The old saying goes: You don’t get a second chance to make a first impression. For digital businesses, that first impression is the digital onboarding process. It must be a smooth and easy process for the customer, while at the same time ensuring the proper protocols for regulatory compliance and to prevent fraud are in place.

However, onboarding new customers seamlessly in a digital environment without adding risk is a challenge for many organizations, especially those with unique regulatory requirements and different tolerances for risk. As the competition for customers (and dollars) tightens, customer abandonment and conversion rates will become increasingly important metrics, as will the impact of fraud on the bottom line.

To learn more on this important topic, PaymentsJournal recently hosted a webinar featuring Gareth Walker, Global Head of Client and Digital Onboarding at Refinitiv, and Brian Riley, Director of Mercator Advisory Group’s Credit Advisory Service.

The Importance of First Impressions

Historically, a customer’s first impression of a business came through a face-to-face interaction with a sales representative, or perhaps a phone call with a customer service rep.

“Now it is digital,” said Walker. “And it’s about how many clicks you have to make, how long the website takes to load, and how much information you have to give out.”

It’s not surprising then that businesses in all industries are spending heavily on the digital customer experience. Walker noted that global spending on digital transformation initiatives is expected to reach $1.8 trillion by the end of 2022, and around $300 billion of that is earmarked for digital customer experience improvements.

“A better customer experience brings really rich rewards,” said Walker, adding that in the financial services industry, for example, satisfied customers are seven times more likely to increase their deposits and twice as likely to open a new account with an institution if they consider themselves a satisfied customer.

Yet despite the investment made in digital customer experience (CX) and onboarding, it’s an area that businesses often fail at. Walker said that 66% of consumers abandoned a digital application without completing it in 2021, up from 63% in 2020. This abandonment is largely due to poor digital user interfaces (UI).

This is especially true for Millennial and Gen Z customers, who are much less likely to put up with onerous digital processes than older consumers, said Riley.

“Think of where you want to grow your portfolio,” Riley continued. “Your long-term customers are going to be in those younger-age cohorts for obvious reasons.”

Simplicity Is Key

The top three reasons for digital abandonment are the consumer changed their mind, the consumer was asked to input too much information, or the process took too long.

While not much can be done if a potential customer changes their mind on buying a new product or service, the latter two reasons can be fixed with a better digital onboarding experience, according to Walker.

For example, “If an onboarding experience lasts longer than two-and-a-half minutes, there’s a high risk of abandonment,” he said. “They move on to the many other distractions available on their device.”

Having to input too much information can be resolved by using data that the company already has on that consumer, added Riley. He cited an example of getting a preapproved credit card offer but then having to still input basic personal information in a digital form.

“If they already prescreened me, why do I have to put in my name and address again?” he asked.

Overall, a poor onboarding experience can have an outsized negative impact for businesses, with Walker noting that 52% of consumers report they are less inclined to use a company’s services in the future if the onboarding process is too onerous.

A Delicate Balancing Act

One dynamic that makes it hard for businesses to get digital onboarding right is competing internal dynamics. Sales and marketing, for example, want as quick and easy a process as possible, while regulatory, compliance, and security teams may want more robust protocols.

This is especially important because digital application fraud is on the rise. About one in six U.S. consumers have been affected by application fraud in the past year, Walker noted.

Application fraud can be committed in various ways. Sometimes criminals buy username and password combinations that have been leaked after data breaches. Criminals can also piece together enough personally identifiable information (PII) from consumers through tactics such as monitoring social media accounts to create “synthetic identities” that look like they could be real people. Sometimes victims have had their credentials stolen by a family member or people they know.

Application fraud affects virtually every industry, said Walker.

“When talking about application fraud, you have to be cognizant of how fraud is committed specifically in your industry and what the regulatory landscape is,” he added.

