In a recently published McKinsey report, the firm discusses BNPL lending options, but they include some interesting tidbits about credit card account-level revenue derived from sampling and their Global Payments model.

The model looks at revenue by consumer credit cards in two components, those customers that transact with their accounts and settle balances each month and those that revolve, by carrying over their transactions.

Transactors do not pay interest because they bring their balances to zero each billing cycle, and revolvers tend to transact less because they exhaust much of their available credit. According to the recently published report,

However, today’s issuers face circumstances that make profitable growth harder to sustain.

Their profits rely mainly on revolvers or customers who carry a balance on their credit-card account from month to month.

Revolvers make up around 60 percent of credit-card accounts, but they generate 85 to 90 percent of issuers’ revenues, net of rewards.

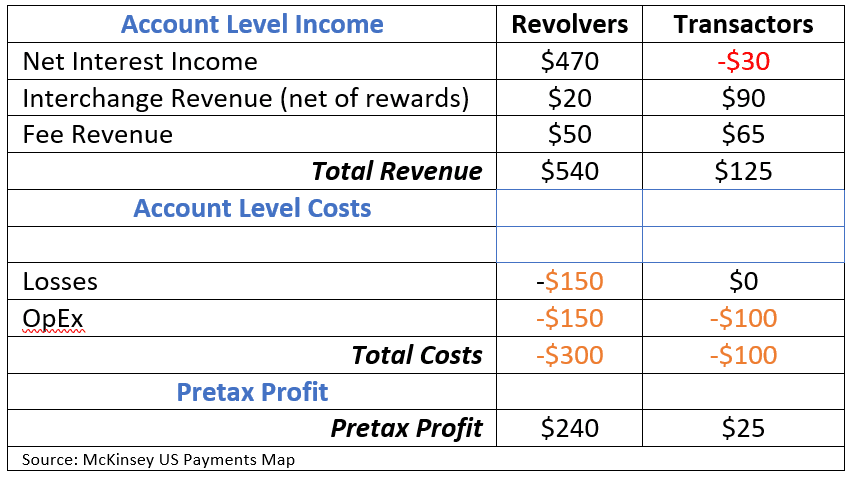

Profit per account stands at around $240 for revolvers but at just $25 for transactors, or customers who pay off their balance every month.

Building a business on revolvers rather than transactors can be a risky situation. The net interchange numbers might make one think twice about credit card rewards if the Senate Judiciary Committee starts poking at interchange.

It will be interesting to watch these numbers change as the recession forms. Reduced consumer spending would decrease interchange revenue. Revolvers might increase, or the amount they carry over might increase, affecting net interest income. On top of this, if the CFPB takes action on credit card late fees, expect to see the Fee Revenue inch down.

Operational expense costs will increase as collection volumes swell, and losses, which today only amount to 1.82% of portfolio value and could easily double. If you remember, back in 2Q2010, the loss number hit an all-time high of 10.97%, positioning even the best-run credit card business in a pretax loss position.

But the best news of the day is on Bank Stress Tests, which the NYT reported. Win, lose, or draw, financial institutions are positioned strongly if (and when) the recessionary cycle takes hold.

Overview by Brian Riley, Director, Credit Advisory Service at Mercator Advisory Group