Podcast: Play in new window | Download

Internet-connected, contactless smart-terminals are buzzing in the payments industry. These devices are ideal for enabling a wide range of payment options, and the omnichannel, “sticky,” and cost-effective value-added solutions (VASs) that small and medium business (SMB) merchants desperately need. But what are they, and how can providers take advantage of all they have to offer?

To further discuss the benefits of smart terminals and how providers can leverage their smart-terminal estates to increase merchant engagement, PaymentsJournal sat down with Gregg Aamoth, Co-Founder and CEO of POPcodes, and Raymond Pucci, Director of Merchant Services at Mercator Advisory Group.

What is a “smart” terminal?

The payment terminal evolution is similar to the evolution of mobile phones over the past 20 years. Smartphones, which gained traction for their mobile calling capabilities, are now in virtually everyone’s hands and are used primarily for doing everything but making a phone call. “Smart” payment terminals, initially desired for their contactless payment and wireless capabilities, now combine the performance and easy to use graphical interface of a modern smartphone. They provide merchants with the ability to securely accept a variety of physical and digital tenders and perform many of the same functions of a traditional point-of-sale system.

Although much less commonly used than on a smartphone, Smart terminal apps can also enable a variety of both payment and non-payment based value-added services, that make them beneficial for both merchants and consumers. But, with tight security restrictions and no industry standard for “App Stores,” merchants often look to payments providers to educate them on the benefits from these cloud-connected devices. These smart terminals are much easier to update, accept more payment types, and enhance security while offering additional value-added services. “Often, merchants don’t realize the full capabilities and cost effectiveness in the smart terminals that they receive from their payment providers, like [Independent Sales Organizations] (ISOs),” added Pucci.

In fact, Mercator Advisory Group recently queried 2,000 small businesses with under $10 million in annual sales. One particular question asked about merchants’ use and preferences regarding some of these value-added services. Of those surveyed, 70% said they are using some sort of loyalty or integrated marketing program, while only 30% are getting these value-added services from ISOs. “More ISOs should really get into this because this is a big part of the market share pie here that is out there for them,” suggested Pucci.

As adoption of smart terminals by SMB continues and the market better utilizes the capabilities of smart terminals, consumers can also expect to see sleeker and more compact terminals.

Smart terminals have plenty to offer

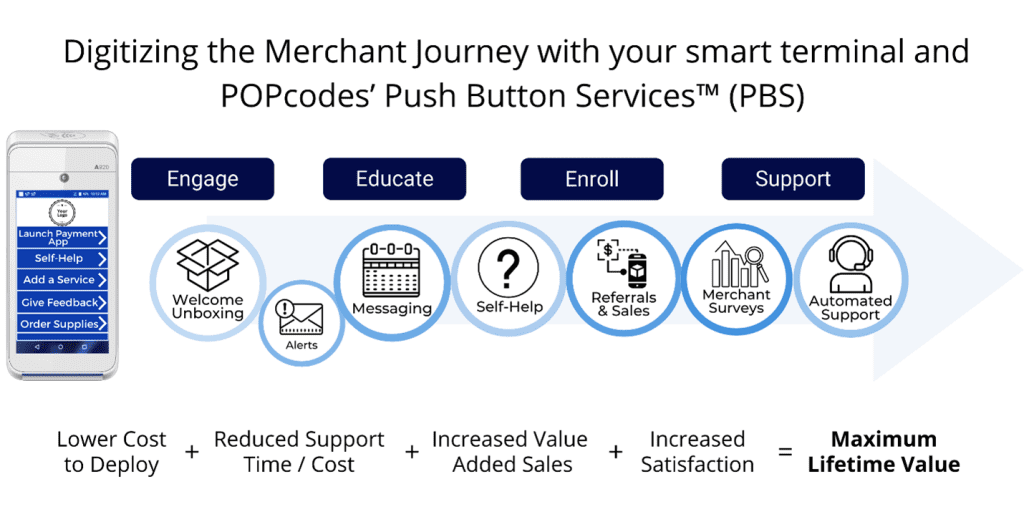

In today’s climate, acquirers and ISOs typically leverage terminal and estate management tools to distribute software and post security updates. But these devices have so many more capabilities, such as providing an engaging unboxing experience and delivering just-in-time access to training and support content. “The key to realizing the full capabilities of the smart terminal is for the organizations that control them to shift from a focusing on file level systems and operations level Estate Management mentality to one that recognizes the potential for these devices to digitize key operations, support, sales processes. Especially for service providers with very large SMB portfolios, where effective communication and building long-lasting relationships is so challenging.”, explained Aamoth.

