If you spend any time following the payments industry, you’re bound to have heard of faster payments. The term refers to payment methods that settle and clear faster than the traditional payment rails. From Zelle to the RTP Network to Same Day ACH, faster payments have been gaining traction recently.

And when the Federal Reserve announced its plans to launch a real-time payments platform called FedNow by 2024, the faster payments space gained further momentum.

In order to understand how faster payments are set to expand in the coming years, and which products are poised to be on the forefront of this expansion, PaymentsJournal sat down with Jack Baldwin, CEO of BHMI, and Steve Murphy, director of Commercial and Enterprise Payments Advisory Service at Mercator Advisory Group.

Charts referenced in the episode can be found in the slider graphic above.

The different segments of faster payments

Murphy began the conversation by sketching out the contours of the faster payments market.

The newest generation of faster payment systems have been around for years, beginning with Same Day ACH in 2016, he explained. Then the faster payments landscape expanded in 2017 with the introduction of RTP and Zelle. Soon after, these were followed by the branded networks rolling out platforms that pushed money to accounts in near real-time, such as Visa Direct.

At first, adoption was slow, but recently, banks and payment service providers have been ramping up efforts to expand adoption, said Murphy.

There’s been a “general acceptance of the inherent value of faster payments and certainly real-time payments, as well as a recognition of the potential competitive disadvantage of not having such client solutions,” he explained.

And when the Federal Reserve announced its real-time payments solution would go live within a few years, this had the effect of clearing up uncertainty in the market, further spurring adoption.

When measured against the benchmarks laid out by a policy paper published by the Fed in 2015, it’s apparent that faster payments are maturing but still have significant room to grow. The paper identified five desired outcomes for real-time payments: speed, ubiquity, security, efficiency, and international.

Murphy explained how the current landscape has achieved speed, but has yet to achieve a desirable level of ubiquity or international reach. Security also remains an ongoing issue, although that is a problem across the payments landscape.

When it comes to efficiency, Murphy noted there was still work to be done, especially in the “tangled web involving back office integration that’s required to provide both service and financial integrity.”

In order to facilitate the adoption of faster payments from a back office perspective, BHMI—a fintech specializing in back-office optimization—offers a product called Concourse Financial Software Suite™.

Concourse was designed to provide modular solutions for the various components of the transaction lifecycle.

Can Concourse handle all the different types of faster payments?

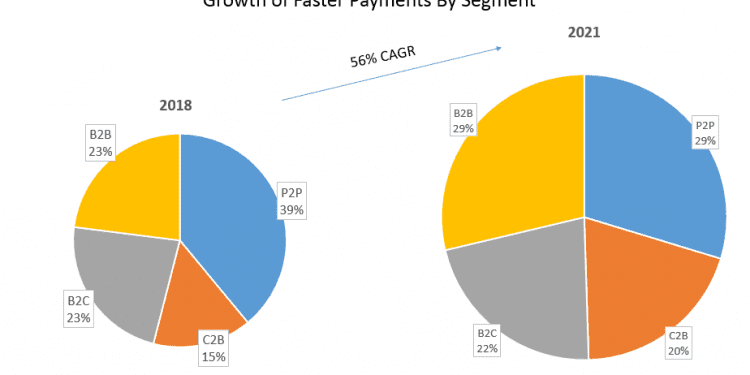

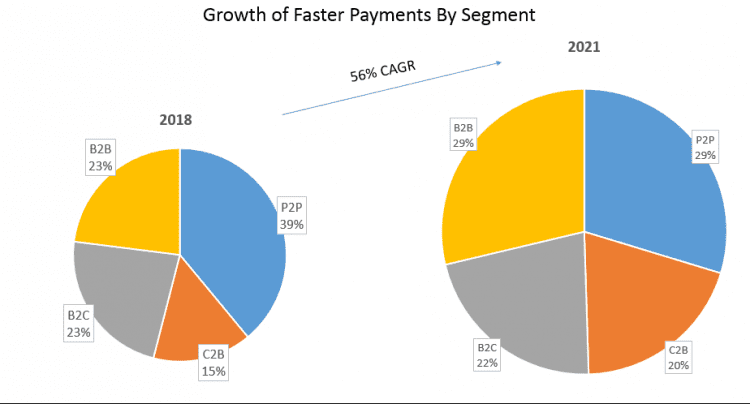

As the above graph indicates, there are four different segments in faster payments: B2B, B2C, C2B, and P2P. While it may appear that these segments would require different solutions to process, BHMI’s Concourse is equipped to handle all four types.

