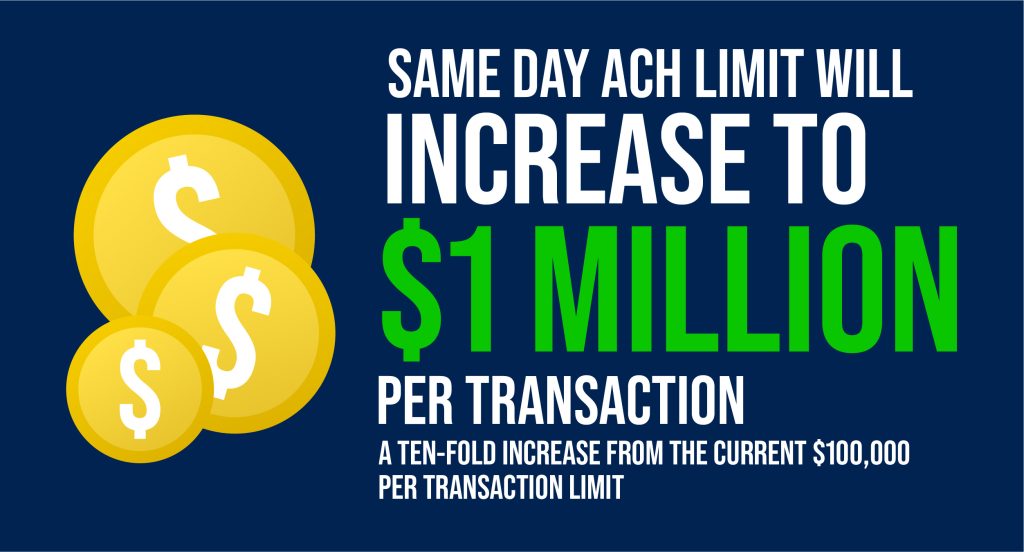

September 2021 marked the five-year anniversary of the Same Day ACH (SDA) debut. When SDA went live, the ACH Network only allowed up to $25,000 per same day payment. Now, on March 18, 2022, the Same Day ACH limit will increase to $1 million per transaction, a ten-fold increase from the current $100,000 per transaction limit. Since its introduction, the market has only grown more accustomed to SDA as a payment method, and if SDA expansion continues at the current rate, the sky is the limit.

To learn more about Same Day ACH, its meteoric rise, and what that rise means for the payments industry, PaymentsJournal sat down with Mike Herd, Senior Vice President of ACH Network Administration at Nacha, and Sarah Grotta, Director of Debit and Alternative Products at Mercator Advisory Group.

Growth leads to opportunity – and vice versa

The higher ceiling in allowed dollar value per SDA transaction means one thing: opportunity. A wide spectrum of industries, government entities, and consumers will be able to utilize and benefit from the ACH Network while ensuring that their payments continue to be safe and secure.

B2B payments will likely see a particular boon, including vendor or supplier payments, tax payments, and payroll funding. Other uses like insurance claims and other A2A transfers are also expected to increase.

“The last time there was a dollar limit increase was about two years ago, to the current level of $100,000 per payment,” Herd noted. “That generated larger dollar flows using Same Day ACH almost immediately. We’re going to be watching closely as that goes into effect, but that’s our anticipation.”

According to Grotta, this planned increase demonstrates three things:

- The market is finding utility for Same Day ACH with expanded use cases.

- Financial institutions have confidence in the ACH Network and confidence that they can successfully manage any accompanying fraud.

- There is a growing expectation that money should move more quickly.

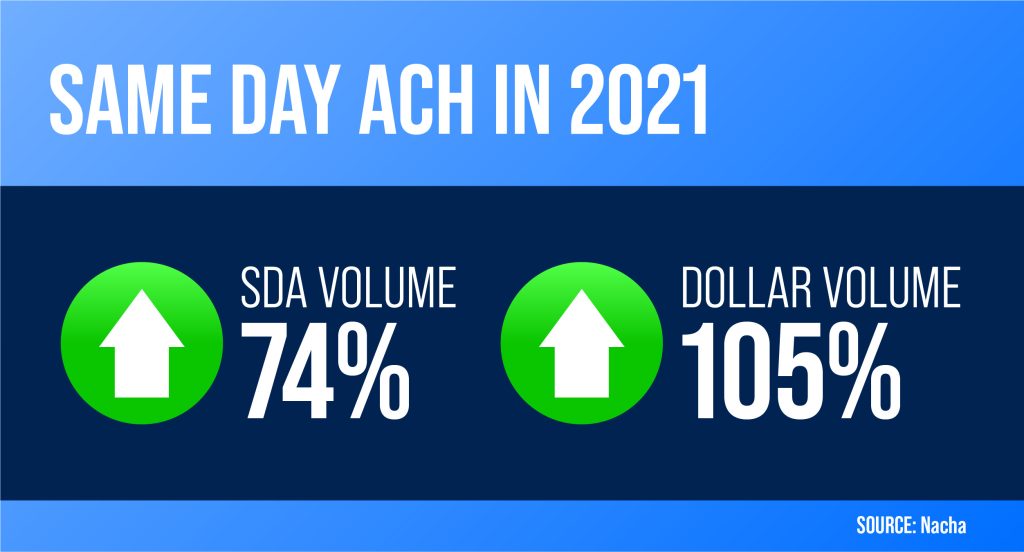

“Hockey stick” inflection point

The numbers being recorded surrounding Same Day ACH are frankly staggering. In 2021, SDA volume increased by 74%, and dollar volume increased by 105%. A combination of factors in the last two years – the prior dollar limit increase to $100K, the expanded hours of availability for Same Day ACH settlement, and the general economic conditions of the country moving towards electronic and faster payments – all ignited steep growth after a steadier period. If you were to track SDA use on a graph, it would resemble a hockey stick – mostly flat and then a sharp turn upward.