Making merchants aware of the operational environment outside of their control and any issues that might affect their day-to-day processing of payments is crucial to success, as is the acceleration of the onboarding of merchant associates and the effectiveness of tools provided to them. After the foundation is built and the users are engaged, the same platform should be used to more effectively educate, actively enroll, and efficiently support a number of different value-added services.

“The app store concept is great, and every smart terminal should be connected to an app store environment. But being able to deliver curated, industry vertical [and] specific information about those apps that will benefit the merchant and their customers the most is really the key aspect,” concluded Aamoth.

How to measure Merchant Engagement

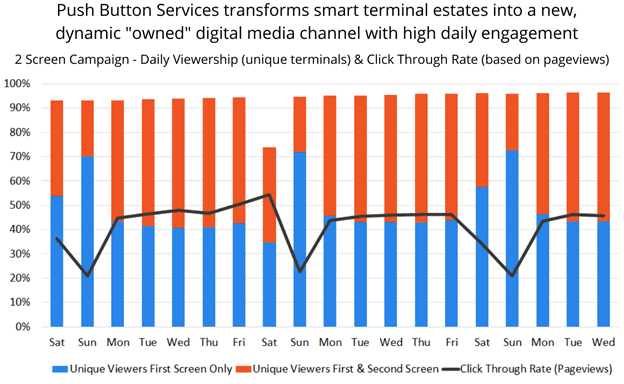

In many digital media channels, administrators can monitor web traffic and site interactions, but to measure merchant engagement, providers have typically looked at the transactional data. “While that’s important to understand for the velocity of the merchant—how they’re growing, and how payment services are being leveraged—there’s a whole lot of other information that [providers] really need to be able to understand,” said Aamoth. For example, is the merchant satisfied and are providers helping them to train their employees more quickly?

By deploying POPcodes software into those terminals, providers can deliver the information needed throughout the merchant engagement lifecycle, starting from the moment they power-on their new smart terminal. Then, the provider can measure engagement by tracking when merchants view messages, quantifying how often they use training and self-help content, or when they look up service and product offerings. POPcodes uses familiar online metrics such as sessions and click through rate, adapted for the payment device.

POPcodes data reveals the daily click through rate of an anonymous payment provider’s messaging campaign. This insight helps providers target sales messaging by seeing when merchants are most likely to click through to more information on promoted products and services, and what messaging resonates best across campaigns.

In a recent Power-up Campaign™ POPcodes executed for a Tier 1 Acquirer, 91% of the targeted audience viewed a multi-screen graphic rich workflow on their terminal at least once during a two-week period, with an average daily click through rate of 41%.

“As a part of an omni channel strategy, providers can leverage that in-store device to drive awareness. For example, displaying a QR code on the payment device to make the merchant’s or in-store associate’s journey into content on the web through their mobile phone a seamless and consistent experience, whether it’s the merchant portal, training material, or documentation. At the same time, they reduce the risk of the merchant being exposed to competitive or inaccurate information, and still have the same level of trackability,” elaborated Aamoth.

The provider can then see a traceable path taken by the merchant as they learn about the provider’s services, which then offers up the ability to leverage those services and extend any needed support.

Payment terminal software VS. POPcodes solutions

POPcodes has taken a strategic approach to delivering these value-added services that are adjacent, but not necessarily connected to the payment solution, so it is often out of scope for PCI compliance. The software also allows for fast and simple modifications of content, and a business user, with no programming or app redeployment required, can make changes to welcome, operational, and sales messages.

These two factors dramatically reduce the time to market and allow providers to start with something as simple as a digital unboxing experience, reducing training and support required for new device deployments while accelerating device activations and first transactions. The ROI is immediate and measurable; in both reduced time and cost to deploy, and in improved merchant satisfaction.

“The acquirers and ISOs benefit by reducing their operational and support overhead, and free up time and resources for sales activity,” added Aamoth. This is a major opportunity for increased ROI and revenue generation from value-added services and creates long-lasting, high lifetime-value customers.