Podcast: Play in new window | Download

With paper check use declining and electronic payment methods on the rise, the ACH Network has grown tremendously in recent years. A recent PaymentsJournal podcast unpacked how this growth continued into 2020, even as the pandemic disrupted regular economic activity. In fact, the pandemic underscored just how reliable and valuable the ACH Network is to commercial and economic activity.

Part of the ACH Network’s continued success is tied to Same Day ACH, Nacha’s faster payment offering. First launched in 2016, Same Day ACH offers users the ability to compress the full cycle of an ACH payment into one banking day. This means that ACH payments can be initiated, cleared, settled and posted into the receivers account all on the same day, rather than over one or two banking days, as may be the case with other ACH payments.

To better understand how and why Same Day ACH volumes have been growing and what use cases Nacha’s faster payment option supports, PaymentsJournal sat down with Michael Herd, Senior Vice President of ACH Network Administration at Nacha, and Sarah Grotta, Director of Debit and Alternative Products Advisory Service at Mercator Advisory Group.

Same Day ACH volumes have continued to grow through the pandemic

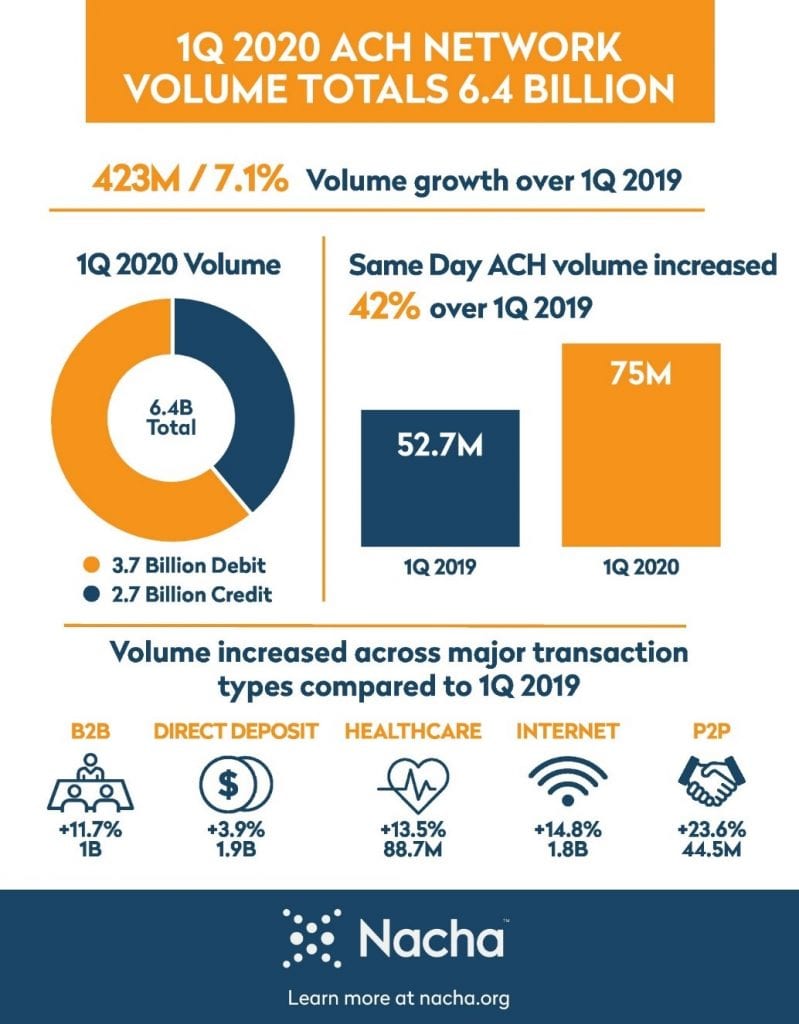

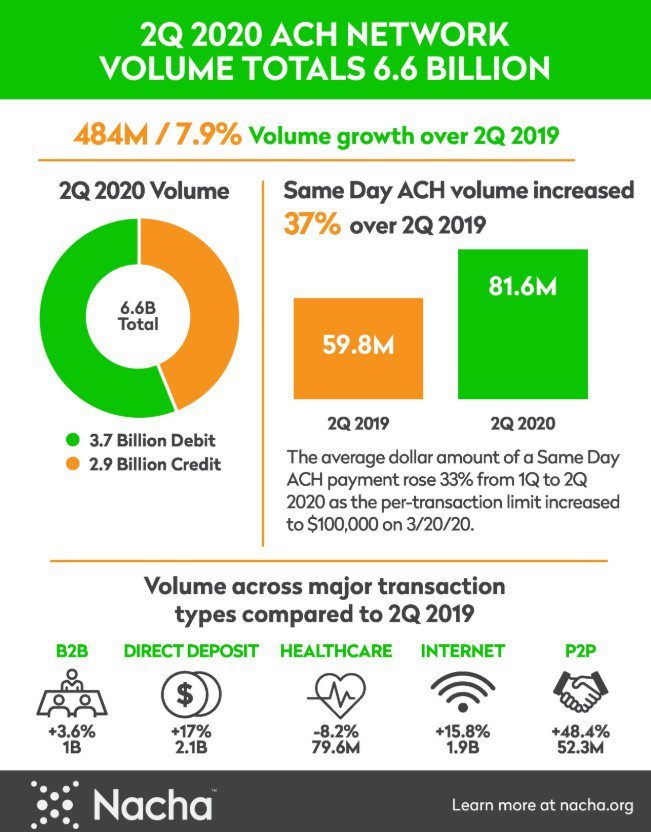

Similar to trends associated with other ACH payments, Same Day ACH volumes have continued to grow at a normal rate in 2020. In the first quarter, the ACH Network’s overall volume grew by 7.1% compared to the previous year, with Same Day ACH volumes rising by 42%. The second quarter was very similar, with overall ACH volume rising 7.9% year-over-year and Same Day ACH volumes climbing 37% compared to 2Q 2019.

These statistics show how the “ACH network was used extensively, particularly in the second quarter, to deliver assistance payments to businesses and to individuals,” noted Herd. Assistance payments included Economic Impact Payments, unemployment benefits, small business loans, and the variety of other stimulus payments made by the government in response to COVID-19.

Since Same Day ACH has a smaller base of transactions, its growth rate will be higher than the ACH Network’s overall growth rate. Overall, nearly 156.6 million Same Day ACH transactions were made in the first half of 2020. In contrast, the ACH Network as a whole handled almost 13 billion transactions. Nonetheless, considering that Same Day ACH has only been offered for the past four years, its growth has been robust and remarkable.

Everything ACH can do, Same Day ACH can do… faster.

When Nacha went live with Same Day ACH in 2016, it was one of the first faster payments options available on the market. It allowed for regular ACH use cases—including payroll, bill payments, and B2B transactions—to be conducted faster; when made as a Same Day ACH payment, these use cases are posted and paid on the same day.

