The impact of COVID-19 pandemic has been wide ranging, affecting the lives of people and businesses. While moving to digital touchless payments, the pandemic has also influenced and changed the prioritization of current and future payments projects. Severe market disruptions, changing customer and business needs and expectations have placed unprecedented pressure on financial institutions (FIs). With increasing emphasis on efficiencies, financial institutions are gravitating to a consolidated payments infrastructure – that aids digital transformation, reduces system and operational complexity and improves resilience.

To learn more about the need for financial institutions to digitize, especially in the COVID-19 era, PaymentsJournal spoke with Dudley White, SVP & General Manager of Payments, Financial & Risk Management Solutions at Fiserv, and Tim Sloane, VP of Payments Innovation at Mercator Advisory Group.

Financial Institutions are aware that advances in technology are needed

Many Financial Institutions are still operating on decades-old, often siloed, complex legacy infrastructure, which tends to be inflexible and expensive to maintain. To remain relevant and stay competitive within an increasingly digitized market, these Financial Institutions must embark on a digital and technological transformation—a fact that many institutions now recognize.

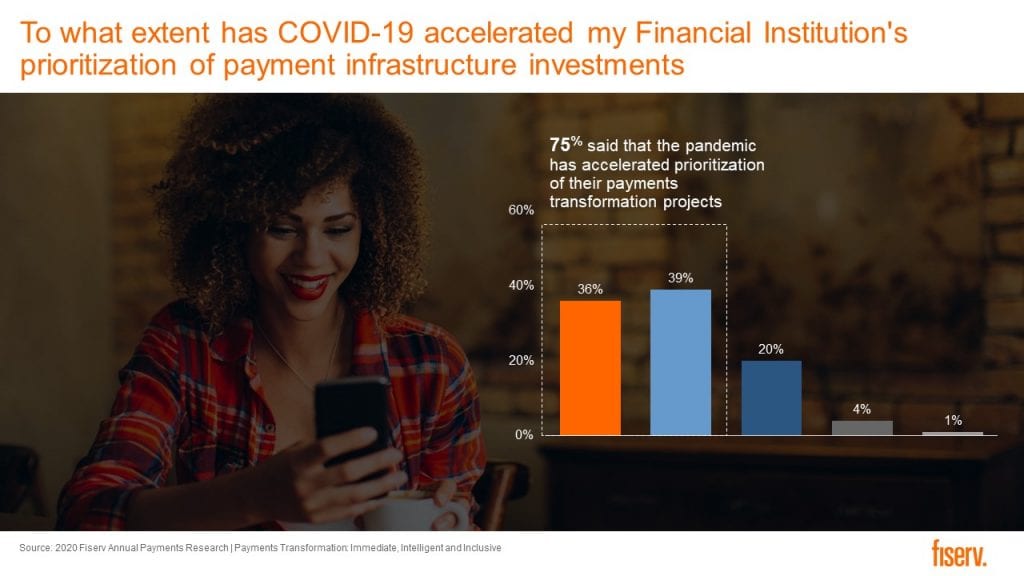

Fiserv recently conducted a survey measuring the impact COVID-19 has had on Financial Institutions’ views toward technology and digital transformation. As the chart below reveals, 75% of survey respondents said that the pandemic has accelerated prioritization of their payments transformation projects. The data substantiates the 2019 survey, where 85% of survey respondents either agreed or strongly agreed that their Financial Institution would significantly increase investment in its payments systems infrastructure over the next three years.

“Payments infrastructures have seen a significant increase in demand from direct deposit government schemes pushing funds directly to citizens and business accounts. Therefore, digital transformation across financial services is critical,” said White. More specifically, he highlighted the growing demand for real-time payments. “Financial Institutions are looking for ways to simplify on an integrated platform,” he added. “They want [simple, integrated] platforms that are scalable, and they want platforms that are open and adaptable, whether it’s on-premises, hosted, or in the cloud.”

Sloane agreed, adding that “during the pandemic, people have moved to P2P payments as a way to move money to friends and family.” Beyond P2P payments, there has been a dramatic shift in e-commerce and mobile pay for pickup. “Those trends have a real impact on how a financial institution operates and the technology it needs to implement, so it’s good to see that they recognize that.”

A legacy system overhaul vs. an incremental approach to upgrading: Which is better?

Whether a financial institution should go for a big-bang overhaul or take an agile, incremental approach to updating technology depends on their specific circumstances; there is no one size fits all approach. Financial institutions need to consider their existing infrastructure, digital ecosystem and desired outcomes before moving forward.

When deciding on an approach, Financial Institutions should plan, prioritize, and decide what to keep or build in-house and what to achieve through working with a technology vendor. One perk of working with established technology vendors means that regulatory and compliance updates are automatic, saving Financial Institutions the time and effort needed to stay compliant.

Moving to the cloud: The natural evolution of the payments landscape

Legacy platforms are riddled with operational inefficiencies, regulatory concerns, and other shortcomings. “The legacy systems are not built to drive faster payments, and in most cases don’t support the ambitious growth plans of a financial institution,” said White. “The move to cloud is just the natural evolution for where the payments landscape is moving, [with] the ability to support 24/7 operations and the ability to scale as needed.”

But how should Financial Institutions execute the move to cloud technology? Choosing the pace at which to upgrade, determining the best cloud hosting option varies from Financial Institution to Financial Institution. This is largely dependent on the size of the institution. Most large financial institutions host technology on-premises or through a public or private cloud, while smaller, tier-two institutions tend to move towards a private managed service with a specialist provider managing their cloud infrastructure.

A rising number of FIs are leveraging the cloud to modernize their payments infrastructure and reap the value that comes with doing so. A large financial institution has moved its entire IT infrastructure, including payments, to the cloud. Meanwhile, a European client of Fiserv opted for cloud-based payments infrastructure and were able to go live in less than six months.

Smaller institutions are moving to the cloud too. The reasons behind doing so are plentiful. For example, Software as a Service (SaaS), or managed services, provides financial institutions with ample flexibility and key cost benefits. Additionally, they don’t have to make heavy investments in in-house technology, and aren’t responsible for maintaining them.

Organizations using the cloud can leverage actionable data

Updating legacy systems to ISO 20022 data formats also enables organizations to capture and handle valuable payments data. Investing in preventive, predictive, monitoring, and reporting analytic tools makes it easier for organizations to prevent fraud, improve cash flow, and provide real-time consumer and transaction data that contain value-added insights.

Corporate treasurers can improve enterprise liquidity with data analytics and insights. They can also use the data to foster customer engagement, improve the overall customer experience, and identify individual behavior patterns that make it possible to customize products and services targeted towards niche segments.

“As you get the data up in the cloud, it makes it easier to access and try new types of machine learning and analytics,” said Sloane. “If you’re in the cloud, and you have AI helping with conversational commerce capabilities, you can make that way more scalable than you can with people [performing customer service].”

Lastly, data enables companies to mitigate risk by addressing issues before they occur, preventing potentially long-lasting reputational damage that comes with security breaches.

Conclusion

COVID-19 has been a major driver in the acceleration of investment in modern payments infrastructure. Financial Institutions are increasingly aware of the need for improved, scalable and flexible technological capabilities; more specifically, they are recognizing the value of moving to the cloud. By using Artificial Intelligence and Machine Learning and leveraging actionable data, financial institutions can be well-prepared to serve their customers both now and in future times of need.