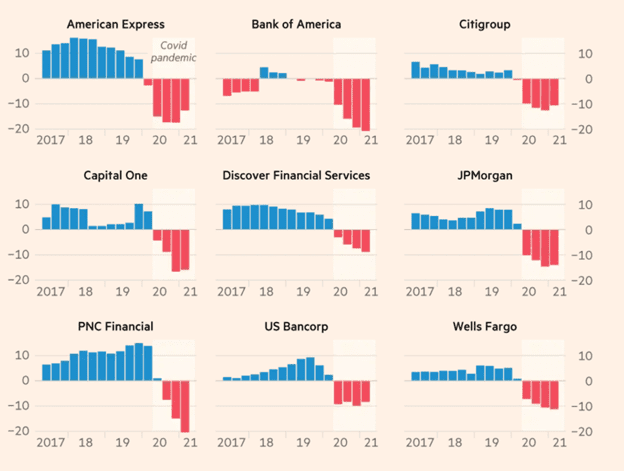

Based on Bloomberg numbers, nine top credit card portfolios continue to show negative growth. The Financial Times illustrates credit card YoY loan growth as a percentage of the prior period. Portfolio shortfalls range from 9% at Discover to 21% at PNC.

The good news is that 2Q21 revenue should hold well, as credit card issuers continue to release loan loss reserves after Stress Tests indicated that the future would be less risky as expected. The bad news is that the cushion will be gone by 3Q21, so it is time to market.

- Loan balances slid between 9 and 14 percent yearly among the largest credit card lenders, including JPMorgan, Citigroup, and Discover in the first quarter. So now, those lenders are at the forefront of a marketing blitz that is accelerating into the summer months.

- According to Competition, online solicitations for new card customers jumped 85 percent last month year on year as lenders trotted out enhanced rewards, higher credit limits, and low promotional rates.

- Even with the surge, overall balance transfer offers are still at only 50 percent of 2019 levels.

This is not the first time in recent years where issuers scramble to bulk up their portfolios. If they do not, they will feel the pain with reductions in interest revenue and interchange. With collection volume down, now is a good time for some aggressive lend

- Last month Citigroup, Bank of America, and Capital One doled out unsolicited credit line increases to some customers with good credit history, raising those limits by as much as a third, according to offers reviewed by the FT and Competiscan data. Citigroup led the pack with the most increased notifications, according to Competiscan.

Collections are under control, and many issuers have their loss rates in the bag for 2021. Now, it is time to beef up solicitations and underwriting to build the revenue stream. If done effectively, 2022 will be off to a good start. If not, expect 2022 to start off in the red!

Overview provided by Brian Riley, Director, Credit Advisory Service at Mercator Advisory Group