Another growing use case for both regular ACH and its faster payment alternative is B2C payments. For example, insurance companies are increasingly using the ACH to make payments to customers, including rebates and claim payouts.

In a similar vein, the government has relied on the ACH Network to make the myriad of assistance payments to citizens and companies across the country. Same Day ACH can allow the government to make these types of payments much faster, which can be very helpful in times of emergency.

Herd used Hurricane Laura as an example, explaining that the federal government and insurance companies could use Same Day ACH to swiftly send emergency or assistance payments to those affected by the storm. Such an approach is better than using paper checks because mailing a check is too slow, and those on the receiving end of the payment have often been forced out of their homes, meaning a check mailed to their address would not reach them.

Same Day ACH continues to evolve and expand

Since Nacha unveiled its faster payment option four years ago, it has kept improving the service based on feedback from ACH Network users. This has directly contributed to Same Day ACH’s remarkable growth.

One salient example pertains to the dollar limit on Same Day ACH transactions. At first, companies could only send up to $25,000 per Same Day transaction. For many businesses, especially those in the insurance industry, this amount was simply too low. Nacha listened to this feedback and in March 2020, raised the allowable per-transaction dollar limit to $100,000.

“We saw an impact immediately in terms of the Same Day dollars flowing through the ACH Network,” said Herd. Between 1Q and 2Q 2020, the average dollar amount of a Same Day ACH payment rose 33%. These numbers are “good evidence that there was demand for that type of capability and improvement,” he said.

Nacha will continue to look for ways to improve its service to meet industry needs. “Improvements that are ongoing and will continue into the future,” said Herd.

The next major rules change: Extended hours

Currently, the latest that a Same Day ACH payment can be sent to an ACH Operator is 2:45 p.m. ET. For those on the West Coast, these hours are not optimal, as many businesses have a need to make payments beyond 11:45 a.m. PT.

In response, the two ACH Network operators are adding a new Same Day ACH processing window. Beginning on March 19, 2021, Same Day operating hours will be extended by two hours every banking day.

“If you think about an employer in California that wants to originate Same Day ACH payroll on a Friday, the extended hours give them enough additional time that could make the difference between adopting Same Day ACH for those type of payments or any other core ACH use cases,” Herd said.

Long term, he added, there is still industry interest in additional increases to the dollar limit for Same Day ACH transactions. “I have no predictions about what might happen and when, but it is certainly a live discussion,” Herd said.