The buzz today is about Wells Fargo exiting the consumer loan business. Although headlines across the U.S. make the strategic move sound like Americans will miss the age-old installment loan process, it looks like members of the fourth estate did not take a moment to review Wells’ regulatory reporting. Bank—personal installment loans are not in great demand, at Wells or at other top banks.

The Motley Fool screams that “Some Wells Fargo Customers May See Credit Score Drop Due to Account Closures,” but only deep into the story you find that the reference is to line utilization, where unused credit lines can add to your cherished FICO Score. FICO Scores are predictive and proven of risk. So do not expect a radical change.

Yahoo News announces: “Wells Fargo Abandons Personal Loans Business,” and they paint an ugly view in the first paragraph of the story when they say, “Now, having seen an error in its ways, it has decided to close accounts its customers want.”

Here is the reality. Lending is a consumer service business, and consumers make choices. The lending model calibrates pricing based on risk and demand. It uses interest rate spreads to generate revenue, and costs reduce noninterest income, including credit risk and operating expenses.

Wells previously announced in April 2020 the suspension or limitation of home equity lines of credit (HELOC). As the WSJ reported, so did Bank of America, Chase, and Citi. Yet, those strategies barely made the news because COVID was on every newswriter’s mind.

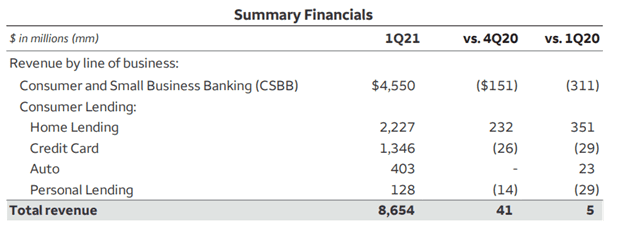

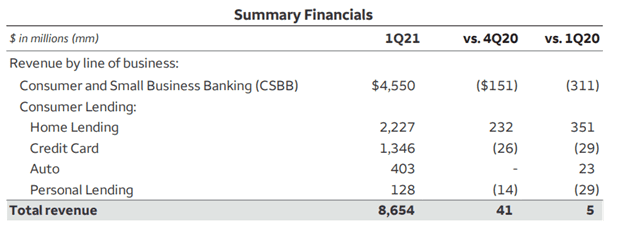

Now, consider Wells Fargo 1Q2021 financials. Reported revenue for 1Q2021 was $18.1 billion, with $8.8 coming from the net interest income channel and $9.3 resulting from noninterest income. Net revenue was $8.654 billion in the consumer bank, coming from five sources, as shown below.

Note the Personal Lending line, which accounted for only $128 million in revenue. This represents only 2.8% of the bank’s consumer revenue, and within the big picture of Wells’ total revenue, that is only 0.7072% of total revenue.

The product is not in high demand. Doing the same exercise at other top banks will find similar revenue trends; installment loans do not take up much of major bank lending strategies. If you’ve read Mercator’s recent report on Buy Now Pay Later lending, explained that banks do not dominate the installment lending space; fintechs do.

Maybe today’s stories should carry a different spin than the gloom and doom mentioned. I’d use something like “Wells Re-Aligns Lending Strategies,” or perhaps follow the WSJ with “Borrowing is Back as Sign-Ups for Auto Loans, Credit Cards Hit Records.”

Overview provided by Brian Riley, Director, Credit Advisory Service at Mercator Advisory Group