It’s time for a breather on credit cards, just for a day. If you need to fill the void for credit card info, take a look at these recent Mercator Viewpoints on QR Codes, Secured Cards, and the 2020 Credit Outlook. Today, a few moments on student loans, a problem that will impact the U.S. at least through 2060.

On one hand, it would be great to be in college. Young and foolish, pizza and Budweiser, carefree and bliss. But, the debt? Forget about it!

Here’s a read from the Ascent at the Motley Fool on student loans. It will make you appreciate your credit card debt.

- The U.S. Federal Reserve reports that the average monthly student loan payment is $393 (not including borrowers whose payments are in deferment).

- As of early 2019, there are 5.2 million borrowers in default on their federal student loans, according to The Ascent’s Student Loan Debt Statistics for 2019.

- Federal student loans are in default once a borrower goes 270 days without making a payment. But as soon as you reach default status, you face a host of unsavory repercussions. For one thing, your credit score is pretty much guaranteed to tank.

Digging deeper into the stats are some scary numbers.

- In 2018, 20% of student loan borrowers were behind with their payments.

- Those aged between 35-49 have the highest total student debt, with $548 billion in debt.

- Women hold almost two-thirds of total outstanding U.S. student debt – close to $929 billion as of early 2019.

- The average student loan borrower graduated college with $28,650 in student loan debt in 2017.

- Connecticut was the state with the highest average student loan balance, at $38,510. Utah had the lowest.

- As of the first quarter of 2019, there are an estimated 5.2 million federal student loan borrowers in default.

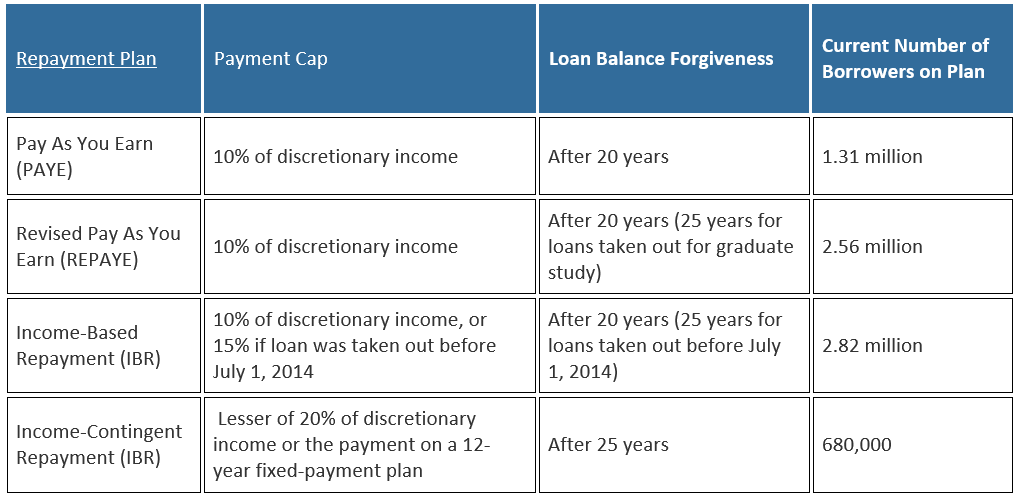

And loan work out programs? Here are the four big ones, acronyms and all:

What a mess! A burden for students and parents. A burden for taxpayers who carry the brunt. And, an economic logjam that will impact household budgets for decades to come.

Overview by Brian Riley, Director, Credit Advisory Service at Mercator Advisory Group