Podcast: Play in new window | Download

With the uncertainty of the ongoing economic impact of COVID-19, it is more important than ever for credit unions to be aware of and serve their members’ financial needs. To identify what these needs are, credit unions need to have a deep understanding of their members’ purchasing behaviors and transaction trends.

To delve into consumer trends in the COVID-19 era, and how credit unions can use these trends to better serve their members, Payments Journal sat down with Glynn Frechette, Senior Vice President, Advisors Plus at PSCU, and Norm Patrick, Vice President, Advisors Plus at PSCU, and Peter Reville, Director of Primary Research Services at Mercator Advisory Group.

How Consumer Spending is Changing During COVID-19

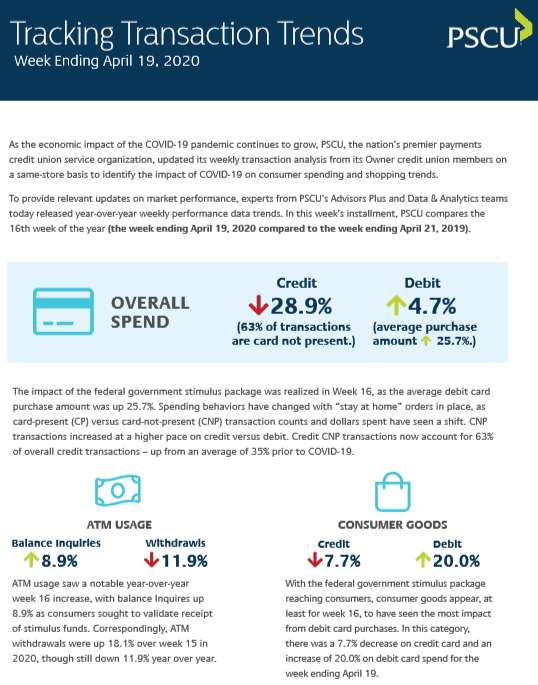

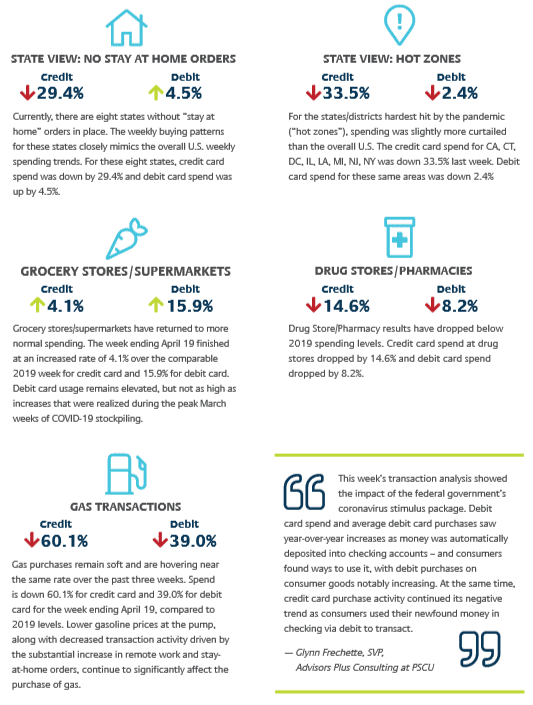

PSCU’s Advisors Plus and Data & Analytics teams are closely tracking transactions to identify the impact COVID-19 is having on consumer behavior. Since the pandemic began, there have been noteworthy changes in debit and credit spending in key merchant verticals.

The following is a snapshot of the year to year changes between the 13th week of 2020 (beginning March 23) and the 13th week of 2019 (beginning March 26):

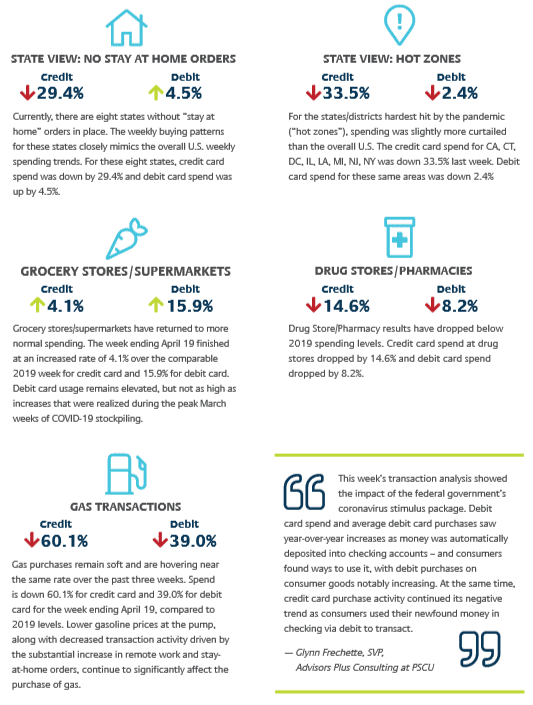

Grocery Stores/Supermarkets

Grocery stores and supermarkets saw a substantial bump in spending over the previous two weeks, but the week of March 23 returned to a much lower growth rate of 24.9% for credit card and 10.0% for debit card. This indicates that consumers are easing back from their “stock-up” purchases conducted during the early weeks of the COVID-19 pandemic.

