The dispute process is a crucial component of the credit card industry. When a consumer disputes a transaction, believing it to be fraudulent, for example, the card issuer and merchant must resolve who is financially liable for the purchase.

And with the transaction volume of credit cards expected to rise significantly over the next few years, the number of disputes is expected to increase as well. In response to the forecasted increase in disputes, Visa and Mastercard have implemented changes to their respective dispute processes.

To understand the dispute process generally, and what changes Mastercard and Visa are making, PaymentsJournal sat down with Lynne Baldwin, the president of BHMI, and Brian Riley, director of Credit Advisory Services at Mercator Advisory Group.

During the conversation, Baldwin and Riley discussed how transaction volumes are rising, what changes the major networks have made, and what to expect going forward.

More credit card transactions mean more disputes

Riley began the conversation by providing a forecast of credit card transaction volumes in the United States.

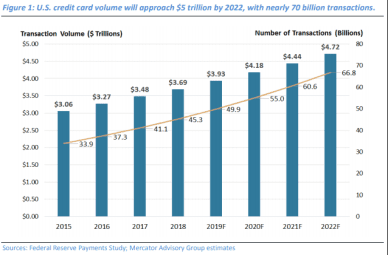

By the end of 2019, Riley predicted that the number of credit transactions will hit 50 billion, a significant increase over the past few years. In 2015, the U.S. transaction volume hit 33.9 billion transactions.

The high number of transactions translates to large sums of money being spent.

The dollar volume is in the neighborhood now of $4 trillion for 2019, said Riley. Just looking a few years ahead to 2020, what we predict is transaction volume will be 66.8 billion transactions, accounting for 4.7 trillion in dollar volume, he said.

As the number of credit card transactions increases, the number of disputed transactions will also rise. With more disputes on the horizon, it’s important that consumers, issuers and merchants understand how the dispute process works.

“Dispute management is truly very complex”

The first thing to know about the dispute process is that it is complicated.

“Dispute management is truly very complex,” explained Baldwin. “This is because for each type of dispute, each card network has very specific steps and timelines that have to be met.”

Although the process varies by network, Baldwin provided a rough overview of how the process works in general. She explained that a dispute claim typically begins when a credit card issuer or cardholder asks the merchant for a copy of a transaction ticket.

The two parties will message back and forth until the proper information is either supplied or not. In the former case, the provided information may be enough to resolve the dispute.

For example, the cardholder may not remember the transaction, but once shown evidence of the sale, they may be satisfied, meaning the process is able to end at this point, said Baldwin.

However, if the information is provided and the cardholder still denies the transaction, or the merchant is unable to provide the information, the dispute process begins in earnest.

In these cases, the issuer will return the financial liability back to the merchant. If the merchant has sufficient information that the consumer did indeed make the purchase, the merchant can challenge the issuer and, if the issuer agrees, the liability will go back to the customer.

While this can be the end of many disputes, there’s the potential for more steps if the customer provides additional evidence to contest the issuer’s finding.

“The final phase is arbitration, which is when the arbitration is finally submitted, and the card network itself is asked to step into the process,” said Baldwin. She explained how this step can cost a lot of money for the initiator, due to filing and review fees. Then the card network will issue a ruling that often entails large fines for the losing party.

“Currently, only Visa allows an arbitration appeal, and it must be for amounts greater than $5,000” said Baldwin. “The arbitration appeal ruling is final.”

Given how complex dispute resolution can be, Riley pointed out that any inefficiencies in the process can waste tons of valuable time and resources.

Visa & Mastercard have recently updated their dispute processes

With the number of disputes expected to increase, Mastercard and Visa felt that the time was right to revamp their dispute resolution programs, explained Baldwin.

For Visa, the new system is called Visa Claims Resolution, also known as VISA VCR, while Mastercard’s new system is the MasterCom Claims Manager, also called Mastercard MCM.

Baldwin explained that for Mastercard, the overall goal was to manage the dispute lifecycle in one place, simplifying the overall process. To do so, Mastercard reduced the amount of time that a claim can be outstanding, and also eliminated arbitration.

In addition, Mastercard now requires more information from issuers before a chargeback can be filed.

Visa also wanted to speed up the process and eliminate unnecessary processing before it flowed into the dispute lifecycle. Thus, Visa implemented new processing rules that eliminate a large number of chargebacks if the transaction data does not support the chargeback, explained Baldwin.

Further, Visa’s rules have already split chargebacks into two categories, allocation and collaboration, said Baldwin. Allocation allows Visa to assess the responsible party without furthering the disputes lifecycle, thereby shortening the process overall. Any remaining disputes fall into collaboration, where the parties proceed to the dispute process to reach resolution.

Additionally, both networks have been working on consolidating the reason codes to further simplify the process. However, each network still has its own codes.

Both Baldwin and Riley agreed that it’s very important to pay attention to the dates and rules governing the process, especially since the time frame to resolve disputes has been reduced.

“People have to be very vigilant in making sure they don’t let these time windows expire,” said Baldwin. “Because if you let it expire, and you are the one trying to show evidence that it’s not your fault, you will lose. And it’s all about win-lose when it comes to chargeback processing.”

With large sums of money at stake, it’s important for customers, issuers, and merchants to familiarize themselves with the dispute resolution process.