Booking a new credit card account is not cheap. Issuers pay aggregators, such as Credit Karma and Nerd Wallet, hefty bounties to help consumers direct their applications. In addition, firms like Competiscan scour through direct mail credit card volumes and find that despite digital engagement, more than 30 billion direct mail pieces are annually processed through the ailing U.S. Postal System.

Forget about reward points for the moment. Credit cards are lending products, and interest rates are essential. Rewards can be profitable, but they are distracting.

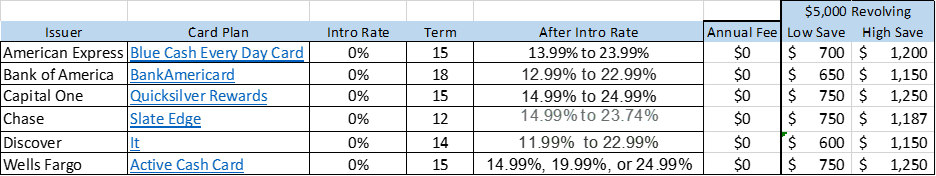

Let’s take a look at some current offers by top issuers.

With the prime rate locked at 3.25%, credit card issuers can make some aggressive offers. Pity the cardholder who justifies extravagant expenses in the hopes of generating cashback. The typical revolver, the 42% of those who carry forward balances monthly, should consider a way to save their way out of debt.

Other factors should come into the mix, such as the rewards structure. Topping off these savings with a 3% kicker on rewards points with a $2,000 monthly spend adds another $720 in savings. Additionally, the consumer should have other accounts; savings and checking accounts are a place to start.

With an introductory rate, credit cardholders have access to low-rate financing for a prescribed term. Once the term expires, the After Intro Rate prevails. In this example, note that Wells underwrites specific rate tranches, and the other five issuers calibrate rates to a range.

Our advice to credit card issuers is to keep a keen eye on competitive intro rates. Smart consumers look for them. My advice to my adult kids – if you can’t afford it, don’t buy it. And if you need to revolve, take advantage of intro rates – but be sure the debt is repaid before the expiration period. If not, find another deal!

And, focus on rewards when you can pay your bills off every month. That was the brilliance of the American Express “Spend-Centric” model.

Overview by Brian Riley, Director, Credit Advisory Service at Mercator Advisory Group