Drug Stores/Pharmacies

These performed well over the prior two weeks, but the week of March 23 yielded much different results. Credit card spending at drug stores grew by only 0.7%, and debit card spending was actually down 7.5%. In the prior week, the growth rates were both very much positive at 33.0% and 27.4%, respectively.

Gas Pumps

Purchases made at gas pumps have been on a sharp decline over the past three weeks, with spending down 52.2% for credit card and 40.1% for debit card during the week of March 23. Lower gasoline prices at the pump and decreased transaction activity, likely driven by the substantial increase in remote work and stay-at-home orders, contributed significantly to these declines.

Consumer Goods

Sales of consumer goods have also begun to decline significantly, with an 18.6% decrease in credit card spending and a 17.7% decrease in debit card spending for the week of March 23.

Overall Trends and Predictions

Overall credit card spending was down 29.9%, and overall debit card spending was down 18.1% year over year, which is indicative of “a pretty solid beginning of downward pressure on spending that is likely to continue for the foreseeable future,” noted Patrick.

Although the overall decrease in credit card spending was much greater than the decline in debit card spending, that may not remain the case. “I think we’re going to see some consumers switch over to credit as the amount of money they have, their liquid assets, dries up due to layoffs, furloughs, and hours being cut,” explained Reville. But later, when government stimulus money is funneled into people’s bank accounts, debit card use will likely resume.

How Can Credit Unions Utilize Consumer Insights?

There are a number of ways credit unions can utilize the abundance of consumer insights data to better service their customers during COVID-19:

They can strengthen their relationships with and serve the needs of small businesses.

Small businesses don’t have the same resources and funding as their larger counterparts, and are thus being disproportionately impacted by this crisis. Yet only a small percentage of credit unions serve the commercial small and medium-sized business market.

For this reason, it is important for credit unions to remain close to their small business members by engaging with them through digital tools and serving them regularly to help them get through the pandemic. “Leveraging payments, thought leadership, and consumer insights that service providers like PSCU can make available would be prudent,” said Frechette.

“Credit unions have been reluctant to jump into the commercial space with both feet, for sound reason,” added Frechette, but “it would be wise for them to use COVID-19 as a catalyst to step up and serve the small business market on behalf of their credit union membership.”

They can enhance their digital banking suite.

Credit union branches have closed across the nation to prevent the spread of COVID-19. While consumers were rapidly adopting online banking even before the pandemic began, adoption is accelerating further as branch closures make digital the only option available.

There’s a high likelihood that certain digital banking features survive and thrive in the new normal after the era of COVID-19. Opportunity lies in contactless cards, such as wearables and digital wallets, as consumers shift away from cash and other payment methods with high degrees of human contact.

For credit unions wanting to compete in the mobile and contactless world, this is the time to incentivize and provide rewards to their members to ensure that credit unions become a top digital wallet that is used frequently.

They can use their fraud prevention approach to employ ways to keep their members safe.

Even though commerce has slowed down substantially, it hasn’t come to a full stop. Rather, many consumers have moved their shopping online, making it crucial for credit unions to protect and educate their consumers about fraud prevention. Recognizing this shift towards e-commerce, credit unions—and card processors, for that matter—can employ different ways to keep members safe, not only through authentication, but biometrics, artificial intelligence, and other stepped-up fraud prevention techniques as well.

PSCU in particular is intercepting and predicting fraud through a combined use of machine learning, anomaly analysis, data analytics, and human intelligence using a consortium of data. All of these different sources combined have helped PSCU do a much better job intercepting malicious patterns of fraud.

Beyond reassuring customers that they are being taken care of when it comes to fraud mitigation, credit unions can educate customers to look out for phishing attacks. A prominent form of phishing attacks are malicious phone calls and emails trying to intercept COVID-19 government assistance payments. By using their website, mobile app, or other means, credit unions can keep their customers informed of red flags.

The Takeaway

Consumers have been forced to change their spending behavior to adapt to COVID-19, which is reflected in consumer insights that reveal stark differences in year to year spending. Credit unions that want to best serve their customers during these times can use these consumer insights to offer valuable, targeted services that meet their evolving needs.

Updated Statistics Provided By PSCU: