It is still early in the game to prove whether the increase in consumer debt cited by the Federal Reserve is due to consumer confidence improving or if the source is increased inflation.

There are a few facts to consider.

First, Liberty Street Economics, a well-respected group staffed by economists from N.Y. Fed, based at the headquarters located at 33 Liberty Street, announced that “Credit Card Trends Begin to Normalize after Pandemic Paydown.” The crux of their report is:

Overall debt balances increased, bolstered primarily by a sizeable increase in mortgage balances, and for the second consecutive quarter, an increase in credit card balances.

The changes in credit card balances in the second and third quarters of 2021 are remarkable since they appear to be a return to the normal seasonal patterns in balances.

The seasonal trend Liberty mentions is one that every credit manager worth their salt knows. Consumer credit tends to grow slightly in the second quarter, continues to grow somewhat in the third quarter, then hops up in the fourth quarter due to the holidays, then falls in the first quarter as people pay the shopping bills and cash their tax refund checks. This trend has been around for as long as I can remember, which is measured in decades.

The report mentions:

These patterns changed a lot over the first four quarters of the pandemic (2020:Q2–2021:Q1). The changes that we saw over the past two quarters were notable in their relative normalcy with regard to the increasing levels and the typical seasonal pattern of credit card balances, after a particularly challenging year.

Consumption saw sharp swings, as it was alternately tamped down by pandemic-related lockdowns and then bolstered by cash transferred from relief efforts.

These swings were reflected in credit card balances. And when banks reduced risks in the early part of the pandemic, they reduced exposures by pausing the issuance of new cards and closing some existing accounts.

That’s all fine and dandy, but take a look at today’s inflation numbers. It is too early to pull in factual data, but consider the latest U.S. Bureau of Labor Statistics.

