Podcast: Play in new window | Download

The same technological advancements that have caused an explosion of e-commerce and fintech growth in recent years have also given bad actors easier access to the payments system.

By exposing and preventing malicious activity before merchants are onboarded, financial organizations can mitigate risk, comply with Know Your Customer (KYC) requirements, and preserve their hard-earned reputations as they look to expand their merchant portfolios. Expedient and thorough underwriting is the first step in accelerating successful onboarding.

To shine a light on how payment processors can improve merchant underwriting, PaymentsJournal sat down with Ron Teicher, Founder and President of EverC, and Don Apgar, Director of Merchant Services Advisory Service at Mercator Advisory Group.

An increasingly complex payments system

The payments system used to be simple. At its core, it worked on the premise that any merchant entering the system could be easily identified and verified across several attributes.

Today, that is no longer the case. What was once an interaction between a merchant and bank now includes players such as payment facilitators (PayFacs), payment service providers, online marketplaces, cross-border payment providers, and more. Growing e-commerce, which is on track to reach $1 trillion in U.S. sales in 2022, combined with an influx of small businesses and micro-merchants complicate the payments ecosystem even more.

This has made the underwriting process, when acquirers determine whether merchant account applications meet the risk standards to begin accepting payments, less straightforward.

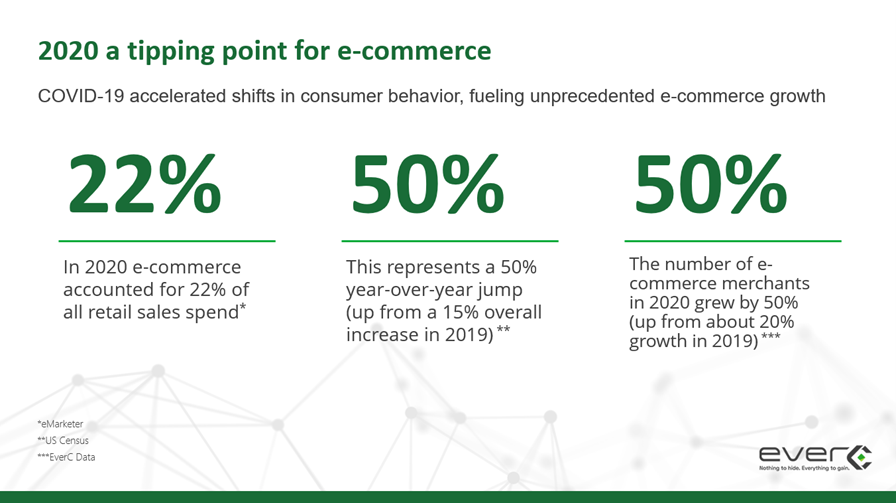

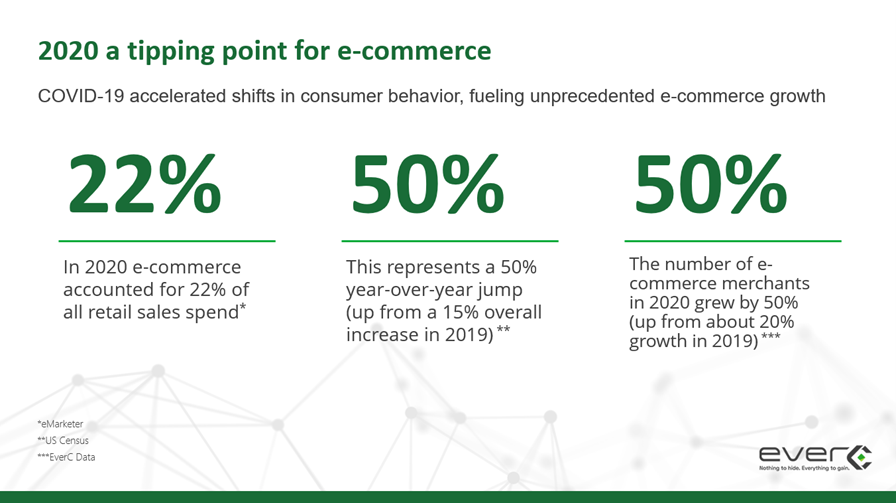

“The combination of a much more complex system and a huge data overload on the underwriting functions creates the conditions for bad actors to thrive in e-commerce as [it] takes more and more share of overall commerce. It means that unless we address these new realities, we’ll find ourselves exposed more than ever before to criminal activity. And unfortunately, the 2020 numbers that we’re showing here tell that story,”

said Teicher.

