dispute a purchase they actually made due to confusion stemming from incomplete or misleading data on their card statement.

Improving chargebacks improves the customer experience (and the experience for everyone)

A crucial impact of dispute management, and the dispute process, is how it impacts customer loyalty, said Sloane. He mentioned a survey conducted by Zendesk, which revealed that 69% of customers who had a dispute actually had a positive attitude about that company, as long as the dispute was resolved quickly. Conversely, 65% of customers who indicated they had a negative experience with the company blamed that negative experience on a slow resolution to the dispute.

Data like these underscore how managing disputes effectively (or ineffectively) directly impacts customer satisfaction.

Kelly agreed and expanded upon the benefits of effective chargebacks even further. When everyone in the payments value chain, from merchants to issuers, have effective tools to resolve customer disputes, everyone benefits, said Kelly.

The current system is simply unsustainable so Mastercard believes now is a good time to offer a better solution.

Improving the digital payment experience through connected intelligence

Before you can understand how Mastercard is improving chargebacks specifically, it helps to understand the company’s approach to the entire payment lifecycle.

Kelly noted that while Mastercard has been successful at processing billions of transactions from issuers to merchants globally, it is now placing a renewed emphasis on ensuring that the journey before and after the transaction goes as planned for consumers, issuers, and merchants.

“So, as an organization, we’ve increased our focus and investment in these two pieces of the cardholder journey,” said Kelly. “So Mastercard came up with a strategy called connected intelligence. And that’s really about the entire cardholder journey from before the transaction, during the transaction, and then afterwards.”

In 2017, Mastercard acquired NuData, a global technology company specialized in preventing online fraud using session and biometric indicators. NuData’s solution uses billions of anonymized data points and machine learning algorithms in order to screen for and identify patterns of fraud.

Biometric data, location data, and patterns associated with the user’s shopping habits are bundled together and analyzed by AI to determine the likelihood that a specific interaction is legitimate or not. Connected intelligence refers to this process of tying together disparate data and leveraging it intelligently to detect and stop fraud.

The interaction doesn’t even need to be a transaction. For example, NuData secures logins and account creations by verifying if the user is legitimate or not.

It may seem surprising that Mastercard is concerned with interactions prior to the transaction, but as Kelly explained, “If we can ensure that we have a good user, whether that’s looking at their IP address, or perhaps how they use the platform itself, then we can ensure a better payment experience once they get to that piece of the value chain.”

Improving the payment journey post transaction: A better chargeback process

To improve the payment experience after the transaction occurs, Mastercard recently underwent a substantial rewrite of the MasterCom Dispute Resolution platform, the system that facilitates chargebacks and disputes.

With the new code, the MasterCom system is now more efficient. Kelly explained, “We consolidated several platforms and we put a rules engine in place to make sure we’re eliminating the noise that’s coming into the ecosystem,” said Kelly.

Mastercard also acquired Ethoca, a company focused on enabling dispute collaboration between merchant and issuer, and is integrating them into its own dispute network, allowing every Mastercard issuer to benefit from Ethoca’s solution and increasing the value proposition for Ethoca’s current merchant base. Its best-in-class network will be a key ingredient into how Mastercard is innovating dispute resolution to support the new needs of the payment’s value chain. Mastercard intends to help Ethoca increase its network scale as well as continue to tackle problems like friendly fraud.

Through the acquisition of Ethoca and the rewriting of the MasterCom platform, Mastercard has created a new dispute system better designed to tackle chargebacks.

Dispute Collaboration: Getting merchants and issuers to work together earlier

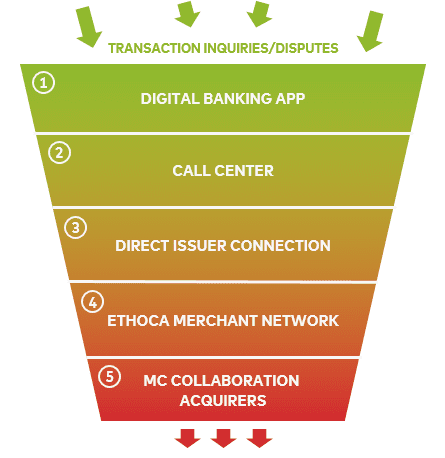

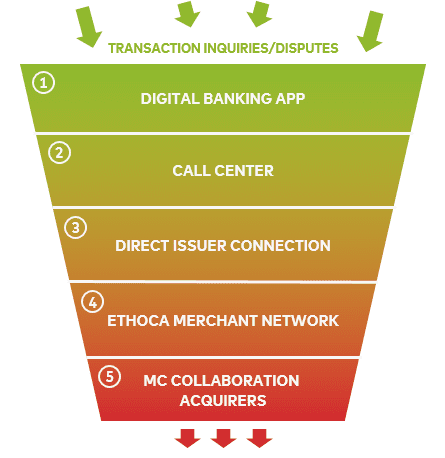

Mastercard’s new approach to the dispute process, termed Dispute Collaboration, consists of three parts: moving disputes upstream, rich data sharing, and scaling the ecosystem.

By improving communication between the issuer and merchant prior to the formal dispute process taking place, many disputes will be settled without entering the chargeback process. Similarly, rich data sharing, including more contextual information, will empower the consumer to make an informed decision about whether to initiate a dispute. This will result in valid transactions not being contested as often.

For example, when looking at the card statement in their banking app, a cardholder can click on a transaction and view its contextual information. Instead of just seeing the merchant name—which can oftentimes be misleading or vague—the cardholder can see more information such as the items actually purchased, the device used to make the purchase, the username of the account, and even the IP address, when applicable. This can refresh the consumer’s memory, or perhaps alert them to the fact their child is purchasing items with the card.

Kelly also stressed that Mastercard fully intends to keep Ethoca as a brand agnostic provider. “This needs to be not a MasterCcard-only solution,” he said. To be successful, the solution must work across any card and product type.

Fixing the chargeback process is part of Mastercard’s push to improve the customer experience. “Fighting friendly fraud, delivering that digital receipt, information at scale to cardholders, and continuing to enable more efficient dispute resolution between merchants and issuers will be key to that,” concluded Kelly.