Consumers and businesses count on financial institutions to help them move money quickly and securely. To keep pace with changing customer expectations, banks and credit unions need to be ready with a range of payment options, including ACH, wires, foreign exchange (FX) services and real-time payments.

While management of compliance and risk are top of mind for financial institutions, there is an increasing focus on customer experience. To learn how technology providers are supporting financial institutions with cutting edge innovative solutions and value-added propositions, PaymentsJournal sat down with Bailey Nelson, Vice President of Enterprise Payments Solutions at Fiserv, and Steve Murphy, Director of Commercial and Enterprise Payments Advisory Service at Mercator Advisory Group.

Wire transfers play a crucial role in the payments ecosystem

Even with the availability of newer digital payment channels, wire transfers remain an essential component of the payments landscape. “Wire payments can reach every account in the United States, meet the requirements of high value and corporate payments, and enable cross-border cross-regional exchanges,” said Nelson. A critical part of banks’ revenue streams, wires contribute significant fee income to financial institutions small and large by moving money, managing liquidity, and more.

The sheer volume of wire transfers in the United States underscores their significance. “When you take the full spectrum of the value that runs through wire transfer systems just in the United States, it’s rather staggering. When you think about wires used for goods and services it’s between about $25 to $30 trillion annually. But if you look at the entire value of [what] goes through the system for liquidity, Fed funds, and everything else, it’s more than a quadrillion [dollars] during the course of a year,” explained Murphy.

The challenges of wire transfers

Despite the indisputable value of wire transfers in the payments ecosystem, financial institutions and their corporate customers face challenges when it comes to managing them. “Some of those challenges include [that] many financial institutions use multiple systems to perform wires, fraud checking, and international wires. Clients seek efficiency, better service, stronger compliance and reduced risk. Clients also desire more robust reporting,” explained Nelson.

Wires are also subject to more review and security controls such as dual controls, security procedures, and service level agreements. Additionally, some businesses rely on wire services for cross-border or cross-regional exchanges. Fortunately, this is where Fiserv can help. Financial institutions, large and small, are using Payments Exchange: Fedwire, formerly known as WireXchange, to take advantage of a complete end-to-end solution that streamlines wire processes and reduces operational costs.

Payments Exchange addresses wire challenges

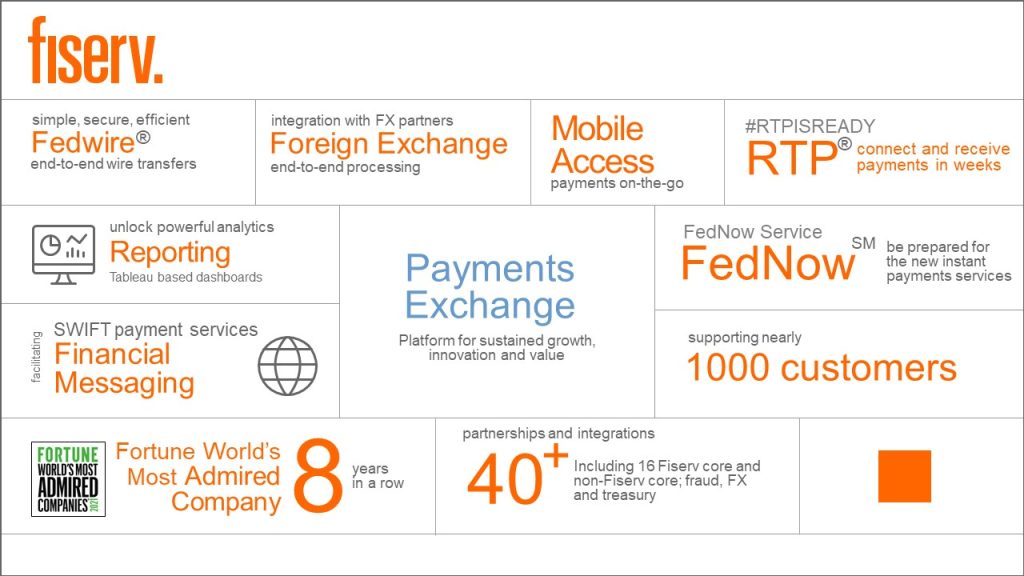

Payments Exchange from Fiserv is a market leader in wire transfers and provides value for financial institutions of all sizes. This rings true whether they do 50 wire transfers per month or 100,000. “With our affordable and feature-rich product, clients have access to full end-to-end domestic and international wire processing capabilities. We essentially make wire processing efficient, flexible, simple, secure, and compliant–a fact testified by over 1,000 financial institutions that use this platform today,’’ said Nelson.

Banks and credit unions using Payments Exchange can monitor and manage payments from a single web-based application service provider (ASP) platform. Fiserv also provides real-time integration to all its bank and credit union core systems as well as many non-Fiserv account processing core systems.

Creating an ecosystem of partners for best-in-class solutions and features

Independent of size and location, financial institutions want to be competitive, innovative, and retain customers. Payments Exchange offers that value proposition so financial institutions can go to market with the solutions their customers need quickly, securely, and in the most optimized way. Fiserv strategic partners have had a key role in making this possible.

“We have always recognized the key benefits our partners play to help support a complete payment solution, providing access to a wider customer segment and solve some of their biggest challenges,” said Nelson.

With this recognition in mind, Fiserv is leveraging its Payments Exchange integration and partnership strategy to expand its foreign exchange, correspondent banking, core integrations, and fraud partnerships. With this approach, Fiserv clients will have access to options that help enhance their domestic, instant, and international payment services.

For example, correspondent bank partnerships enable financial institutions to take advantage of the Payments Exchange platform without maintaining an account with the Federal Reserve. Foreign exchange partners allow them to originate foreign wires with real-time quotes. Corporate treasury integration means their consumers can originate their own payments. Fraud partners make real-time fraud screening with industry leading providers a reality.

Getting Financial Institutions Real-time Ready

There are also exciting recent and upcoming developments in store for Payments Exchange. “We’ve had a very busy year designing, developing, and implementing new features [and] we have a lot of new and exciting features on our roadmap,” explained Nelson.

For starters, Fiserv has expanded the capabilities of Payments Exchange to support The Clearing House RTP® network for the receive and send personas. “Payments Exchange: RTP® is affordable, quick to implement, and easy to connect to The Clearing House. It’s a flexible web-based solution for completing end-to-end real time payments 24/7/365 through the RTP network… with immediate funds availability and payment certainty for commercial and retail customers,” Nelson added. Clients have the full power of RTP® with less financial investment and time commitment.

There are also two new subscription services for Payments Exchange. The first, Mobile Access, is an annual subscription services where users can approve wire transfers from their mobile device. The second subscription is a reporting module that enhances reporting capabilities using Tableau.

“We’re really excited about the many possibilities of how Payments Exchange can help our clients,” concluded Nelson.