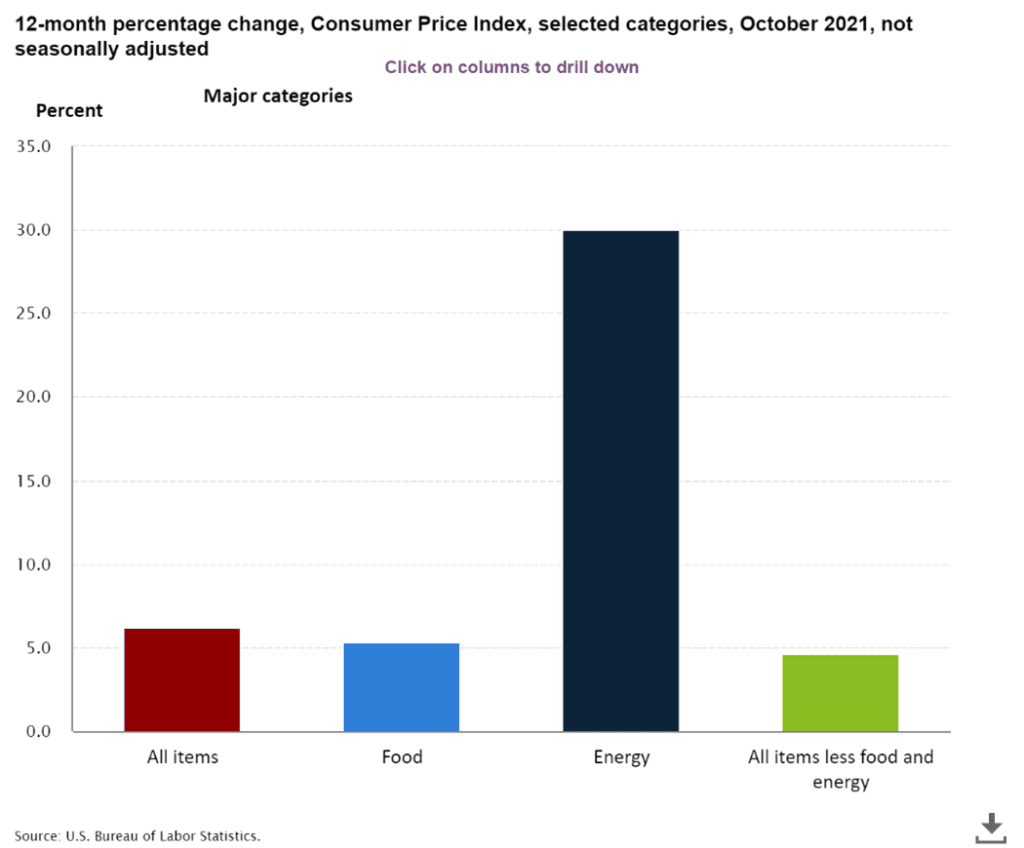

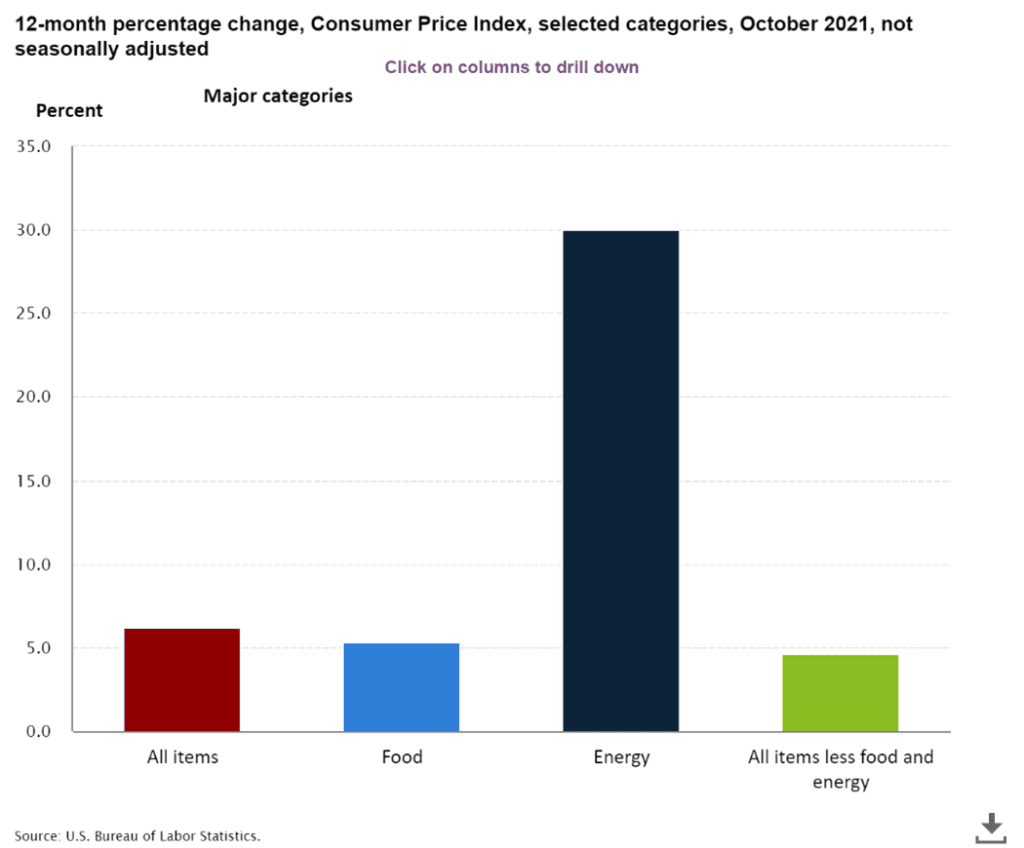

In October, the Consumer Price Index for All Urban Consumers rose 0.9 percent on a seasonally adjusted basis, rising 6.2 percent over the last 12 months, not seasonally adjusted.

The index for all items less food and energy increased 0.6 percent in October (S.A.), up 4.6 percent over the year.

Then, consider this from an earlier report:

Consumer prices for meats, poultry, fish, and eggs up 10.5 percent for the year ended September 2021

And the cost of energy, including heating oil and automotive gas, is up 30% YoY October 2021.

So, with revolving consumer credit volumes growing at the seasonally adjusted annual rate of 5.6%, and a 7.4% hop in revolving credit card debt as announced by the Federal Reserve on November 5, 2021, is the growth a credit marketer’s dream or a credit manager’s nightmare?

It will take a few months for the data to prove out, but if the revolving debt is the function of increased real consumer confidence, that is good. However, we have a credit management issue if it is a stress indicator that more people are revolving because prices are higher.

And, this is all before we consider rising interest rates, which will likely increase in July 2022.

So, for operations executives, indeed, marketing goals might indicate that 2021 bonuses were well earned – but you’d better keep collection managers happy and ready to go in 3Q2022.

Overview by Brian Riley, Director, Credit Advisory Service at Mercator Advisory Group