Podcast: Play in new window | Download

With consumer behavior increasingly favoring digital channels in the wake of COVID-19, credit card disputes and chargebacks are on the rise. To minimize their impacts, issuers need to prioritize dispute management solutions that prevent chargebacks before they happen.

To learn more about how to prevent chargebacks with consumer transaction clarity, PaymentsJournal sat down with Lee Kennedy, VP of Product Management at Ethoca, and Brian Riley, Director of Credit Advisory Service at Mercator Advisory Group.

Card disputes are on the rise

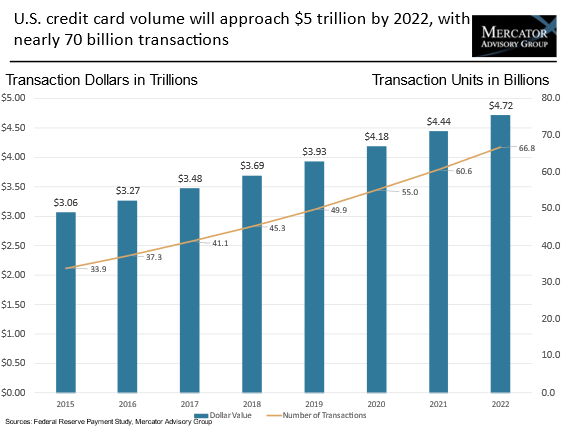

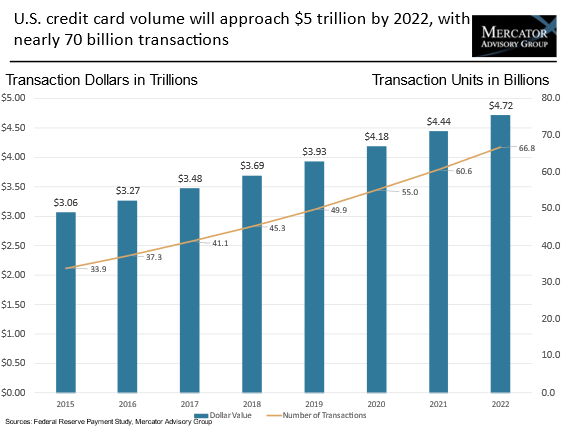

The rise in transaction disputes is closely linked with banking and commerce growth in recent years. The chart below, provided by Mercator Advisory Group, explores the growth of credit card transaction volume in the United States since 2015:

“One of the most important premises here is that transaction volumes will continue to grow, and we’ve seen many use cases of that across the world. But something that’s important within that are transactions that get disputed, and in a card business, it’s essential that chargebacks can be handled effectively,” explained Riley.

If disputes do arise, they need to be resolved. “On the current trajectory, we expect to have close to 70 billion transactions by 2023 going through the payments network, and when you translate that into dispute items, we’re talking about 26 million items for operations to handle [that] need various levels of attention,” he added.

How the pandemic impacted banking and commerce

With the pandemic-driven shift toward digital payments, there is even more opportunity for disputes to arise. “Even when people are buying in person, they’re frequently using contactless payment methods rather than cash, and that’s a fairly significant uptick even on the in-person shopping experience, where more than 40% of in-store purchases are now done with a contactless method,” said Kennedy. In other words, even in-person shopping experiences are often conducted through contactless methods such as mobile devices.

Another shift caused by the pandemic is that merchants, particularly those in the brick & mortar space, had to roll out online capabilities quickly. Similarly, banks began interacting with more of their customers digitally, due to sheer necessity. “In many cases, the branches literally weren’t open, so you could go use an ATM machine, or you can go online and use your mobile app, or use the website,” Kennedy added.

What do these changes mean for dispute risk? According to Kennedy, “the digital shift does lead to an increase in disputes and chargebacks. There’s always been a natively higher dispute rate on those e-commerce types of transactions, and those factors that are leading people to do that—not always by choice—lead to a higher rate. The estimated chargeback volume for 2021 is going to be over 615 million.”

The cost of chargebacks—and how to stop them

For banks, there is nothing small about the cost of disputes that lead to chargebacks. In fact, chargebacks are expected to exceed $1 billion by 2023.

“The net impact of a lot of this from a dispute and operational standpoint as a bank is massive upticks in volume, and particularly a lot of this occurred at a time when again, due to some of the impact of the pandemic, things like call centers were struggling to stay staffed,” explained Kennedy. Put simply, the influx of chargebacks is hitting banks exactly at the point when they are least equipped to handle them.

Many chargebacks are caused by preventable friendly fraud. Friendly fraud occurs when a cardholder makes a legitimate purchase, receives the goods, and then disputes the charge for a refund. This is not always intentional—in many cases, consumers simply do not recognize the transaction on their bank statement and assume it is fraud.

“That leads to a very large [number] of disputes being classified as friendly fraud, as much as 70% in certain segments of the business,” said Kennedy.

The brunt of friendly fraud falls onto banks

When consumers do not recognize a transaction, their bank statement may not clearly identify the merchant from which the purchase was made. With nowhere else to go, they turn to their bank to help them resolve the situation.

The good news for banks is that many of these scenarios can be avoided by simply providing clear and transparent transaction information on bank statements. “As many as 25% of these transaction [disputes] can be removed immediately just by providing some additional detail. That’s really the biggest lever that you have as an issuer, is providing better information,” noted Kennedy.