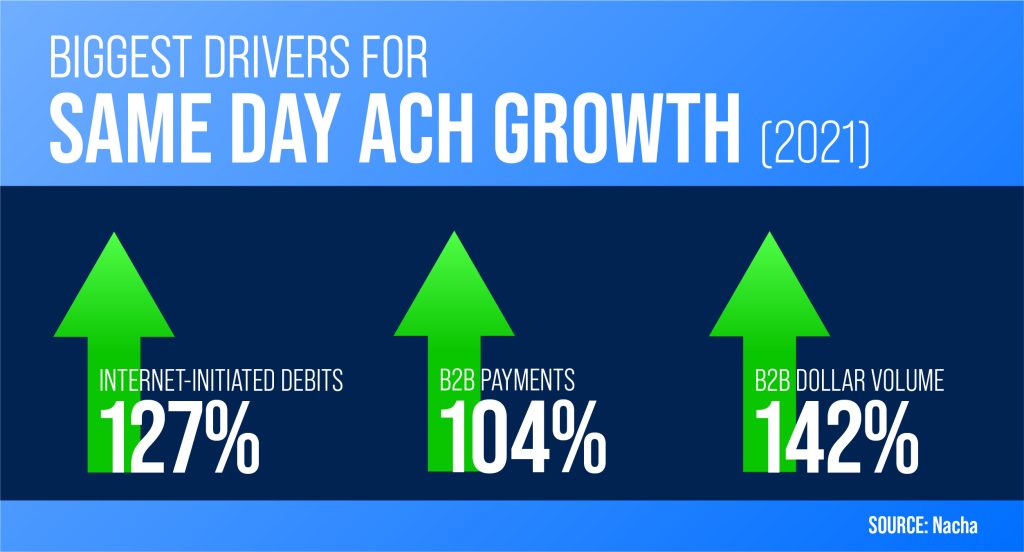

On a more granular level, Herd pointed out two specific growth areas for Same Day ACH in 2021. The first is consumer debits initiated online, which increased by 127%. The second area is B2B payments, which saw a doubling in the number of transactions and a 142% increase in dollar volume. Whereas prior growth was driven primarily by consumer direct deposit and other disbursements, these new use cases have spurred tremendous gains.

ACH currently clocks in at 29.1 billion payments valued at $72.6 trillion – with a T. Compared with 2020, that represents an increase in ACH Network payment volume by 8.7%, or 2.3 billion, and dollar volume by 17.4%, or $10.8 trillion. “ACH is really in record-setting territory at the moment,” Herd summarized.

Three primary factors

The remarkable growth in ACH can be attributed to three main factors, according to Herd:

- ACH payments initiated online by consumers

- Consumer online payments are the largest growth area, with more than 1 billion new payments in 2021. These payments include bills, recurring donations and subscriptions, A2A transfers, and links between fintechs and bank accounts. “Using online abilities to initiate payments has become more important than ever over the last couple of years,” Herd pointed out.

- B2B payments

- The 5.3 billion B2B payments, valued at $50 trillion, reflect a 20.4% increase from 2020, and over the past two years, ACH B2B payments have jumped 33.2%. A big part of that is the transition from check usage, which has declined to the remote work conditions of the pandemic. “Close to 40% of business-to-business transactions are still done via check,” Grotta elaborated, “so I think there’s even more to be had there.”

- Government payments

- The federal government continued economic assistance in 2021 using payments largely distributed by ACH. These payments included direct deposit of Economic Impact Payments, child tax credits, unemployment benefits, as well as disbursements to states, businesses, agencies, and medical providers and facilities.

The future of the ACH Network

With all the positive movement in the ACH space, one might assume it would be easy for the ACH Network to rest on its laurels. But this is not the case.

“One thing we’re interested in is expanding the ACH Network’s availability and settlement capabilities into additional days and times,” explained Herd. “For example, to shorten the time over a weekend or a holiday weekend when ACH payments currently cannot be settled.” Nacha has reached out to the Federal Reserve to advocate for the expansion of the Fed’s interbank settlement service, positing that it would benefit both banks and customers by increasing the availability of funds.

Another opportunity is simply to lock in the gains made in the last several years with B2B and government payments. The IRS looks to be on a record pace to issue tax refunds by direct deposit during this filing season, which is a good sign for ACH. “One thing I hear people wonder about is, if we are returning to a state of more normalcy, is there going to be some backsliding with payments going back to paper?” Herd said. “So far, it appears that type of backsliding is not happening.”

Expanding ACH adoption into new business models akin to bill payments is also a top priority. From a payments perspective, repeat donations and subscriptions have much in common with monthly utility bills, and the ACH Network is well-equipped to handle it. Even BNPL solutions and the predicted onset of open banking in the U.S. could utilize ACH. “There’s a lot of opportunity for ACH to expand into the payments for those types of services,” Herd concluded.