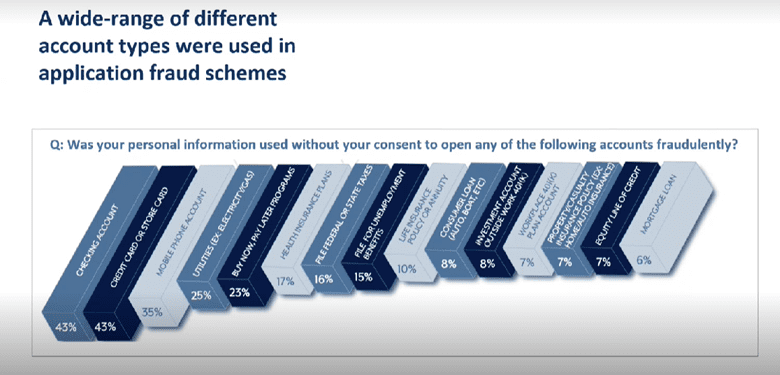

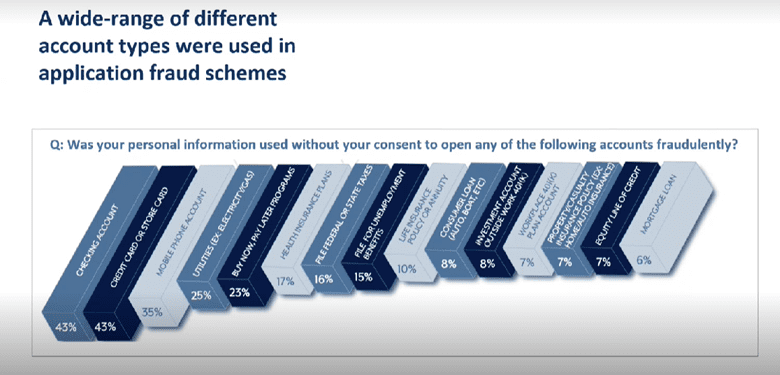

As seen in the following graph, bank checking accounts, credit cards, and mobile phone accounts are the top areas where fraudsters commit application fraud.

Digital Onboarding by Refinitiv Giact

How then can businesses balance a smooth and easy digital onboarding process with having the proper fraud protocols in place? Giact, a Refinitiv company, aimed to solve this conundrum with its digital onboarding solution, said Walker.

“It’s a digital onboarding solution that is fully configurable and guides customers through a user-friendly onboarding process while also conducting real-time verification checks that are integrated with your in-house systems,” explained Walker.

He added that the solution is fully customizable and dynamic so that businesses can ensure they “are delivering the right CX to the right customer.”

For example, if certain information about a customer is already known, such as name and address, those questions can be bypassed so as not to add undue friction to the process. Furthermore, a picture of a driver’s license or passport can be taken, and information can then be extracted from there to auto-populate certain fields.

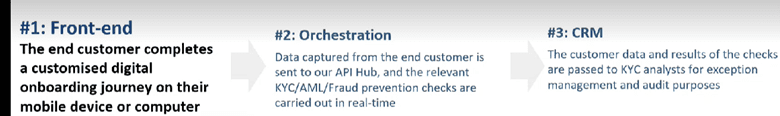

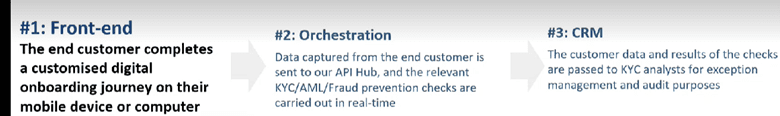

The solution has three main components: a front end that the customer sees and can be completely white-labeled and customized to show the business’ branding. There is also an orchestration layer, which Walker called “the brains of the operation,” that captures data and sends them to Giact’s application programming interface (API) hub, where know your customer (KYC), anti-money laundering (AML), and other antifraud checks are carried out in real time. Finally, the data and results are passed through a customer relationship management (CRM) system for exception management and audit purposes.

Ultimately, the solution enables “different onboarding processes with different controls depending on your industry,” Walker said.