Issuers that do not remove this pain point will continue to experience the brunt of handling the chargebacks. “You’re going to be dealing with acceleration of the process, dispute escalation issues, and sometimes eating the chargeback at the end of the day. So, there’s a multi-pronged reason why you want to deal with this,” said Riley.

Ultimately, resolving disputes before the chargeback occurs begins with meeting customers’ needs when they have a question or concern about their transaction.

Give consumers clarity with Ethoca’s Consumer Clarity™

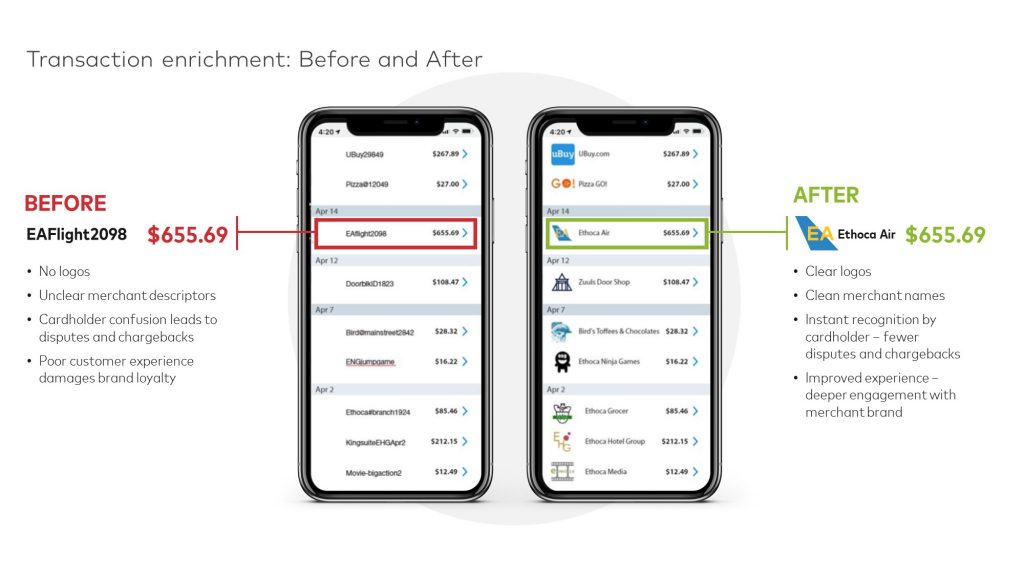

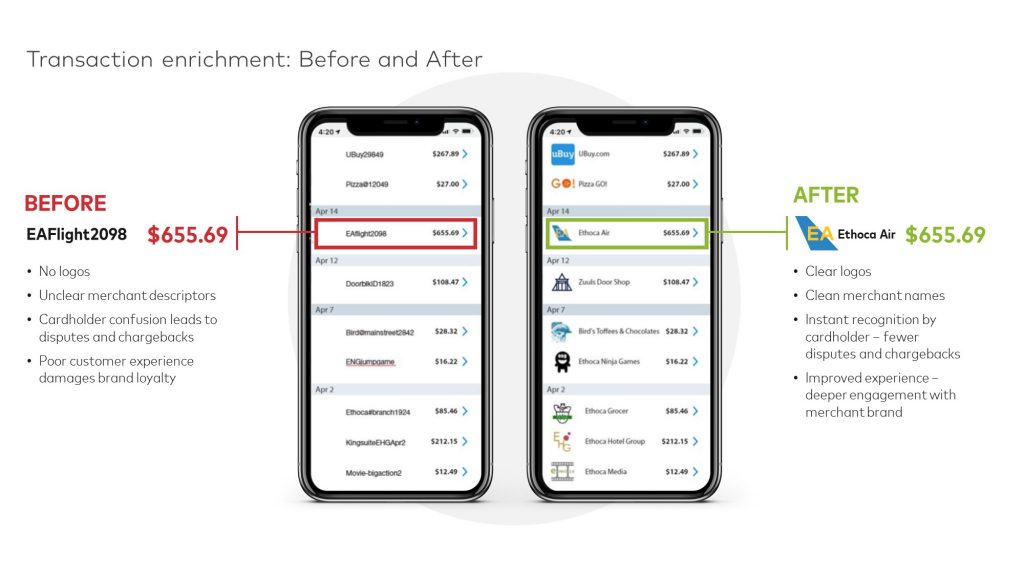

To help banks resolve the ongoing problem of transaction confusion and the downstream effects, Ethoca released Consumer Clarity to bring transaction information into the hands of cardholders. With Consumer Clarity, customers have access to enriched transaction details such as the retailer’s name, logo, a physical location displayed on a map, and basic merchant contact information.

“In that scenario, as a consumer, I’m sitting in my mobile banking application, I see a transaction I don’t recognize. If I can click on that, what I see there is a really easy way to contact the merchant. Now I can go have a conversation with the merchant about that transaction, instead of going through the bank channel, and the merchant can help resolve that,” explained Kennedy.

The transaction enrichment features of Consumer Clarity are highlighted in the graphic below, provided by Ethoca:

The need for such clarity is data-backed. More than 96% of consumers say they wish there was better information in their digital banking applications surrounding their transactions.

“It’s one of the most common things that consumers complain about from a user experience standpoint, and so more and more this is becoming not just an operational cost concern and dispute management concern. It’s becoming a retention and customer loyalty concern, and that experience has an opportunity to be a real differentiator,” Kennedy concluded.