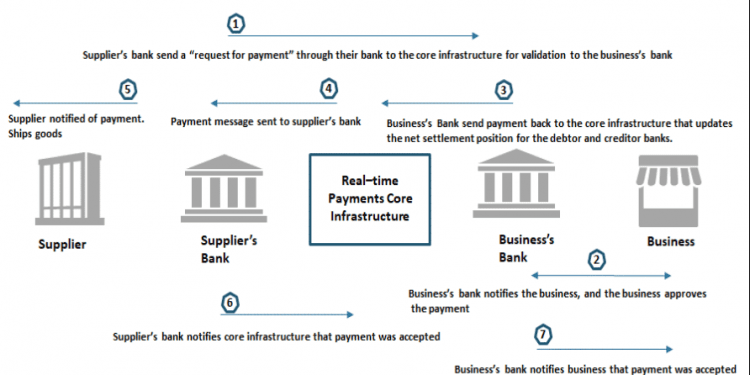

Baldwin explained that while the complexity of the transaction may vary across segments, all the segments fundamentally consist of a transfer of funds from one account to another. Since Concourse is a rules-driven platform, it can handle each transaction accordingly, even complex B2B transactions involving invoices and the resulting payments.

“We have a rules engine that is embedded throughout the Concourse modules,” said Baldwin. “As a consequence of that, we’re able to take attributes of different transactions, and logically link them together so that they form a single logical unit.”

Of course, Concourse would need to be configured differently for each type, but this doesn’t require new code or a different platform, he said.

How Concourse enables faster payments

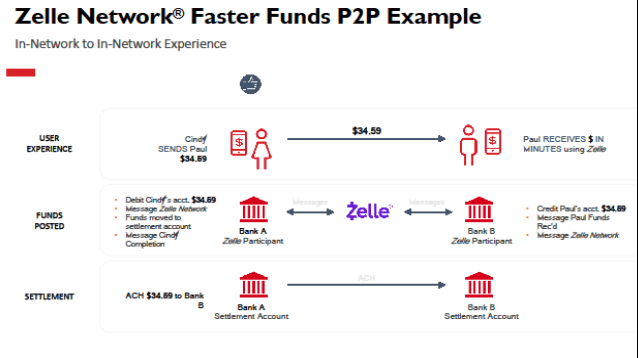

Baldwin noted that on the above chart, Concourse fits into all the categories since it is a near real-time processing product. He used settlements to illustrate his point.

“Traditional settlement methodology is that during the course of the day, financially related transactions are accumulated into one or more holding files,” Baldwin explained. At some point, all of the transactions that have been accumulated that day are processed, a time consuming endeavor because “you’re starting from scratch to go through the settlement process.”

But in the case of Concourse, when each financial transaction comes into the system, it’s loaded into a repository, and then it’s processed all the way to completion, or as far as possible, he explained. So when the cutover moment arrives and the payments are processed, Concourse has already pre-processed everything as much as possible. This makes the settlement occur quickly, especially if there are multiple cutoff points a day.

Baldwin also noted that using Concourse can help reduce overhead costs. He said that many clients seek out the product in order to handle dispute resolution and chargebacks, as the platform seamlessly works with primary card networks to handle disputes as they arise, based on each network’s requirements.

BHMI’s partnership with Zelle

Concourse and the Concourse repository is the tracking and audit environment of record for Zelle.

“One of the things that Zelle wants us to be able to do is to intercept every single transaction flowing through the network, incorporate it into the Concourse repository, and be able to use that repository for disputes reconciliation and research purposes,” said Baldwin.

Since the platform has the ability to combine disparate transactions together into one logical unit, he explained that Concourse is well equipped to meet Zelle’s requirements.

In fact, BHMI has a similar business partnership with Cuscal Limited, a major aggregator and gateway processor for smaller institutions that want to gain access to Australia’s New Payments Platform, a real-time network processing environment.

As faster payments become more common, companies will need to adopt solutions that enable them to offer these services to their customers. A company looking for a faster payments solution should consider products such as BHMI’s Concourse Financial Software Suite™ in order to stay competitive in the shifting payments landscape.