During the economic hardship of COVID-19, retail consumers became more interested in accessing credit to make purchases, and retailers became more interested in offering them.

But what happens to consumers without the credit score to qualify for traditional financing options? Oftentimes, they get left out. But rather than leaving those customers behind, enterprise retailers can accommodate them with buy now pay later (BNPL) and lease-to-own (LTO) solutions. With such solutions in place, more customers can access the products they need, and retailers can increase their transactions. It’s a win-win for everyone.

To learn more about alternatives to traditional financing like BNPL and LTO and how it can be beneficial, PaymentsJournal sat down with Tony Cerino, VP of Sales at Katapult and Brian Riley, Director of Credit Advisory Service at Mercator Advisory Group.

What is an alternative to traditional financing?

One alternative to traditional financing includes offering lease-purchase options to consumers who are considered higher risk by traditional finance companies due to low or blemished credit ratings. Nonprime borrowers may not qualify for prime-rate credit products or loans.

Waterfalls allow merchants to use a network of lessors and finance companies to offer various options to their customers, rather than a single credit product for the consumer. This enables them to offer solutions to customers considered subprime.

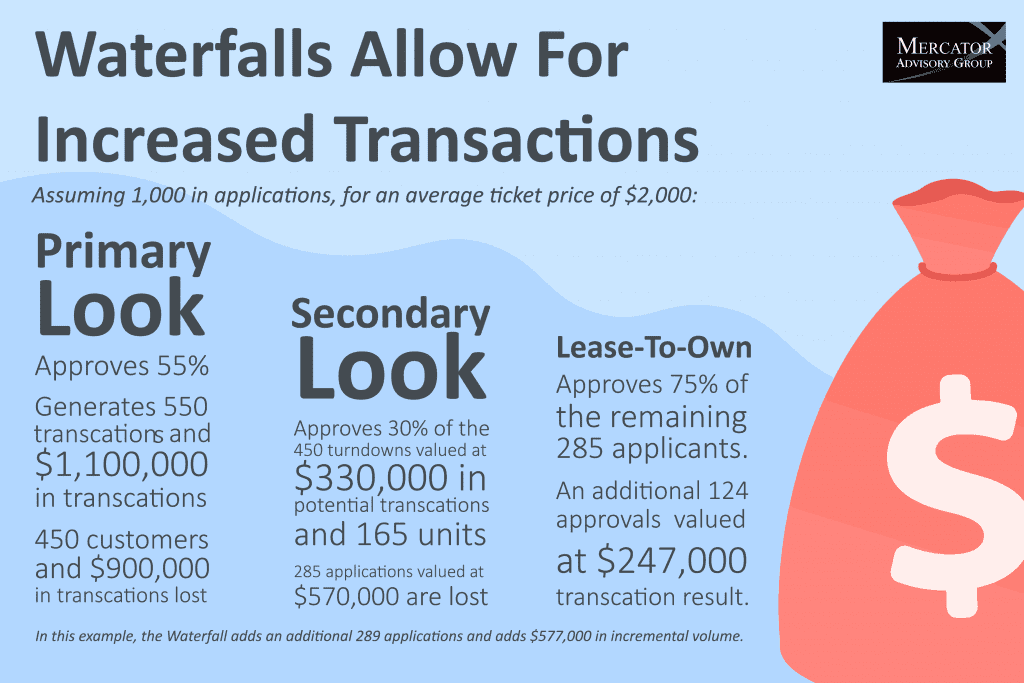

Imagine a merchant receives 1,000 credit applications with an average ticket price of $2,000 (as demonstrated in the chart above). The applications start with a primary lender, which typically follows bank grade lending standards. In this example, the primary lender approves 550 (55%) of the applications.

“We still have 450 customers that have not been served, and the potential volume is $900,000,” said Riley. The remaining 450 applications then cascade to a second company. “The second company… won’t be at the bank rate, they’ll be down a notch. So there will be some that survive that approval process and underwriting,” explained Riley. In this scenario, the second entity approves another 165 customers, or 30% of the 450 remaining applications.

That leaves 285 applications with a potential of $570,000 in transaction volume. “By adding the third step into the waterfall process, where it’s not going to be a traditional credit solution… but it’s going to be a lease-to-own option, being able to generate 75% of those turndowns gives us another 124 approvals,” said Riley.

Adding it all together, having the secondary lender and third lease-to-own option in place results in 289 more transactions than if the retailer had used the primary lender alone. This translates into an additional $577,000 in volume.

Lease-to-own versus buy now pay later

The multi-lender waterfall approach is ideal for customers looking for a buy now pay later solution. A lease-to-own agreement, as seen in the third step of the waterfall option described above, is a little different.

“Lease-to-own offers customers a way to obtain durable goods without the need for [a] credit score. They enter into a lease-purchase agreement with a lease-to-own company like Katapult, who then purchases the item and leases it back to the consumer” said Cerino.

Unlike the BNPL model, lease-to-own customers have multiple options for their lease-purchase agreement. “They can make payments for the length of the lease term (typically 12-18 months) and own the item, they can return the item to the lease-to-own company at any time and not make any additional payments not already incurred, or they can exercise an early purchase option at any time, including the option to purchase the leased item during the first 90 days for the cash price, and typically for a fee and the initial payment that they made,” he explained.

Retailers were historically hesitant to offer lease-to-own checkout options

Lease-to-own creates a new opportunity for retailers to offer alternative options to consumers that do not qualify for traditional financing. Despite the benefits this model can bring to both parties, lease-purchase solutions have historically been plagued with negative connotations and viewed as predatory. “The good thing is that’s no longer the case,” said Cerino. “Lease-to-own companies are changing the way [merchants] treat consumers, and specifically the non-prime consumers.”

Consumers who fall under the category of subprime come from an array of generations and backgrounds and have various reasons for needing alternative to financing options that do not rely on a FICO score. “At the end of the day, the non-prime segment is a group of customers who have needs just like any other shopper, and it’s the responsibility of a lease-to-own company like Katapult not only to treat them with respect and grace, but also to help them on their path to ownership,” he added.

How retailers benefit from lease-to-own

In conclusion, retailers that don’t offer BNPL or lease-to-own options are not providing their customer base the full array of options available and are limiting their transaction volume. Katapult’s research found that enterprise retailers offering lease-purchase options for durable goods like appliances and electronics see a 112% increase in transactions and 11% conversion rate increase.

By multiplying the value of declines from the prime financing option currently being offered by 45%—Katapult’s general percentage based on its annual metrics—retailers can calculate themselves around what they’re leaving on the table. For example, an enterprise retailer that sees $375 million in prime declines, multiplied by 0.45 (45%), is missing out on nearly $169 million in revenue that could be captured with a lease-to-own option.

For retailers that want to integrate a lease-purchase solution into their offerings, reaching out to an experienced partner is the first step. Katapult works directly with e-commerce and brick and mortar merchants to integrate lease-to-own solutions at the point of sale.

“It’s a full integration, very seamless for both the salesperson working in the store and for the consumer as well… We work very closely with our merchants to make sure all the consumer facing materials are ready to go when they launch with us so the customer can be fully aware of the options that [are] available to them,” concluded Cerino.