Nonetheless, it remains crucial for payment processors to do due diligence on every prospective merchant account. This is true “whether it’s a merchant account or a sub-merchant or a PayFac, and it’s really created quite a clerical load [when] onboarding new merchants,” said Apgar.

A growing body of regulations impacts merchant underwriting

Underwriting is where financial institutions, including payment organizations, comply with Know Your Customer (KYC) regulatory requirements. There is a wide regulatory framework covering KYC in the United States, the genesis of which lies in Section 326 of the Patriot Act. The Patriot Act, which is short for the “Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2002,” was passed by Congress in the wake of the September 11, 2001, terrorist attacks.

At the time, high-level U.S. government officials declared that the fight against terrorist organizations’ financing was as critical as fighting against terrorism itself. In fact, it has been presented as key in the fight against terrorism. The failure to put appropriate controls in place could very well enable terrorist groups to cause more harm.

“This is not some kind of fixation by the government. This is a hard-learned lesson following this epic catastrophe. But it’s not just about terrorist organizations. It’s also about protecting consumers and protecting and enabling e-commerce. If it’s easy for criminals to conduct their crimes or launder their criminal money online, then by necessity, consumers will be deterred from consuming online goods and services,” explained Teicher.

More recently, on January 1, 2021, Congress passed the National Defense Authorization Act (NDAA) to address a variety of defense and national security measures and introduce amendments and increased penalties to existing anti-money laundering (AML) and counter-terrorism financing (CTF) laws. The passing of the NDAA was the most substantial and sweeping legislative reforms to AML and CTF laws since the Patriot Act.

But it gets even more complicated. “There’s also the beneficial ownership clause now, where acquirers and PayFacs are supposed to look at the ownership of every single merchant and sub-merchant … As we try to take the friction out of onboarding merchants and making payments more accessible, the compliance requirements are more burdensome than ever,” Apgar noted.

As is the nature of the world, regulations will continue to emerge and evolve. Acquirers will need to keep up with these changes. “The environment certainly is not static, especially in the global stage as the environment shifts and the politics shift and regulations change. And it’s the responsibility of the acquirers and the processors to be compliant. And staying up to speed on what constitutes compliance is as much of a job as actually doing the legwork to be compliant,” warned Apgar.

Common hurdles in merchant underwriting

Underwriting is no trivial task to begin with but has gotten increasingly complex in the age of fintech. “Everybody’s looking for frictionless onboarding. How do we complete an onboarding process as fast as we can, allow maximum business in, and interrupt the merchant as [minimally] as possible? This often results in limited ability to obtain sufficient or accurate data that will allow for proper underwriting,” said Teicher.

Many organizations have gaps in complying with some of the most basic and fundamental KYC requirements. A common example is the misclassification of merchant codes. EverC estimates that misclassification of the basic information of what the merchant is doing is at roughly 50%, which has a huge impact on the ability to accurately assess the risk level of a potential merchant.

Secure and seamless underwriting is key to growing merchant portfolios

Speedy and accurate merchant underwriting is crucial for organizations looking to safely grow their merchant portfolios. Companies that rely solely on manual underwriting processes to assess risk could lose merchants to payment organizations that can accept them faster.

According to Apgar, the burden of compliance is multiplied by merchants’ expectations for a quick and seamless account approval process. “Getting it right is important. But getting it right and not making the customer wait is really the end game in onboarding new merchant accounts,” he warned.

Ultimately, the future of KYC compliance and merchant underwriting will depend on systems that can both triangulate traditional sources of data and utilize non-traditional sources of data such as the internet and social media, crowd intelligence, and website traffic analysis. This enables the win-win of conducting a thorough risk analysis and meeting the payment system profile needs of prospective merchants.

“An underwriting process that lacks the technological tools that allow for proper processing of data and volume with the ability to provide deep analysis of risk at speed and scale can result in accepting unimaginable risk that the regulations set following 9/11 were meant to prevent,” concluded Teicher.

EverC is a global leader in cyber intelligence for merchant risk and compliance. EverC MerchantView Underwriter is a next generation automated solution for merchant onboarding that helps organizations grow their portfolio and keep customers happy. For more information, download the e-book, “Accelerate your underwriting without sacrificing due diligence.”

Download the complimentary e-book – Accelerate your underwriting without sacrificing due diligence.